Comparing 15 vendors in Automotive Refinish Coatings Startups across 0 criteria.

The automotive refinish coatings market is evolving rapidly, driven by rising vehicle ownership, increased road accidents, and growing demand for aesthetic and protective finishes. These coatings enhance vehicle appearance and durability, with applications in basecoats, clearcoats, and primers. Technological advancements in waterborne and UV-cured systems support environmental compliance and performance. Emerging economies are witnessing strong growth due to expanding automotive sectors. Competitive dynamics are shaped by innovation, strategic partnerships, and the rise of startups offering niche and sustainable solutions.

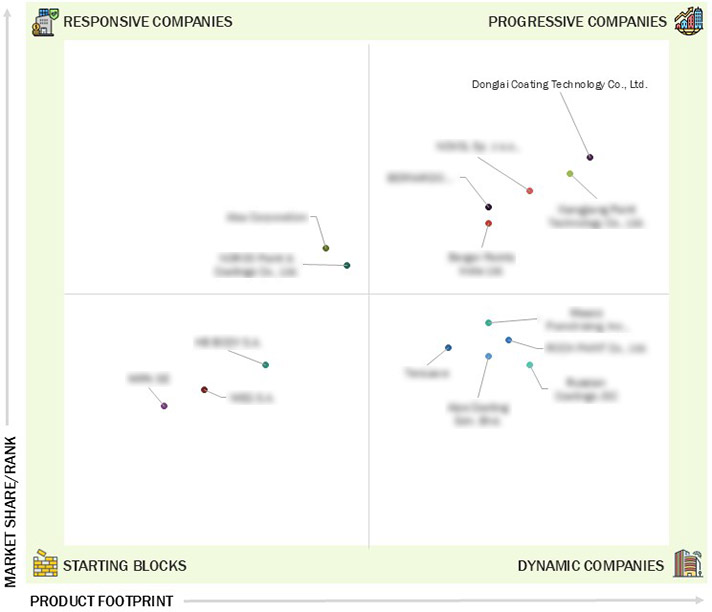

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Market Scope

1.3.1 Automotive Refinish Coatings Market Segmentation and Regional

Spread

1.3.2 Automotive Refinish Coatings Market: Inclusions & Exclusions

1.3.3 Automotive Refinish Coatings Market: Market Definitions and

Inclusions, By Layer Type

1.3.4 Automotive Refinish Coatings Market: Market Definitions and

Inclusions, By Resin Type

1.3.5 Automotive Refinish Coatings Market: Market Definitions and

Inclusions, By Vehicle Type

1.3.6 Years Considered

1.3.7 Currency Considered

1.3.8 Units Considered

1.4 Stakeholders

1.5 Summary of Changes

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Expanding automotive aftermarket services

2.2.1.2 Growth in road accidents and collisions

2.2.1.3 Technological advancements in coatings

2.2.1.4 Rising insurance penetration and claims processing

2.2.2 Restraints

2.2.2.1 Disruption in supply chain due to geopolitical tensions

2.2.2.2 Toxicity and health concerns

2.2.3 Opportunities

2.2.3.1 Adoption of eco-friendly coatings

2.2.3.2 Expansion into emerging markets

2.2.4 Challenges

2.2.4.1 Stringent environmental regulations

2.3 Porter’s Five Forces Analysis

2.3.1 Threat of Substitutes

2.3.2 Threat of New Entrants

2.3.3 Bargaining Power of Suppliers

2.3.4 Bargaining Power of Buyers

2.3.5 Intensity of Competitive Rivalry

2.4 Macroeconomic Indicators

2.4.1 GDP Trends and Forecast for Major Economies

2.5 Supply Chain Analysis

2.5.1 Raw Materials Supplier

2.5.2 Manufacturer

2.5.3 Distribution Network

2.5.4 End-Use Industries

2.6 Trends/Disruptions Impacting Customer Business

2.7 Ecosystem Analysis

2.8 Technology Analysis

2.8.1 Key Technologies

2.8.1.1 Waterborne coatings technology

2.8.1.2 UV-curable coatings technology

2.8.2 Complementary Technologies

2.8.2.1 Low-VOC/high-solid coatings technology

2.9 Key Conferences & Events in 2025–2026

2.10 Investment and Funding Scenario

2.11 Patent Analysis

2.11.1 Approach

2.11.2 Document Types

2.11.3 Top Applicants

2.11.4 Jurisdiction Analysis

2.12 Impact of US Tariff – Overview

2.12.1 Introduction

2.12.2 Key Tariff Rates

2.12.3 Price Impact Analysis

2.12.4 Impact on Country/Region

2.12.4.1 US

2.12.4.2 Europe

2.12.4.3 Asia Pacific

2.12.5 Impact on End-Use Industries:

2.13 Impact of AI/Gen AI on Automotive Refinish Coatings Market

3.1 Introduction

3.2 Key Players Strategies/Right to Win

3.3 Market Share Analysis, 2024

3.4 Revenue Analysis, 2023−2025

3.5 Company Evaluation Matrix: Startups/SMEs, 2024

3.5.1 Progressive Companies

3.5.2 Responsive Companies

3.5.3 Dynamic Companies

3.5.4 Starting Blocks

3.5.5 Competitive Benchmarking: Start-Ups/SMEs, 2024

3.5.5.1 Detailed list of key start-ups/SMEs

3.5.5.2 Competitive benchmarking of key start-ups/SMEs

3.6 Company Valuation and Financial Metrics

3.7 Brand/Product Comparison

3.8 Competitive Scenario

3.8.1 Deals

3.8.2 Expansions

3.8.3 Other Developments

4.1 ROCK PAINT CO., LTD.

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 MAACO FRANCHISING, INC.

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 XIANGJIANG PAINT TECHNOLOGY CO., LTD.

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 BERGER PAINTS INDIA LTD.

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 DONGLAI COATING TECHNOLOGY CO., LTD.

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 NOROO PAINT & COATINGS CO., LTD.

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 ALSA CORPORATION

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 WEG S.A.

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 BERNARDO ECENARRO S.A.

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

4.10 ALPS COATING SDN. BHD.

4.10.1 Business overview

4.10.2 Products/Solutions/Services offered

4.10.3 Recent developments

4.11 RUSSIAN COATINGS JSC

4.11.1 Business overview

4.11.2 Products/Solutions/Services offered

4.11.3 Recent developments

4.12 NOVOL SP. Z O.O.

4.12.1 Business overview

4.12.2 Products/Solutions/Services offered

4.12.3 Recent developments

4.13 MIPA SE

4.13.1 Business overview

4.13.2 Products/Solutions/Services offered

4.13.3 Recent developments

4.14 HB BODY S.A.

4.14.1 Business overview

4.14.2 Products/Solutions/Services offered

4.14.3 Recent developments

4.15 TERSUAVE

4.15.1 Business overview

4.15.2 Products/Solutions/Services offered

4.15.3 Recent developments

einpresswire

einpresswire

Feb 2026

Feb 2026