Comparing 9 vendors in Hospital Filtration Startups across 0 criteria.

Hospital filtration refers to the use of specialized air and water filtration solutions designed to maintain a clean, safe, and sterile environment within healthcare facilities. These filtration systems are critical for removing airborne and waterborne contaminants, including bacteria, viruses, particulate matter, and chemical pollutants, to prevent infections and ensure patient and staff safety.

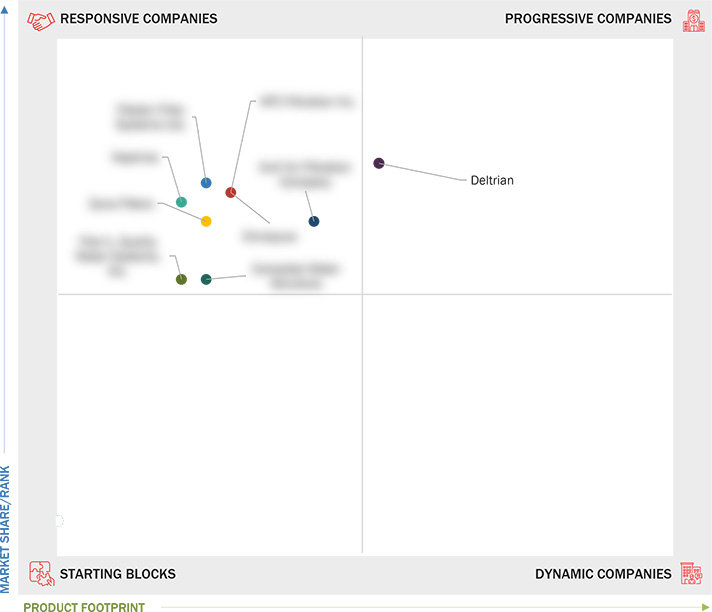

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Units Considered

1.6 Stakeholders

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Surge in aging population and chronic diseases

2.2.1.2 Increasing investments in healthcare infrastructure

2.2.1.3 Need for high-efficiency filtration systems to prevent

spread of infectious diseases

2.2.2 Restraints

2.2.2.1 High initial investments required for hospital filtration

systems

2.2.3 Opportunities

2.2.3.1 Growing demand for filtration in emerging economies

2.2.3.2 Surge in medical tourism and expansion of high-end

healthcare facilities

2.2.4 Challenges

2.2.4.1 Integrating modern systems with existing infrastructure

2.2.4.2 Stringent regulations and quality standards

2.3 Porter’s Five Forces Analysis

2.3.1 Threat of New Entrants

2.3.2 Threat of Substitutes

2.3.3 Bargaining Power of Suppliers

2.3.4 Bargaining Power of Buyers

2.3.5 Intensity of Competitive Rivalry

2.4 Value Chain Analysis

2.4.1 Raw Material Suppliers

2.4.2 Manufacturers

2.4.3 Distributors

2.4.4 End Users

2.5 Ecosystem Analysis

2.6 Key Conferences and Events, 2025–2026

2.7 Patent Analysis

2.7.1 Methodology

2.7.2 Document Types

2.7.3 Publication Trends

2.7.4 Insights

2.7.5 Jurisdiction Analysis

2.7.6 Top Applicants

2.8 Trade Analysis

2.8.1 Import Scenario (HS Code 900220)

2.8.2 Export Scenario (HS Code 900200)

2.9 Macroeconomic Indicators

2.9.1 Global GDP Trends

2.10 Investment and Funding Scenario

2.11 Pricing Analysis

2.11.1 Average Selling Price Trend, By Region, 2021–2030

2.11.2 Average Selling Price Trend of Key Players, By Type, 2023

2.11.3 Average Selling Price Trend of Key Players, By Application, 2023

2.12 Trends/Disruptions Impacting Customer Business

2.13 Impact of AI on Hospital Filtration Market

3.1 Overview

3.2 Key Player Strategies/Right to Win

3.3 Revenue Analysis

3.4 Market Share Analysis, 2023

3.4.1 Pentair

3.4.2 Veolia

3.4.3 Daikin

3.4.4 Camfil

3.5 Company Valuation and Financial Metrics

3.6 Brand/Product Comparison Analysis

3.7 Company Evaluation Matrix: Startups/SMEs, 2023

3.7.1 Progressive Companies

3.7.2 Responsive Companies

3.7.3 Dynamic Companies

3.7.4 Starting Blocks

3.7.5 Competitive Benchmarking: Startups/SMEs, 2023

3.7.5.1 Detailed list of key startups/SMEs

3.7.5.2 Competitive benchmarking of key startups/SMEs

3.8 Competitive Scenario

3.8.1 Deals

3.8.2 Expansions

4.1 FILEDER FILTER SYSTEMS LTD.

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 NEPHROS

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 OMNIPURE

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 DYNA FILTERS

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 APC FILTRATION INC.

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 DELTRIAN

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 GULF AIR FILTRATION COMPANY

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 COMPLETE WATER SOLUTIONS

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 FLIER’S QUALITY WATER SYSTEMS, INC.

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

businesswire

businesswire

Sep 2023

Sep 2023