Comparing 10 vendors in Biostimulants Startups across 0 criteria.

Plant biostimulants contain substance(s) and/or microorganisms whose function, when applied to plants or the rhizosphere, is to stimulate natural processes to enhance/benefit nutrient uptake, nutrient efficiency, tolerance to abiotic stress, and crop quality. It contains substances and/or microorganisms that stimulate natural processes. The effect will be independent of its nutrient content and will improve one or more of the following characteristics of the plant or the plant rhizosphere.

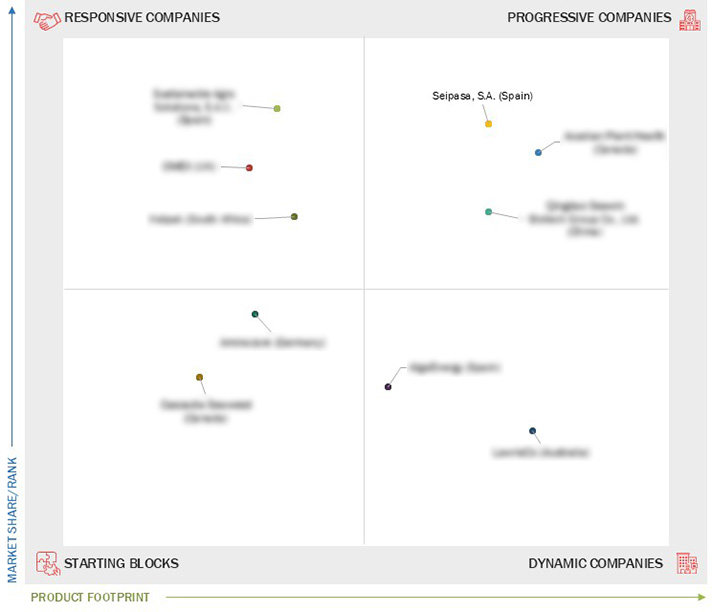

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Market Segmentation and Regional Spread

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.3.4 Currency Considered

1.3.5 Units Considered

1.4 Limitations

1.5 Stakeholders

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Rising need for sustainable agriculture

2.2.1.2 Easy availability of seaweed as raw material

2.2.1.3 Growing demand for high-value crops

2.2.2 Restraints

2.2.2.1 Commercialization of low-quality biostimulants

2.2.2.2 Storage complexities and limited shelf life

2.2.2.3 Preference for synthetic plant growth regulators in emerging economies

2.2.3 Opportunities

2.2.3.1 Technological advancements in biostimulant production

2.2.3.2 Significant developments in seed treatment

2.2.3.3 Integration of biostimulants with fertilizers to optimize nutrient uptake

2.2.3.4 Shift toward regenerative agriculture and sustainable practices

2.2.4 Challenges

2.2.4.1 Uncertainty in global biostimulants regulatory framework

2.2.4.2 Lack of awareness and adoption

2.3 Value Chain Analysis

2.3.1 Research & product development

2.3.2 Raw material sourcing

2.3.3 Manufacturing & Production

2.3.4 Packaging, storage, & distribution

2.3.5 Post-sales Services

2.4 Technology Analysis

2.4.1 Key Technologies

2.4.1.1 Software to operationalize analytics

2.4.1.2 Nanoencapsulation

2.4.1.3 EnNuVi

2.4.2 Complementary Technologies

2.4.2.1 Precision agriculture

2.4.3 Adjacent Technologies

2.4.3.1 CRISPR and gene editing

2.4.3.2 Carbon sequestration

3.1 Overview

3.2 Key Player Strategies/Right to Win, 2020-2025

3.3 Revenue Analysis, 2019-2023

3.4 Market Share Analysis, 2024

3.5 Company Evaluation and Matrix: Startups/SMEs, 2024

3.5.1 Progressive Companies

3.5.2 Responsive Companies

3.5.3 Dynamic Companies

3.5.4 Starting Blocks

3.5.5 Competitive Benchmarking: Startups/SMEs, (2024)

3.5.5.1 Detailed list of key startups/SMEs

3.5.5.2 Competitive benchmarking of key startups/SMEs

3.6 Company Valuation and Financial Metrics

3.7 Brand/Product Comparison

3.8 Competitive Scenario

3.8.1 Prouduct Launches

3.8.2 Deals

3.8.3 Expansions

3.8.4 Other Developments

4.1 Acadian Plant Health

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 AlgaEnergy

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 Aminocore

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 Kelpak

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 LawrieCo

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 OMEX

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 Qingdao Seawin Biotech Group Co.

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 Cascadia Seaweed

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 Seipasa, S.A

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

4.10 Sustainable Agro Solutions, S.A.U.

4.10.1 Business overview

4.10.2 Products/Solutions/Services offered

4.10.3 Recent developments

www.global-agriculture.com

www.global-agriculture.com

Sep 2025

Sep 2025