Fleet Management Software in Europe

- Enterprise

- SME

- Startups

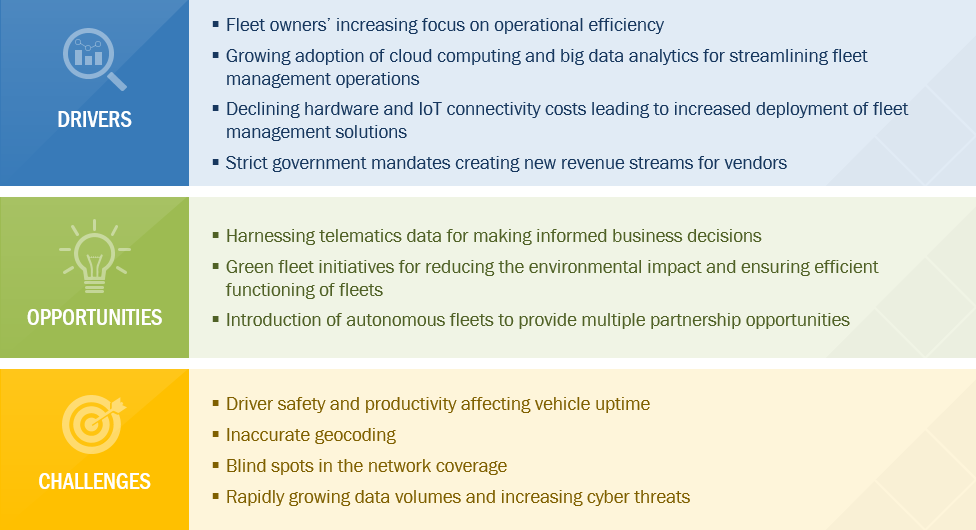

Fleet management, a discipline of asset management, enables companies to manage the entire fleet operation, thus resulting in controlled costs, maximized profitability, improved fleet efficiency, and fleet-related risk mitigation and compliance with government regulations. The fleet management market is highly competitive due to the presence of many market players, including top-tier and mid-tier companies. The fleet management industry is gradually adopting advanced technologies, and various fleet organizations are undertaking green initiatives to reduce environmental impact and increase the overall fleet efficiency.

Fleet management, a discipline of asset management, enables companies to manage the entire fleet operation, thus resulting in controlled costs, maximized profitability, improved fleet efficiency, and fleet-related risk mitigation and compliance with government regulations. The fleet management market is highly competitive due to the presence of many market players, including top-tier and mid-tier companies. The fleet management industry is gradually adopting advanced technologies, and various fleet organizations are undertaking green initiatives to reduce environmental impact and increase the overall fleet efficiency.

The global fleet management market size is expected to grow to USD 34 billion by 2025, at a CAGR of 11%. The growth of the market can be attributed to the cost benefits versus Software-as-a-Service (SaaS) and cloud-based deployments of fleet management solutions.

Growing adoption of cloud computing and analytics is driving the growth in the Fleet Management Market

This report identifies and benchmarks the best fleet management software vendors such as ARI Fleet Management (US), Azuga (US), Chevin Fleet Solutions (Australia), Inseego (US) and Donlen Corporation (US), and evaluates them on the basis of business strategy excellence and strength of product portfolio within the Fleet Management ecosystem, combining inputs from various industry experts, buyers, and vendors, and extensive secondary research including annual reports, company press releases, investor presentations, free and paid company databases. Best fleet management software vendors are rated and positioned on 2x2 matrix, called ‘Company Evaluation Quadrant’, and identified as Visionary Leaders, Dynamic Differentiators, Innovators, or Emerging companies. This report also identifies and benchmarks the top fleet management solution start-ups, positioned on the 2x2 matrix, and identified as Progressive Companies, Starting Blocks, Responsive Companies, or Dynamic Companies.

The report includes market-specific company profiles of all 26 players and assesses the recent developments that shape the competitive landscape of this highly fragmented market.

This report identifies and benchmarks the best Fleet Management software vendors such as ARI Fleet Management (US), Azuga (US), Chevin Fleet Solutions (Australia), Inseego (US) and Donlen Corporation (US), and evaluates them on the basis of business strategy excellence and strength of product portfolio within the Fleet Management ecosystem, combining inputs from various industry experts, buyers, and vendors, and extensive secondary research including annual reports, company press releases, investor presentations, free and paid company databases. They are rated and positioned on 2x2 matrix, called as ‘Company Evaluation Quadrant’, and identified as Visionary Leaders, Dynamic Differentiators, Innovators, or Emerging companies.

SAMPLES:

- Updated version of this Quadrant

- Different Company Evaluation Quadrant

- 'Startup Only' Company Evaluation Quadrant

- Region or Country specific evaluation

- Application or Industry specific evaluation ..Read More

- Submit a Briefing Request

- Question about our published research

- Request for evaluation of your organization for specific market

- Request for re-evaluation of Company Evaluation Quadrant ..Read More