Comparing 10 vendors in Drone Communication Startups across 0 criteria.

The drone communication market is emerging as a pivotal sector in the global technology landscape. It emphasizes secure and efficient data exchange between unmanned aerial systems (UASs) and their command units.

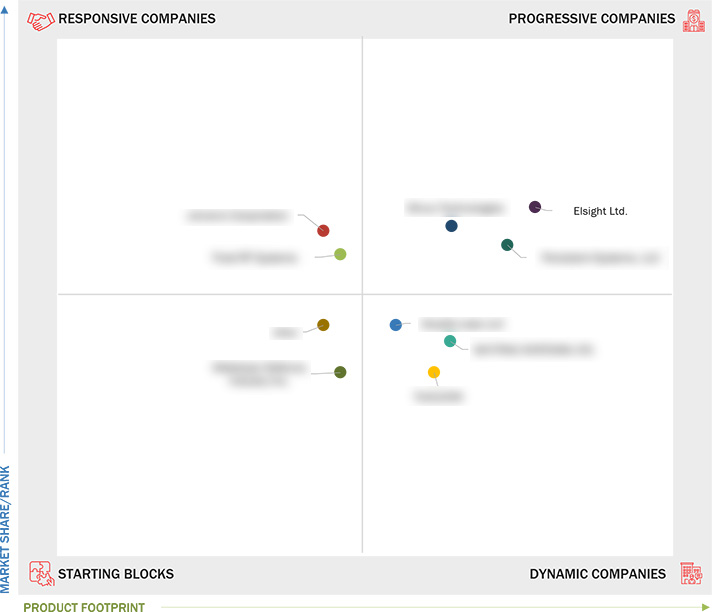

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Market Segmentation & Geographical Spread

1.3.2 Inclusions & Exclusions

1.4 Years Considered

1.5 Currency Considered

1.6 Stakeholders

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Advancements in communication technologies

2.2.1.2 Increasing procurement of UAVs in military applications

2.2.1.3 Growing need for secure and encrypted communication

2.2.2 Restraints

2.2.2.1 Cybersecurity risks and data vulnerabilities

2.2.2.2 Regulatory and airspace restrictions

2.2.3 Opportunities

2.2.3.1 Commercial expansion in urban air mobility (UAM) and

logistics

2.2.3.2 Emergence of swarm drone communication

2.2.3.3 Increasing adoption of drone-based emergency and

humanitarian response system

2.2.4 Challenges

2.2.4.1 Interoperability and standardization issues

2.2.4.2 Limited spectrum availability and frequency congestion

2.3 Value Chain Analysis

2.4 Trends & Disruptions Impacting Customer Business

2.5 Ecosystem Analysis

2.5.1 Drone Manufacturers

2.5.2 Drone Communication System Manufacturers

2.5.3 End Users

2.6 Investment & Funding Scenario

2.7 HS Codes

2.7.1 Import Scenario

2.7.2 Export Scenario

2.8 Key Conferences & Events, 2025–2026

2.9 Operational Data

2.10 Business Models

2.10.1 Direct Sales

2.10.1.1 Key features

2.10.1.2 Advantages

2.10.1.3 Challenges

2.10.2 Oem and White-Labeling

2.10.2.1 Key features

2.10.2.2 Advantages

2.10.2.3 Challenges

2.10.3 Distributor & Channel Partner

2.10.3.1 Key features

2.10.3.2 Advantages

2.10.3.3 Challenges

2.10.4 Customized Integration Services

2.10.4.1 Key features

2.10.4.2 Advantages

2.10.4.3 Challenges

2.11 Total Cost of Ownership

2.11.1 Initial Acquisition Costs

2.11.2 Operating Costs

2.11.3 Maintenance & Repair Costs

2.11.4 Training & Personnel Costs

2.11.5 Security & Compliance Costs

2.11.6 Lifecycle & Depreciation Costs

2.12 Bill of Materials (BOM)

2.13 Technology Analysis

2.13.1 Key Technologies

2.13.1.1 Cognitive radio systems

2.13.1.2 Multiple-Input Multiple-Output (MIMO) Technology

2.13.1.3 Software-defined networking

2.13.2 Complementary Technologies

2.13.2.1 Antenna beamforming technology

2.13.3 Adjacent Technologies

2.13.3.1 Advanced energy and battery storage systems

2.14 Technology Roadmap

2.15 Macroeconomic Outlook

2.15.1 Introduction

2.15.2 Macroeconomic Outlook for North America, Europe, Asia Pacific,

and Middle East

2.15.2.1 North America

2.15.2.2 Europe

2.15.2.3 Asia Pacific

2.15.2.4 Middle East

2.15.3 Macroeconomic Outlook for Latin America and Africa

2.15.3.1 Latin America

2.15.3.2 Africa

3.1 Introduction

3.2 Key Player Strategies/Right to Win, 2020–2024

3.3 Revenue Analysis, 2020–2023

3.4 Market Share Analysis, 2023

3.5 Company Evaluation Matrix: Startups/SMEs, 2024

3.5.1 Progressive Companies

3.5.2 Responsive Companies

3.5.3 Dynamic Companies

3.5.4 Starting Blocks

3.5.5 Competitive Benchmarking

3.5.5.1 List of startups/SMEs

3.5.5.2 Competitive benchmarking of startups/ SMEs

3.6 Company Valuation and Financial Metrics

3.7 Supplier Analysis

3.8 Brand/Product Comparison

3.9 Competitive Scenario

3.9.1 Product Launches

3.9.2 Deals

3.9.3 Other Developments

4.1 ELSIGHT

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 DOODLE LABS LLC

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 SKYTRAC SYSTEMS LTD.

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 TRIAD RF SYSTEMS

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 TUALCOM

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 UAVIONIX

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 ULTRA

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 SILVUS TECHNOLOGIES

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 PERSISTENT SYSTEMS, LLC

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

4.10 METEKSAN DEFENCE INDUSTRY INC.

4.10.1 Business overview

4.10.2 Products/Solutions/Services offered

4.10.3 Recent developments

Unmanned airspace

Unmanned airspace

Jan 2026

Jan 2026