Comparing 10 vendors in Space Propulsion Startups across 0 criteria.

The space propulsion market is driven by the growing deployment of satellites, advancements in propulsion technologies, expansion of deep-space missions, and the need for advanced propellants for long-duration operations. Satellite constellations for communication and Earth observation require efficient propulsion systems for orbit management and deorbiting. Electric propulsion, especially ion and Hall-effect thrusters, is gaining traction due to its fuel efficiency and suitability for extended missions. Green propellants are emerging as safer, environmentally friendly alternatives to traditional fuels.

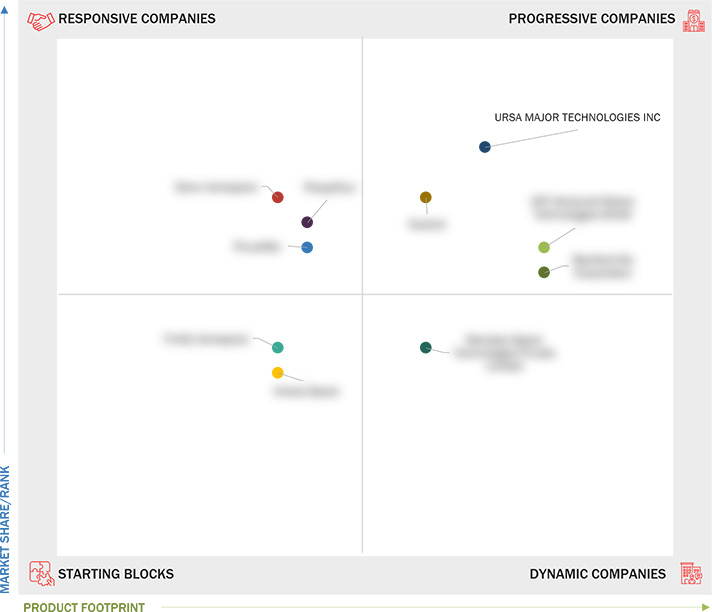

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Stakeholders

1.6 Summary of Changes

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Growing deployment of satellites

2.2.1.2 Advancements in propulsion technologies

2.2.1.3 Expansion of deep-space missions

2.2.1.4 Need for advanced propellants for long-duration missions

2.2.2 Restraints

2.2.2.1 High development and manufacturing costs

2.2.2.2 Stringent regulatory and safety standards

2.2.3 Opportunities

2.2.3.1 Increased government investments in space programs

2.2.3.2 Emergence of nuclear thermal and nuclear electric propulsion

2.2.3.3 Proliferation of LEO constellations

2.2.3.4 Surge in demand for reusable launch vehicles

2.2.4 Challenges

2.2.4.1 Supply chain disruptions

2.2.4.2 Rise of space debris

2.3 Trends and Disruptions Impacting Customer Business

2.4 Regulatory Landscape

2.5 Value Chain Analysis

2.6 Ecosystem Analysis

2.6.1 Prominent Companies

2.6.2 Private and Small Enterprises

2.6.3 End Users

2.7 Technology Analysis

2.7.1 Key Technologies

2.7.1.1 Electric propulsion systems

2.7.1.2 Solar sails

2.7.1.3 Ion propulsion

2.7.2 Complementary Technologies

2.7.2.1 Heat management systems

2.7.2.2 Advanced propellant management

2.7.3 Adjacent Technologies

2.7.3.1 Magnetoplasmadynamic thrusters

2.7.3.2 Autonomous propulsion

2.8 Patent Analysis

2.9 Trade Analysis

2.10 Supply Chain Snapshot

2.11 Market Forecast Assumptions

2.12 Key Conferences and Events, 2025

2.13 Investment and Funding Scenario

2.14 Macroeconomic Outlook

2.14.1 Introduction

2.14.2 North America

2.14.3 Europe

2.14.4 Asia Pacific

2.14.5 Middle East

2.14.6 Latin America

2.14.7 Africa

2.15 Business Models

2.16 Technology Roadmap

2.17 Propulsion Mapping of Satellite Constellations

2.18 Bill of Materials

2.19 Total Cost of Ownership

2.20 Impact of Generative AI

2.20.1 Introduction

2.20.2 Adoption of AI in Space by Top Countries

2.20.3 Impact of AI on Space Industry

2.20.4 Impact of AI on Space Propulsion Market

2.21 Operational Data

2.22 Volume Data

3.1 Introduction

3.2 Key Player Strategies/Right to Win, 2020–2024

3.3 Revenue Analysis, 2020–2023

3.4 Market Share Analysis, 2023

3.5 Market Ranking Overview

3.6 Company Evaluation Matrix: Start-Ups/SMEs, 2024

3.6.1 Progressive Companies

3.6.2 Responsive Companies

3.6.3 Dynamic Companies

3.6.4 Starting Blocks

3.6.5 Competitive Benchmarking

3.6.5.1 List of Start-Ups/SMEs

3.6.5.2 Competitive Benchmarking of Start-Ups/SMEs

3.7 Brand/Product Comparison

3.8 Company Valuation and Financial Metrics

3.9 Competitive Scenario

3.9.1 Product Launches

3.9.2 Deals

3.9.3 Others

4.1 THRUSTME

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 URSA MAJOR TECHNOLOGIES INC

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 PHASEFOUR

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 EXOTRAIL

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 DAWN AEROSPACE

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 AST ADVANCED SPACE TECHNOLOGIES GMBH

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 STANFORD MU CORPORATION

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 MANASTU SPACE TECHNOLOGIES PRIVATE LIMITED

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 KREIOS SPACE

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

4.10 FIREFLY AEROSPACE

4.10.1 Business overview

4.10.2 Products/Solutions/Services offered

4.10.3 Recent developments

CompositesWorld

CompositesWorld

Feb 2026

Feb 2026