Comparing 10 vendors in Fertilizers Startups across 0 criteria.

Chemical fertilizers, as defined by International Standard ISO 7851, are fertilizers containing declared nutrients in the form of inorganic salts obtained through extraction or industrial physical and chemical processes. These fertilizers primarily supply the three essential plant nutrients: nitrogen (N), phosphorus (P), and potassium (K), which are crucial for plant growth and crop productivity.

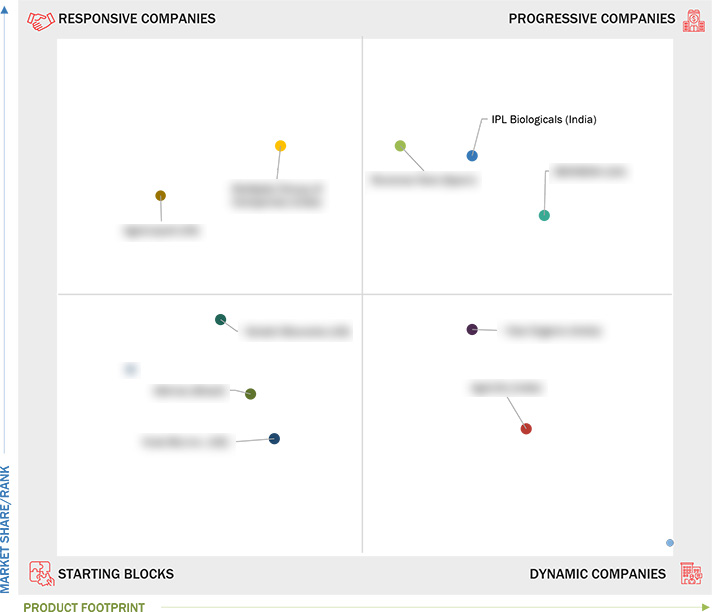

Market Leadership Quadrant

1.1 Study Objectives

1.1.1 Market Definition

1.2 Market Scope

1.2.1 Market Segmentation

1.2.2 Inclusions and Exclusions

1.3 Years Considered

1.4 Unit Considered

1.4.1 Currency/Value Unit

1.4.2 Volume Considered

1.5 Stakeholders

2.1 Introduction

2.2 Macroeconomic Indicators

2.2.1 Global Population Growth and Food Demand

2.2.2 Global Gdp and Economic Growth

2.3 Market Dynamics

2.3.1 Drivers

2.3.1.1 Government Subsidies and Policies

2.3.1.2 Climate Change and Weather Patterns

2.3.1.3 Soil Fertility

2.3.1.4 Need to Increase Agricultural Productivity

2.3.2 Restraints

2.3.2.1 High Cost of Raw Materials

2.3.2.2 Growing Resistance of Insect Pests to Agrochemicals

2.3.3 Opportunities

2.3.3.1 New Technologies Reshaping Fertilizers Market

2.3.3.2 Growing Demand for Organic and Sustainable Farming

2.3.3.3 Expansion in Emerging Markets

2.3.4 Challenges

2.3.4.1 High Costs and Lengthy Development Processes

2.4 Value Chain Analysis

2.4.1 Research and Product Development

2.4.2 Material Sourcing

2.4.3 Agrochemical Manufacturing

2.4.4 Distribution and Sales Management

2.4.5 End-use Industry

2.5 Supply Chain Analysis

2.6 Trade Analysis

2.7 Technology Analysis

2.7.1 Key Technologies

2.7.1.1 Microbial Inoculants

2.7.2 Complementary Technologies

2.7.2.1 Precision Agriculture Technologies

2.7.3 Adjacent Technologies

2.7.3.1 Nanotechnology

2.8 Pricing Analysis

2.8.1 Introduction

2.9 Ecosystem Analysis

2.9.1 Supply Side

2.9.1.1 Active Ingredient Manufacturers and Agrochemical Raw

Material Providers & Manufacturers

2.9.2 Demand Side

2.9.2.1 Startups/Emerging Companies

2.9.2.2 Regulatory Bodies

2.9.2.3 End Users

2.10 Trends/Disruptions Impacting Customer Business

2.11 Patent Analysis

2.12 Key Conferences and Events, 2025–2026

3.1 Overview

3.2 Key Player Strategies/Right to Win

3.3 Annual Revenue Analysis

3.4 Market Share Analysis, 2023

3.5 Company Evaluation Matrix: Key Players, 2023

3.5.1 Stars

3.5.2 Emerging Leaders

3.5.3 Pervasive Players

3.5.4 Participants

3.6 Company Evaluation Matrix: Startups/SMEs, 2023

3.6.1 Progressive Companies

3.6.2 Responsive Companies

3.6.3 Dynamic Companies

3.6.4 Starting Blocks

3.6.5 Competitive Benchmarking: Startups/SMEs, 2023

3.6.5.1 Detailed List of Key Startups/SMEs

3.7 Company Valuation and Financial Metrics

3.8 Brand/Product/Service Comparison

3.9 Competitive Scenario

3.9.1 Product Launches

3.9.2 Deals

3.9.3 Expansions

4.1 IPL BIOLOGICALS

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 BIONEMA

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 ROVENSA NEXT

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 MULTIPLEX GROUP OF COMPANIES

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 AGRILIFE

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 VISE ORGANIC

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 KULA BIO, INC.

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 SWITCH BIOWORKS

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 GÊNICA

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

4.10 AGROLIQUID

4.10.1 Business overview

4.10.2 Products/Solutions/Services offered

4.10.3 Recent developments

AgroLiquid

AgroLiquid

Dec 2024

Dec 2024