Comparing 10 vendors in Cabin Management System Startups across 0 criteria.

The Cabin Management System (CMS) market is experiencing a substantial surge in growth, fueled by a confluence of technological advancements and evolving consumer expectations. This market encompasses a variety of systems designed to enhance in-flight experiences by integrating entertainment, connectivity, and comfort features within aircraft cabins.

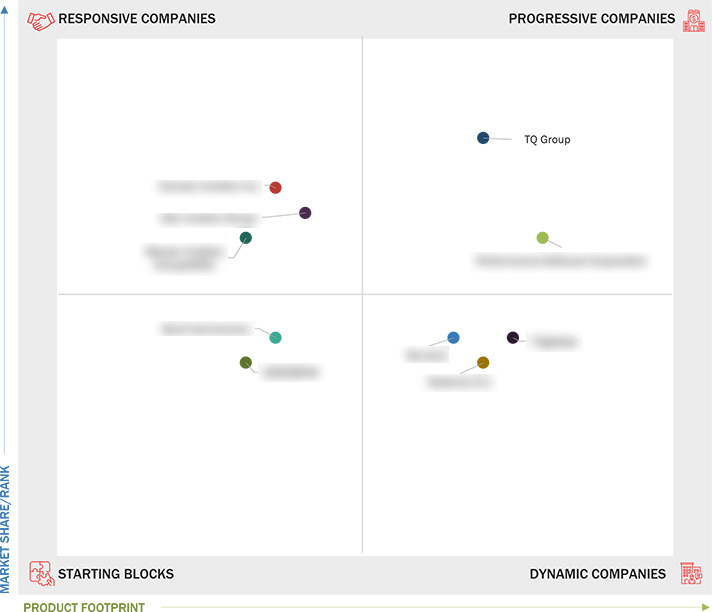

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Market Scope

1.3.1 Cabin Management System Market Segmentation

1.3.2 Years Considered

1.4 Currency and Pricing

1.5 Inclusions and Exclusions

1.6 Stakeholders

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Advancements in smart cabin technologies

2.2.1.2 Growing business & private air travel

2.2.1.3 Increasing aircraft production and fleet expansion

2.2.1.4 Increasing focus on enhancing passenger experience

2.2.2 Restraints

2.2.2.1 Cybersecurity and data privacy concerns

2.2.2.2 High initial costs and installation complexity

2.2.3 Opportunities

2.2.3.1 Growing demand for upgradable and modular designs

2.2.3.2 Advancements in in-flight entertainment

2.2.3.3 Increasing adoption of wireless and touchless technologies

2.2.4 Challenges

2.2.4.1 Limited standardization across aircraft models & airline

fleets

2.2.4.2 Stringent regulatory framework and certification procedures

2.3 Trends and Disruptions Impacting Customer Business

2.4 Value Chain Analysis

2.4.1 R&D Engineers (10-20%)

2.4.2 Component/Product Manufacturing (20-40%)

2.4.3 Testing & Quality Assurance (40-60%)

2.4.4 after-Sales Service (90-100%)

2.5 Ecosystem Analysis

2.5.1 Prominent Companies

2.5.2 Private and Small Enterprises

2.5.3 End Users

2.6 Trade Data Analysis

2.7 Key Conferences and Events, 2025

2.8 Investment and Funding Scenario

2.9 Macroeconomic Outlook

2.9.1 Introduction

2.9.2 North America

2.9.3 Europe

2.9.4 Asia Pacific

2.9.5 Middle East

2.9.6 Latin America

2.9.7 Africa

2.10 Total Cost of Ownership

2.11 Business Models

2.12 Technology Roadmap

2.13 Technology Analysis

2.13.1 Key Technologies

2.13.1.1 Integrated cabin systems

2.13.1.2 Edge computing and cloud integration

2.13.2 Adjacent Technologies

2.13.2.1 Haptic feedback and smart touch surfaces

2.13.2.2 Voice-activated controls

2.13.3 Complementary Technologies

2.13.3.1 Biometric authentication

2.13.3.2 Wireless power transmission

2.14 Bill of Materials

2.15 Impact of Generative AI

2.15.1 Introduction

2.15.2 Adoption of AI in Aviation By Top Countries

2.15.3 Impact of AI on Aviation Industry

2.15.4 Impact of AI on Cabin Management System Market

2.16 Key Functionalities of Cabin Management Systems

2.17 Operational Data

3.1 Introduction

3.2 Key Player Strategies/Right to Win, 2020–2024

3.3 Cabin Management System Market Revenue Analysis, 2020–2023

3.4 Company Footprint

3.4.1 Company Footprint

3.4.1.1 Solution footprint

3.4.1.2 End User footprint

3.4.1.3 AIrcraft type footprint

3.4.1.4 Region footprint

3.5 Cabin Management System Market: Company Evaluation Matrix (Start-

Ups/SMEs), 2023

3.5.1 Progressive Companies

3.5.2 Responsive Companies

3.5.3 Dynamic Companies

3.5.4 Starting Blocks

3.5.5 Competitive Benchmarking

3.5.5.1 List of start-ups/SMEs

3.5.5.2 Competitive benchmarking of start-ups/SMEs

3.6 Brand/Product Comparison

3.7 Company Valuation and Financial Metrics

3.8 Competitive Scenario

3.8.1 Product Launches

3.8.2 Deals

3.8.3 Expansions

4.1 AEROSENS

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 REDIMEC S.A.

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 DUNCAN AVIATION INC.

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 PERFORMANCE SOFTWARE CORPORATION

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 TQ GROUP

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 MECAER AVIATION GROUP (MAG)

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 C&L AVIATION GROUP

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 BURRANA

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 SPIRIT AERONAUTICS

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

4.10 FLIGHTSTAR

4.10.1 Business overview

4.10.2 Products/Solutions/Services offered

4.10.3 Recent developments

Aviation International News

Aviation International News

Aug 2024

Aug 2024