Comparing 7 vendors in Autonomous Forklift Startups across 0 criteria.

An autonomous forklift as a driverless forklift with unique autopilot technology that provides reliable and accurate driverless operation for transporting, stacking, or picking. The autopilot system can function independently and alongside manually operated systems. The growing e-commerce industry also boosts the demand for autonomous forklifts as warehouses and distribution centers seek to enhance efficiency, accuracy, and speed in order fulfillment. With rising consumer expectations for faster deliveries, companies are increasingly adopting automation to streamline inventory management and material handling operations.

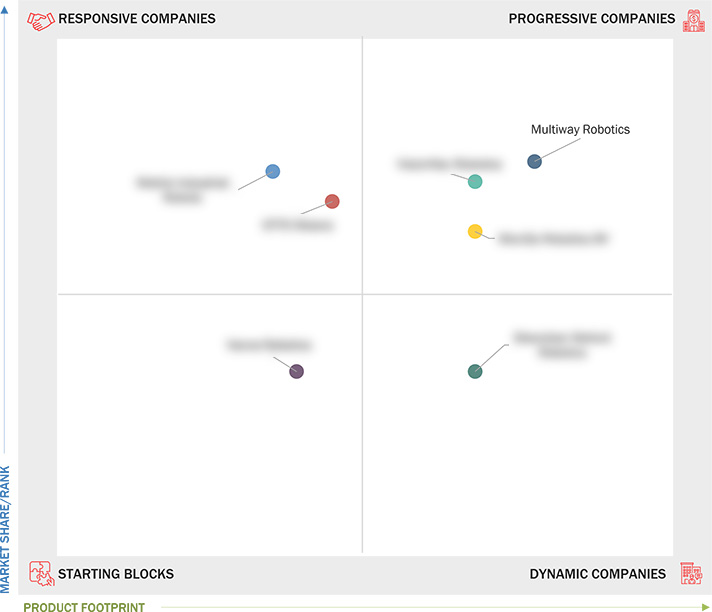

Market Leadership Quadrant

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED AND REGIONAL SCOPE

1.3.2 INCLUSIONS AND EXCLUSIONS

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2.1 INTRODUCTION

2.2 MARKET DYNAMICS

2.2.1 DRIVERS

2.2.1.1 Increasing demand for automation in warehouses

2.2.1.2 Growth of e-commerce and logistics industries

2.2.2 RESTRAINTS

2.2.2.1 High initial investment

2.2.3 OPPORTUNITIES

2.2.3.1 IoT technology in autonomous forklifts

2.2.4 CHALLENGES

2.2.4.1 Failure of sensing elements

2.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

2.4 ECOSYSTEM ANALYSIS

2.5 SUPPLY CHAIN ANALYSIS

2.5.1 COMPONENT SUPPLIERS

2.5.2 SYSTEM INTEGRATORS

2.5.3 AUTONOMOUS FORKLIFT MANUFACTURERS

2.5.4 SERVICE PROVIDERS

2.5.5 END USERS

2.6 IMPACT OF AI/GENERATIVE AI

2.7 KEY CONFERENCES AND EVENTS, 2025–2026

2.8 TECHNOLOGY ANALYSIS

2.8.1 KEY TECHNOLOGIES

2.8.1.1 AI in autonomous forklifts

2.8.2 ADJACENT TECHNOLOGIES

2.8.2.1 Advancements in fuel technology

2.9 INVESTMENT AND FUNDING SCENARIO

2.10 TOTAL COST OF OWNERSHIP

2.11 PATENT ANALYSIS

2.12 TRADE ANALYSIS

2.12.1 IMPORT SCENARIO

2.12.2 EXPORT SCENARIO

3.1 INTRODUCTION

3.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021–2024

3.3 MARKET SHARE ANALYSIS, 2024

3.4 REVENUE ANALYSIS, 2019–2023

3.4.1 COMPANY FOOTPRINT

3.4.1.1 Company footprint

3.4.1.2 Tonnage capacity footprint

3.4.1.3 Forklift type footprint

3.4.1.4 Region footprint

3.5 COMPANY EVALUATION MATRIX, START-UPS/SMES, 2024

3.5.1 PROGRESSIVE COMPANIES

3.5.2 RESPONSIVE COMPANIES

3.5.3 DYNAMIC COMPANIES

3.5.4 STARTING BLOCKS

3.5.5 COMPETITIVE BENCHMARKING

3.5.5.1 List of start-ups/SMEs

3.5.5.2 Competitive benchmarking of start-ups/SMEs

3.6 COMPANY VALUATION AND FINANCIAL METRICS

3.7 BRAND/PRODUCT COMPARISON

3.8 COMPETITIVE SCENARIO

3.8.1 PRODUCT/SERVICE LAUNCHES/DEVELOPMENTS

3.8.2 DEALS

3.8.3 EXPANSIONS

4.1 MOVIGO ROBOTICS BV

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 OTTO MOTORS

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 MOBILE INDUSTRIAL ROBOTS

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 VISIONNAV ROBOTICS

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 SHENZHEN WELLWIT ROBOTICS CO., LTD.

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 MULTIWAY ROBOTICS (SHENZHEN) CO., LTD.

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 VECNA ROBOTICS

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

marketbeat

marketbeat

Jan 2026

Jan 2026