Comparing 10 vendors in Drone Detection Startups across 0 criteria.

The drone detection market is experiencing rapid expansion due to increasing global security concerns and the proliferation of drones across various sectors including commercial, recreational, and defense. This surge in drone usage necessitates advanced airspace security solutions, particularly as unauthorized drone activities pose risks to critical infrastructure such as airports, energy facilities, and government buildings. The market is catalyzed by the integration of AI, multi-sensor technologies, and real-time monitoring systems which enhance operational efficiency and airspace security.

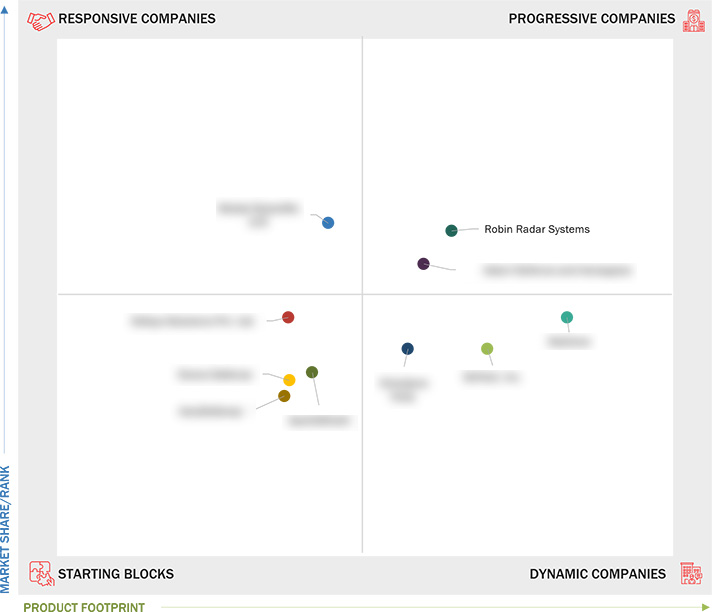

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Market Segmentation & Geographic Spread

1.3.2 Inclusions & Exclusions

1.4 Years Considered

1.5 Currency Considered

1.6 Key Stakeholders

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Increased Need for Drone Detection Systems

2.2.1.2 Regional Conflicts and Geopolitical Tensions

2.2.1.3 Rise in Unauthorized Drone Activities

2.2.1.4 Adoption of Drone Detection Systems in Critical

Infrastructure

2.2.2 Restraints

2.2.2.1 High Initial Deployment and Operational Costs

2.2.2.2 Evolving Regulatory Frameworks

2.2.3 Opportunities

2.2.3.1 Expansion of Iot and Ai in Drone Detection Systems

2.2.3.2 Advancements in Detection Technologies

2.2.3.3 Rising Defense and Homeland Security Budgets

2.2.4 Challenges

2.2.4.1 Cybersecurity Risks in Connected Detection Systems

2.2.4.2 Accuracy Issues in Complex Environments

2.3 Value Chain Analysis

2.4 Ecosystem Analysis

2.4.1 Drone Detection Providers

2.4.2 End Users

2.5 Technology Analysis

2.5.1 Key Technologies

2.5.1.1 Radar-based Detection

2.5.1.2 Radio Frequency (RF) Scanning

2.5.1.3 Electro-optical (EO) & Infrared (IR) Sensors

2.5.2 Complementary Technologies

2.5.2.1 Acoustic Detection

2.5.2.2 Lidar-based Drone Tracking

2.5.3 Adjacent Technologies

2.5.3.1 Counter-drone Systems

2.5.3.1.1 Jamming & Spoofing

2.5.3.1.2 Directed Energy Weapons (DEWS)

2.5.3.1.3 Hard Kill Solutions

2.6 Trends & Disruptions Impacting Customer Business

2.7 HS Codes

2.7.1 Import Scenario (HS Code 852610)

2.7.2 Export Scenario (HS Code 852610)

2.8 Key Conferences & Events

2.9 Investment & Funding Scenario

2.10 Operational Data

2.11 Bill of Materials

2.11.1 Factors Affecting Cost

2.12 Business Models

2.12.1 Direct Sales Model

2.12.2 Subscription Model

2.12.3 System Integration & Customization Model

2.12.4 Conclusion

2.13 Total Cost of Ownership (TCO)

2.13.1 Initial Acquisition Cost

2.13.2 Operating Costs

2.13.3 Downtime & Disruption Cost

2.13.4 Lifetime Extension Cost

2.13.5 End-of-life Cost

2.13.6 Risk Management Cost

2.13.7 Conclusion

2.14 Technology Roadmap

2.14.1 Emerging Trends in Drone Detection Market

2.15 Impact of Artificial Intelligence

2.15.1 Introduction

2.15.2 Impact of AI on Defense Industry

2.15.3 Adoption of AI in Military By Top Countries

2.15.4 Impact of AI on Drone Detection Market

2.15.4.1 Ai-powered Sensor Fusion

2.15.4.2 Deep Learning-based Object Recognition

2.15.4.3 Automated Threat Classification

2.15.4.4 AI-enabled RF Signal Analysis

2.15.4.5 Predictive Analytics for Drone Swarm Detection

2.15.4.6 Autonomous Countermeasures

2.15.4.7 Future Outlook

2.16 Macroeconomic Outlook

2.16.1 Introduction

2.16.2 Macroeconomic Outlook for North America, Europe, Asia Pacific,

and Middle East

2.16.2.1 North America

2.16.2.2 Europe

2.16.2.3 Asia Pacific

2.16.2.4 Middle East

2.16.3 Macroeconomic Outlook for Latin America and Africa

2.16.3.1 Latin America

2.16.3.2 Africa

3.1 Introduction

3.2 Key Player Strategies/Right to Win, 2020–2024

3.3 Revenue Analysis

3.4 Market Share Analysis

3.5 Brand/Product Comparison

3.6 Company Valuation and Financial Metrics

3.7 Company Evaluation Matrix: Startups/SMEs, 2024

3.7.1 Progressive Companies

3.7.2 Responsive Companies

3.7.3 Dynamic Companies

3.7.4 Starting Blocks

3.7.5 Competitive Benchmarking

3.8 Competitive Scenario & Trends

3.8.1 Product Launches

3.8.2 Deals

3.8.3 Other Developments

4.1 WEIBEL SCIENTIFIC A/S

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 DEDRONE

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 DETECT, INC.

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 DRONE DEFENCE

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 DEFSYS SOLUTIONS PVT. LTD.

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 ADANI DEFENCE & AEROSPACE

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 ECHODYNE CORP.

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 ROBIN RADAR SYSTEMS

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 APOLLOSHIELD

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

4.10 AERODEFENSE

4.10.1 Business overview

4.10.2 Products/Solutions/Services offered

4.10.3 Recent developments

ks_report

ks_report

Feb 2025

Feb 2025