Comparing 13 vendors in Grignard Reagents Startups across 0 criteria.

The webpage focuses on the Grignard reagents market, highlighting its significance in organic synthesis, especially for forming carbon-carbon bonds. These reagents are widely used across pharmaceuticals, agrochemicals, polymers, and specialty chemicals. Technological advancements like flow chemistry and microreactors have improved safety and efficiency. The market is driven by rising demand in drug development, material science, and sustainable practices. Asia Pacific leads in production due to strong industrial growth and R&D investments, positioning the region as a key player in global market expansion.

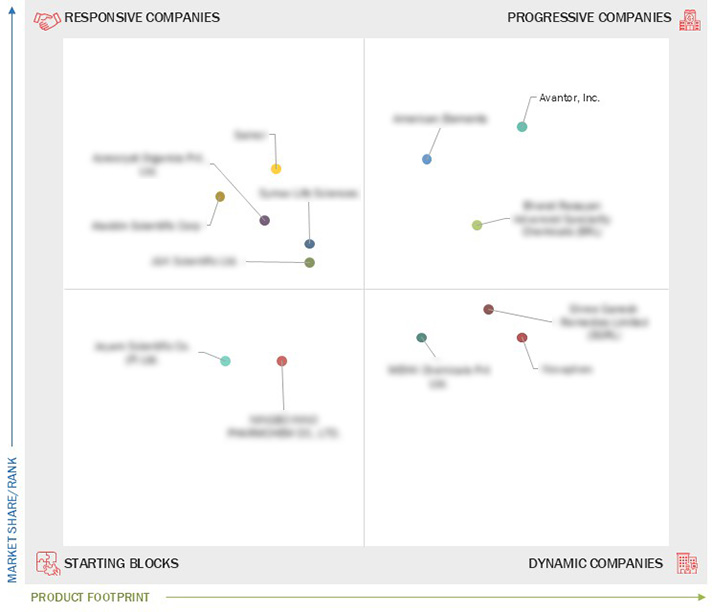

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Technological advancements in Grignard reagent industry

2.2.1.2 Rising demand in pharmaceutical industry

2.2.2 Restraints

2.2.2.1 Highly reactive and moisture-sensitive nature of Grignard reagents

2.2.2.2 Environmental and safety regulations

2.2.3 Opportunities

2.2.3.1 Emergence of green chemistry and sustainable practices

2.2.3.2 Rising demand in Asia Pacific

2.2.4 Challenges

2.2.4.1 Lack of skilled workforce

2.2.4.2 Complexities involved in scaling up processes

2.3 Trends/Disruptions Impacting Customer Business

2.4 Value Chain Analysis

2.5 Ecosystem Analysis

2.6 Investment and Funding Scenario

2.7 Technology Analysis

2.7.1 Key Technologies

2.7.2 Complementary Technologies

2.7.3 Adjacent Technologies

2.8 Patent Analysis

2.9 Trade Analysis

2.10 Porter’s Five Forces Analysis

2.10.1 Threat of New Entrants

2.10.2 Threat of Substitutes

2.10.3 Bargaining Power of Suppliers

2.10.4 Bargaining Power of Buyers

2.10.5 Intensity of Competitive Rivalry

3.1 Introduction

3.2 Key Player Strategies/Right to Win

3.3 Revenue Analysis

3.4 Market Share Analysis

3.5 Company Valuation and Financial Metrics

3.6 Brand/Product Comparison

3.7 Company Evaluation Matrix: Startups/SMEs

3.7.1 Progressive Companies

3.7.2 Responsive Companies

3.7.3 Dynamic Companies

3.7.4 Starting Blocks

3.7.5 Competitive Benchmarking: Startups/SMEs

3.7.5.1 Detailed list of key startups/SMEs

3.7.5.2 Competitive benchmarking of key startups/SMEs

3.8 Competitive Scenario

3.8.1 New Product Launches

3.8.2 Deals

3.8.3 Others

4.1 Avantor Inc.

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 American Elements

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 Bharat Rasayan Advanced Speciality Chemicals

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 Symax Life Sciences

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 Sainor

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 Azeocryst Organics Pvt. Ltd.

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 Aladdin Scientific Corp

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 J&K Scientific Ltd.

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 Shree Ganesh Remedies Limited

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

4.10 Novaphen

4.10.1 Business overview

4.10.2 Products/Solutions/Services offered

4.10.3 Recent developments

4.11 MEHK Chemicals Pvt Ltd.

4.11.1 Business overview

4.11.2 Products/Solutions/Services offered

4.11.3 Recent developments

4.12 NINGBO INNO PHARMCHEM CO., LTD.

4.12.1 Business overview

4.12.2 Products/Solutions/Services offered

4.12.3 Recent developments

4.13 Jeyam Scientific Co. (P) Ltd

4.13.1 Business overview

4.13.2 Products/Solutions/Services offered

4.13.3 Recent developments

American Elements

American Elements

Dec 2024

Dec 2024