Comparing 11 vendors in Advanced Ceramics Startups across 0 criteria.

Advanced ceramics are cutting-edge, non-metallic materials characterized by their strength, corrosion resistance, stability at high temperatures, and chemical inertness. These features make them indispensable in diverse industries such as electronics, telecommunications, manufacturing, transportation, medical, defense, and space exploration. The market for advanced ceramics is witnessing substantial growth, propelled by burgeoning technological demands in areas like 5G, artificial intelligence (AI), the Internet of Things (IoT), and 3D printing.

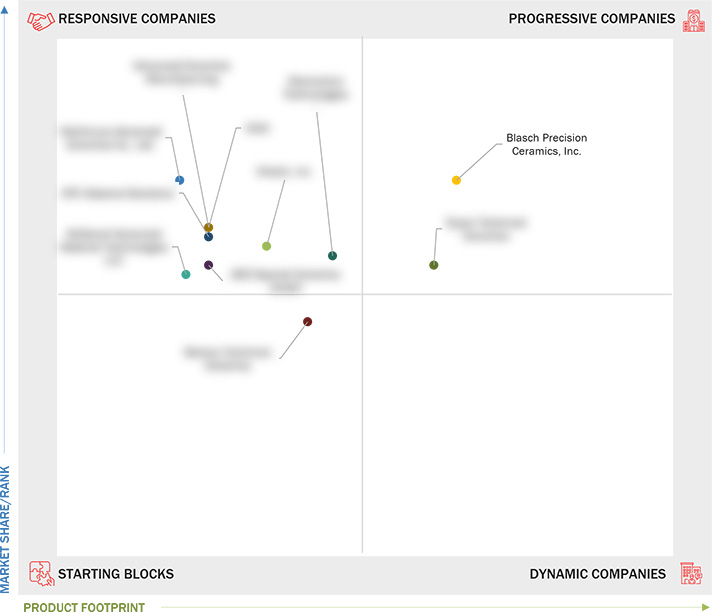

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.3.4 Currency Considered

1.3.5 Units Considered

1.4 Stakeholders

1.5 Summary of Changes

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 High growth of end-Use industries and high performance of

advanced ceramics

2.2.1.2 Rising demand from medical and electronics sectors

2.2.1.3 Government investments in research, energy, and aerospace &

defense industries

2.2.2 Restraints

2.2.2.1 Higher cost than metal and alloy counterparts

2.2.2.2 Complex manufacturing processes of advanced ceramics

2.2.3 Opportunities

2.2.3.1 Integration of nanotechnology in advanced ceramic materials

2.2.3.2 Increasing Use in aerospace and defense industries

2.2.4 Challenges

2.2.4.1 Brittleness of advanced ceramics

2.3 Porter’s Five Forces Analysis

2.3.1 Threat of New Entrants

2.3.2 Threat of Substitutes

2.3.3 Bargaining Power of Suppliers

2.3.4 Bargaining Power of Buyers

2.3.5 Intensity of Competitive Rivalry

2.4 Macroeconomic Indicators

2.4.1 Global GDP Trends

2.4.2 Trends in Automotive Industry

2.5 Value Chain Analysis

2.6 Trade Analysis

2.6.1 Import Scenario (HS Code 6909)

2.6.2 Export Scenario (HS Code 841869)

2.7 Ecosystem Analysis

2.8 Trends and Disruptions Impacting Customer Business

2.9 Technology Analysis

2.9.1.1 Powder synthesis and sintering techniques

2.9.2 Complementary Technologies

2.9.2.1 Nanotechnology

2.9.2.2 Coating technologies

2.10 Key Conferences and Events, 2025

2.11 Patent Analysis

2.11.1 Methodology

2.11.2 Document Types

2.11.3 Publication Trends in Last2 Years

2.11.4 Insights

2.11.5 Legal Status of Patents

2.11.6 Jurisdiction Analysis

2.11.7 Top Applicants

2.12 Impact of Ai/Gen Ai on Advanced Ceramics Market

2.13 Investment and Funding Scenario

3.1 Overview

3.2 Key Player Strategies/Right to Win, 2020–2024

3.3 Revenue Analysis, 2023

3.4 Market Share Analysis, 2023

3.5 Company Valuation and Financial Metrics

3.6 Brand/Product Comparison

3.7 Company Evaluation Matrix: Key Players, 2023

3.7.1 Stars

3.7.2 Emerging Leaders

3.7.3 Pervasive Players

3.7.4 Participants

3.8 Company Evaluation Matrix: Startups/SMEs, 2023

3.8.1 Progressive Companies

3.8.2 Responsive Companies

3.8.3 Dynamic Companies

3.8.4 Starting Blocks

3.8.5 Competitive Benchmarking: Startups/SMEs, 2023

3.8.5.1 Detailed list of key startups/SMEs

3.8.5.2 Competitive benchmarking of startups/SMEs

3.9 Competitive Scenario

3.9.1 Product Launches

3.9.2 Deals

3.9.3 Expansions

4.1 NISHIMURA ADVANCED CERAMICS CO., LTD.

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 MCDANEL ADVANCED MATERIAL TECHNOLOGIES LLC

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 ORTECH, INC.

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 BLASCH PRECISION CERAMICS, INC.

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 COIC

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 BCE SPECIAL CERAMICS GMBH

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 STC MATERIAL SOLUTIONS

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 MOMENTIVE TECHNOLOGIES

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 DYSON TECHNICAL CERAMICS

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

4.10 ADVANCED CERAMICS MANUFACTURING

4.10.1 Business overview

4.10.2 Products/Solutions/Services offered

4.10.3 Recent developments

4.11 BAKONY TECHNICAL CERAMICS

4.11.1 Business overview

4.11.2 Products/Solutions/Services offered

4.11.3 Recent developments

ChemAnalyst

ChemAnalyst

Oct 2024

Oct 2024