Comparing 7 vendors in Data Center Cooling Startups across 0 criteria.

Data center cooling market is growing rapidly due to rising demand for cloud computing, AI workloads, and hyperscale data centers. Efficient cooling solutions are critical to reduce energy consumption, manage heat density, and improve overall data center performance. Technologies such as liquid cooling, free cooling, and AI-driven thermal management are gaining traction alongside traditional air-based systems. Increasing focus on sustainability and carbon reduction is pushing operators toward energy-efficient and eco-friendly cooling designs. North America currently leads the market, while Asia-Pacific is experiencing the fastest growth driven by digital transformation and expanding IT infrastructure.

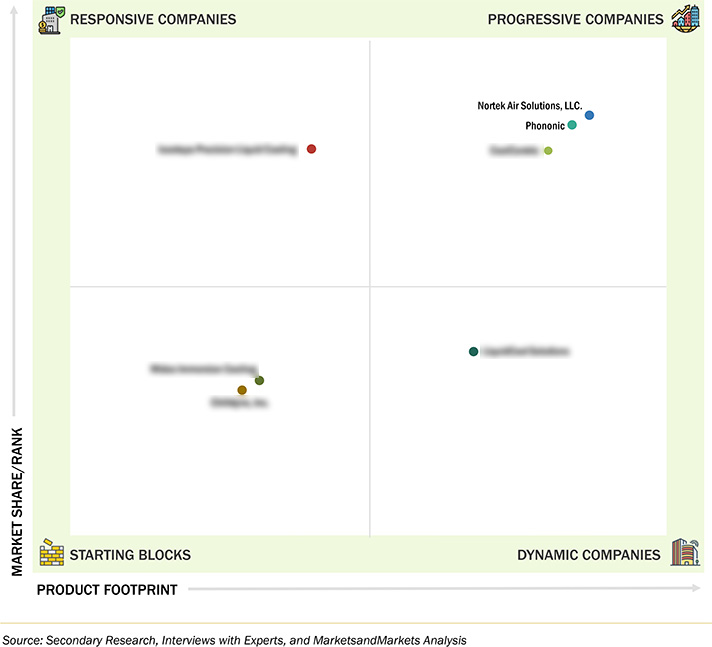

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Inclusions & Exclusions

1.3.1 Data Center Cooling Market, By Region: Inclusions & Exclusions

1.3.2 Data Center Cooling Market, By Component: Inclusions & Exclusions

1.3.3 Data Center Cooling Market, By Solution: Inclusions & Exclusions

1.3.4 Data Center Cooling Market, By Service: Inclusions & Exclusions

1.3.5 Data Center Cooling Market, By Type of Cooling: Inclusions &

Exclusions

1.3.6 Data Center Cooling Market, By Data Center Type: Inclusions &

Exclusions

1.3.7 Data Center Cooling Market, By End-Use Industry: Inclusions &

Exclusions

1.4 Market Scope

1.4.1 Market Segmentation

1.5 Years Considered

1.6 Currency Considered

1.7 Stakeholders

1.8 Research Limitations

1.9 Summary of Changes

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Need for improving efficiency in data centers

2.2.1.2 Significant growth in number of data centers

2.2.2 Restraints

2.2.2.1 High capital investment

2.2.2.2 Requirement of specialized infrastructure

2.2.3 Opportunities

2.2.3.1 Emergence of liquid cooling technology

2.2.3.2 Growing requirement for modular data center cooling

2.2.3.3 Development of innovative cooling techniques

2.2.4 Challenges

2.2.4.1 Cooling challenges during power outage

2.2.4.2 Necessity of reducing carbon emissions

2.3 Porter’s Five Forces Analysis

2.3.1 Bargaining Power of Suppliers

2.3.2 Threat of New Entrants

2.3.3 Threat of Substitutes

2.3.4 Bargaining Power of Buyers

2.3.5 Intensity of Competitive Rivalry

2.4 Supply Chain Analysis

2.4.1 Data Center Original Equipment Manufacturers

2.4.2 Data Center Original Design Manufacturers

2.4.3 Data Center Cooling Original Equipment Manufacturers

2.4.4 System Integrators

2.4.5 Value-Added Service Providers

2.4.6 End Users

2.5 Patent Analysis

2.5.1 Major Patents

2.6 Ecosystem Analysis

2.7 Trends and Disruptions Impacting Customer Business

2.8 Technology Analysis

2.9 Key Technologies

2.9.1 Air Cooling

2.9.2 Liquid Cooling

2.10 Adjacent Technology

2.10.1 Thermoelectric Cooling

2.10.2 On-Chip Cooling/Embedded Microfluidics

2.11 Complementary Technology

2.11.1 Advanced Thermal Interface Materials

2.11.2 Liquid Leak Detection & Containment Systems

2.12 Investment and Funding Scenario

2.13 Key Conferences & Events in 2025–2026

2.14 Impact of AI on Data Center Cooling Market

2.15 Ai-Driven Cooling Optimization

2.16 Shift to Advanced Liquid Cooling Technologies

2.17 Predictive Maintenance and System Reliability

2.18 Sustainability and Regulatory Compliance

2.19 Economic and Investment Opportunities

2.20 Challenges and Future Outlook

2.21 Global Macroeconomic Outlook

2.21.1 GDP

2.22 Impact of US Tariff on Data Center Cooling Market

2.22.1 Key Tariff Rates

2.22.2 Price Impact Analysis

2.22.3 Impact on Major Country/Region

2.22.3.1 US

2.22.3.2 Europe

2.22.3.3 Asia Pacific

3.1 Introduction

3.2 Strategies Adopted By Key Players

3.3 Revenue Analysis

3.4 Market Share Analysis

3.4.1 Ranking of Key Market Players, 2024

3.4.2 Market Share of Key Players

3.5 Brand/Product Comparison

3.6 Startup/SME Evaluation Matrix, 2024

3.6.1 Progressive Companies

3.6.2 Responsive Companies

3.6.3 Dynamic Companies

3.6.4 Starting Blocks

3.6.5 Competitive Benchmarking

3.7 Company Valuation and Financial Metrics

3.8 Competitive Scenario and Trends

3.8.1 Product Launches

3.8.2 Deals

3.8.3 Other Developments

4.1 COOLCENTRIC

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 NORTEK AIR SOLUTIONS, LLC.

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 ICEOTOPE PRECISION LIQUID COOLING

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 LIQUIDCOOL SOLUTIONS

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 MIDAS IMMERSION COOLING

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 CHILLDYNE, INC.

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

ks_report

ks_report

May 2024

May 2024