Comparing 6 vendors in Airport Systems Startups across 0 criteria.

The Airport Systems Market is experiencing transformative shifts, driven by technological advancements and evolving consumer demands. As the aviation sector strives to enhance passenger experiences, safety, and operational efficiency, new technologies are steadily integrated into airport operations. The market innovates rapidly, from AI-driven predictive analytics to biometric and contactless passenger processing. The emergence of smart airports epitomizes this trend, offering seamless travel experiences powered by automation and self-service technologies.

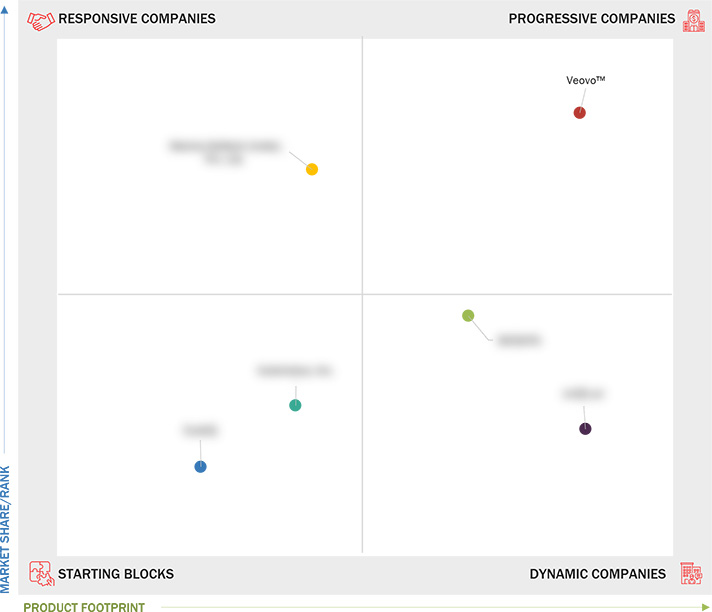

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Stakeholders

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Rise in Air Passenger Traffic

2.2.1.2 Emergence of Smart Airports

2.2.1.3 Evolving Security Challenges

2.2.1.4 Extensive Use of Self-Service Technologies at Airports

2.2.2 Restraints

2.2.2.1 High Operating Costs

2.2.2.2 Data and Privacy Concerns

2.2.3 Opportunities

2.2.3.1 Expansion of Air Cargo Infrastructure

2.2.3.2 Rapid Adoption of Electric and Autonomous Ground Support Equipment

2.2.4 Challenges

2.2.4.1 Complexity of Large Datasets

2.2.4.2 Prevalence of Legacy Infrastructure and Slow Technology Adoption

2.3 Value Chain Analysis

2.4 Trends and Disruptions Impacting Customer Business

2.5 Ecosystem Analysis

2.5.1 Manufacturers

2.5.2 System Integrators

2.6 Operational Data

2.6.1 Total Number of Airports Globally

2.6.2 Airport Investments

2.6.3 Airport Solutions Required

2.7 Trade Analysis

2.7.1 Import Scenario

2.7.2 Export Scenario

2.8 Key Conferences and Events, 2025

2.9 Technology Analysis

2.9.1 Key Technologies

2.9.1.1 Data Integration Platforms

2.9.1.2 Real-Time Analytics

2.9.2 Complementary Technologies

2.9.2.1 RFID and Barcode Technologies

2.9.2.2 Mobile Applications

2.9.3 Adjacent Technologies

2.9.3.1 AR/VR

2.10 Business Models

2.11 Investment and Funding Scenario

2.12 Total Cost of Ownership (TCO)

2.13 Bill of Materials

2.14 Technology Roadmap

2.15 Macroeconomic Outlook

2.15.1 North America

2.15.2 Europe

2.15.3 Asia Pacific

2.15.4 Middle East

2.15.5 Latin America

2.15.6 Africa

3.1 Introduction

3.2 Key Player Strategies/Right to Win, 2020–2025

3.3 Revenue Analysis, 2020–2023

3.4 Market Share Analysis, 2023

3.5 Company Evaluation Matrix: Start-Ups/SMEs, 2024

3.5.1 Progressive Companies

3.5.2 Responsive Companies

3.5.3 Dynamic Companies

3.5.4 Starting Blocks

3.5.5 Competitive Benchmarking

3.5.5.1 List of Start-Ups/SMEs

3.5.5.2 Competitive Benchmarking of Start-Ups/SMEs

3.6 Company Valuation and Financial Metrics

3.7 Brand/Product Comparison

3.8 Competitive Scenario

3.8.1 Product Launches

3.8.2 Deals

3.8.3 Others

4.1 CURBIQ

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 AUTOMOTUS, INC.

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 SKIDATA

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 MANTRA SOFTECH (INDIA) PVT. LTD.

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 VEOVO

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 A-ICE SRL

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

Parking Network

Parking Network

Nov 2024

Nov 2024