Comparing 15 vendors in ETFE and ECTFE Coatings Startups across 0 criteria.

The ETFE & ECTFE coatings market refers to the industry focused on providing specialized surface coating services using ETFE & ECTFE coatings to coat industrial equipment. These fluoropolymer coatings are applied via professional service providers to enhance the durability, chemical resistance, corrosion protection, and thermal stability of various equipment used across industries such as chemical manufacturing, semiconductor production, food processing, pharmaceuticals, and aerospace & defense.

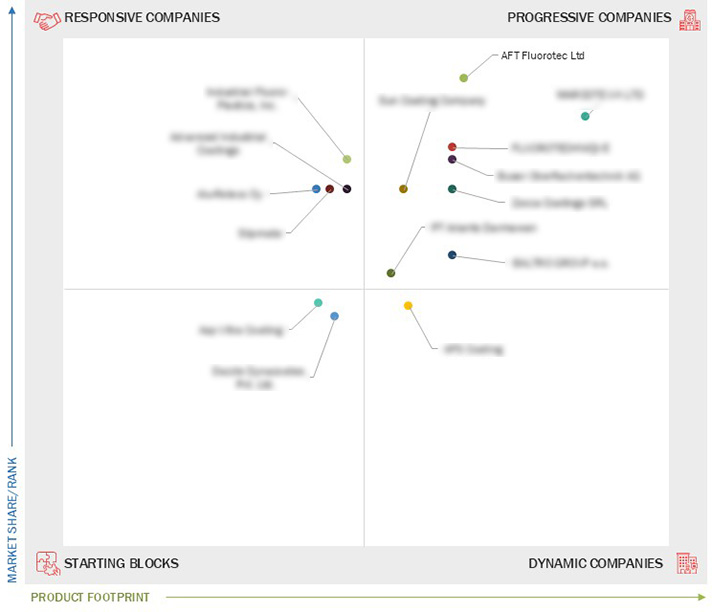

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 High demand for ETFE & ECTFE coating services from end use such as food and beverage, chemicals, and pharmaceutical industries

2.2.1.2 Tightening safety norms drive demand for durable coatings to prevent equipment failures and leaks in chemical and pharmaceutical sectors

2.2.1.3 Superior performance over alternative coatings

2.2.2 Restraints

2.2.2.1 High cost of ETFE & ECTFE coatings limits adoption among price sensitive end users

2.2.3 Opportunities

2.2.3.1 Aerospace & defense industry to present significant growth opportunities

2.2.4 Challenges

2.2.4.1 Resin scarcity and the difficulty in sourcing costly raw materials like fluorine

2.2.4.2 Growing scrutiny of fluoropolymer coatings elevates compliance risks for ETFE & ECTFE coating

2.3 Trends/Disruptions Impacting Customer Business

2.4 Value Chain Analysis

2.5 Ecosystem Analysis

2.6 Investment and Funding Scenario

2.7 Technology Analysis

2.7.1 Key Technologies

2.7.2 Complementary Technologies

2.7.3 Adjacent Technologies

2.8 Patent Analysis

2.9 Trade Analysis

2.10 Porter’s Five Forces Analysis

2.10.1 Threat of New Entrants

2.10.2 Threat of Substitutes

2.10.3 Bargaining Power of Suppliers

2.10.4 Bargaining Power of Buyers

2.10.5 Intensity of Competitive Rivalry

3.1 Introduction

3.2 Key Player Strategies/Right to Win

3.3 Revenue Analysis

3.4 Market Share Analysis

3.5 Company Valuation and Financial Metrics

3.6 Brand/Product Comparison

3.7 Company Evaluation Matrix: Startups/SMEs

3.7.1 Progressive Companies

3.7.2 Responsive Companies

3.7.3 Dynamic Companies

3.7.4 Starting Blocks

3.7.5 Competitive Benchmarking: Startups/SMEs

3.7.5.1 Detailed list of key startups/SMEs

3.7.5.2 Competitive benchmarking of key startups/SMEs

3.8 Competitive Scenario

3.8.1 Deals

3.8.2 Other Developments

4.1 AFT Fluorotec Ltd

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 APS Coating

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 Advanced Industrial Coatings

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 Alu-Releco Oy

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 Asp Ultra Coating

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 BALTRO GROUP a.s.

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 Buser Oberflächentechnik AG

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 Dazzle Dynacoates Pvt.Ltd

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 FLUOROTECHNIQUE

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

4.10 Industrial Fluoro-Plastics, Inc.

4.10.1 Business overview

4.10.2 Products/Solutions/Services offered

4.10.3 Recent developments

4.11 MARCOTE UK LTD

4.11.1 Business overview

4.11.2 Products/Solutions/Services offered

4.11.3 Recent developments

4.12 PT Arianto Darmawan

4.12.1 Business overview

4.12.2 Products/Solutions/Services offered

4.12.3 Recent developments

4.13 Slipmate

4.13.1 Business overview

4.13.2 Products/Solutions/Services offered

4.13.3 Recent developments

4.14 Sun Coating Company

4.14.1 Business overview

4.14.2 Products/Solutions/Services offered

4.14.3 Recent developments

4.15 Zocca Coatings SRL

4.15.1 Business overview

4.15.2 Products/Solutions/Services offered

4.15.3 Recent developments