Comparing 11 vendors in Urban Air Mobility Startups across 0 criteria.

Urban air mobility (UAM) can be defined as an aerial mode of intracity or intercity transportation of passengers and cargo using manned or electrical-unmanned aerial vehicles. This transportation is limited to 20 to 100 km for intracity and 100 to 400 km for intercity travel. UAM offers a combination of onboard/ground-piloted and increasingly autonomous operations and is safe and effective for air passenger and cargo transport in urban areas, including small package delivery and other urban unmanned aircraft system (UAS) services.

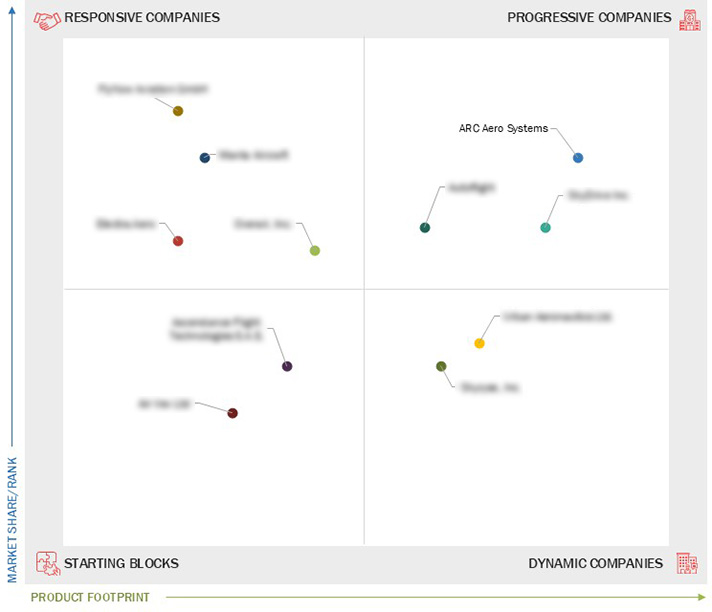

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Years Considered

1.4 Inclusions and Exclusions

1.5 Currency Considered

1.6 Stakeholders

1.7 Summary of Changes

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Rise in urban congestion

2.2.1.2 Shift of rural population to urban areas

2.2.1.3 Technological advancements in battery technology and

electric propulsion systems

2.2.1.4 Smart city initiatives

2.2.2 Restraints

2.2.2.1 High initial investment

2.2.2.2 Increase in urban airspace congestion

2.2.3 Opportunities

2.2.3.1 Growing demand for shorter travel time and efficient

transportation

2.2.3.2 Need for sustainable transportation solutions

2.2.4 Challenges

2.2.4.1 Cybersecurity concerns

2.2.4.2 Lack of skilled labor

2.3 Value Chain Analysis

2.4 Ecosystem Analysis

2.4.1 Prominent Companies

2.4.2 Private and Small Enterprises

2.4.3 End Users

2.5 Trends and Disruptions Impacting Customer Business

2.6 Trade Analysis

2.6.1 Import Data Statistics

2.7 Key Conferences and Events, 2025

2.8 Macroeconomic Outlook

2.8.1 Introduction

2.8.2 North America

2.8.3 Europe

2.8.4 Asia Pacific

2.8.5 Middle East

2.8.6 Latin America

2.8.7 Africa

2.9 Bill of Materials

2.9.1 Bill of Materials, By Platform

2.9.2 Bill of Materials, By Urban Air Mobility Infrastructure

2.10 Total Cost of Ownership

2.10.1 Total Cost of Ownership for Urban Air Mobility Platform

2.10.2 Total Cost of Ownership for Urban Air Mobility Infrastructure

2.10.3 Total Cost of Ownership Comparison, By Solution

2.10.3.1 For urban air mobility platform

2.10.3.2 For urban air mobility infrastructure

2.11 Business Models

2.11.1 Business Models for Urban Air Mobility Platform Operations

2.11.2 Business Models for Urban Air Mobility Infrastructure Operations

2.12 Investment and Funding Scenario

2.13 Roadmap for Urban Air Mobility Market

2.14 Operational Data

2.14.1 Platform Data

2.14.1.1 Key urban air mobility platform order books

2.14.1.2 Key urban air mobility platform noise levels

2.14.1.3 Key urban air mobility platform technology readiness level

2.14.1.4 Key urban air mobility platform system supplier landscape

2.14.2 Infrastructure Data

2.14.2.1 Stages of unmanned traffic management and unmanned

aircraft system research, development, testing, and

implementation

2.15 Technology Roadmap

2.16 Impact of AI/Generative Ai on Urban Air Mobility Market

2.16.1 Introduction

2.16.2 Adoption of AI/Generative Ai in Top Countries for Commercial

Aviation

3.1 Introduction

3.2 Key Player Strategies/Right to Win

3.3 Revenue Analysis

3.4 Market Share Analysis

3.5 Company Evaluation Matrix: Startups/SMEs (By Solution), 2023

3.5.1 Progressive Companies

3.5.2 Responsive Companies

3.5.3 Dynamic Companies

3.5.4 Starting Blocks

3.5.5 Competitive Benchmarking: Startups/SMEs, 2023

3.6 Company Valuation and Financial Metrics

3.7 Competitive Scenario

3.8 Market Evaluation Framework

3.8.1 Product Launches and Developments

3.8.2 Deals

3.8.3 Other Developments

3.9 Brand Comparison

4.1 ARC AERO SYSTEMS

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 SKYDRIVE INC.

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 ELECTRA.AERO

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 AUTOFLIGHT

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 OVERAIR, INC.

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 MANTA AIRCRAFT

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 AIR VEV LTD

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 URBAN AERONAUTICS LTD.

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 SKYRYSE, INC.

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

4.10 ASCENDANCE FLIGHT TECHNOLOGIES S.A.S.

4.10.1 Business overview

4.10.2 Products/Solutions/Services offered

4.10.3 Recent developments

flightglobal

flightglobal

Nov 2024

Nov 2024