Comparing 11 vendors in LNG Storage Tank across 0 criteria.

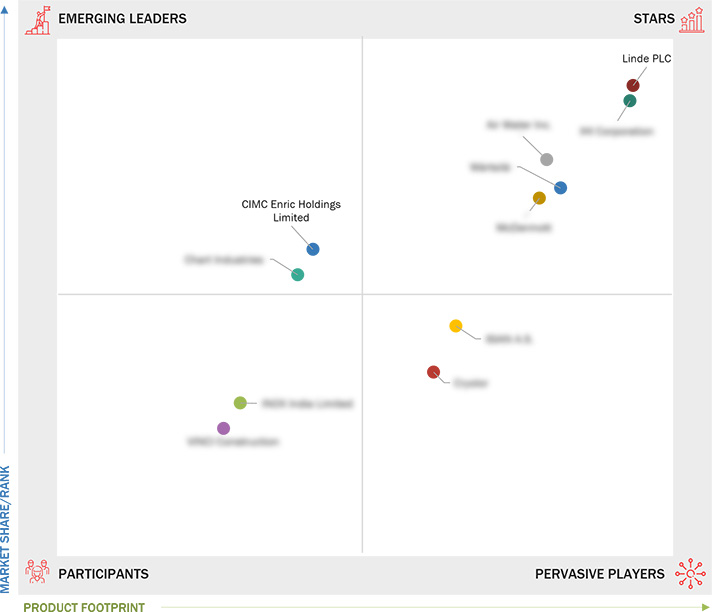

The LNG Storage Tank Companies Quadrant is a comprehensive industry analysis that provides valuable insights into the global market for LNG Storage Tanks. This quadrant offers a detailed evaluation of key market players, technological advancements, product innovations, and emerging trends shaping the industry. MarketsandMarkets 360 Quadrants evaluated over 25 companies of which the Top 15 LNG Storage Tank Companies were categorized and recognized as the quadrant leaders.

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Inclusions and Exclusions of Study

1.3.3 Years Considered

1.4 Currency Considered

1.5 Unit Considered

1.6 Stakeholders

1.7 Summary of Changes

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Growth of global LNG trade as cleaner energy alternative

2.2.1.2 Increasing number of floating storage and regasification

units

2.2.2 Restraints

2.2.2.1 High initial investment and installation cost for LNG

storage tanks

2.2.2.2 Volatility in raw material prices

2.2.3 Opportunities

2.2.3.1 Growing opportunities in marine transport

2.2.3.2 Increasing spending on infrastructure

2.2.4 Challenges

2.2.4.1 LNG leakage and boil-off gas

2.2.4.2 Environmental and regulatory pressures

2.3 Porter’s Five Forces Analysis

2.3.1 Threat of New Entrants

2.3.2 Threat of Substitutes

2.3.3 Bargaining Power of Suppliers

2.3.4 Bargaining Power of Buyers

2.3.5 Intensity of Competitive Rivalry

2.4 Macroeconomic Indicators

2.4.1 Introduction

2.4.2 GDP Trends and Forecast

2.4.3 Trends in Global LNG Industry

2.5 Supply Chain Analysis

2.5.1 Raw Material Analysis

2.5.2 Final Product Analysis

2.6 Value Chain Analysis

2.7 Ecosystem Analysis

2.8 Technology Analysis

2.8.1 Key Technologies

2.8.1.1 Vacuum insulation technology

2.8.1.2 Adhesive application technology

2.8.2 Complementary Technologies

2.8.2.1 Automated welding technology

2.9 Impact of Ai/Gen Ai on LNG Storage Tanks Market

2.9.1 Top Use Cases and Market Potential

2.9.2 Case Studies of Ai/Ml Implementation in LNG Storage Tanks Market

2.9.3 Clients’ Readiness to Adopt Generative Ai in LNG Storage Tanks

Market

2.10 Patent Analysis

2.10.1 Introduction

2.10.2 Methodology

2.10.3 Document Type

2.10.4 Insights

2.10.5 Legal Status of Patents

2.10.6 Jurisdiction Analysis

2.10.7 Top Applicants

3.1 Overview

3.2 Key Player Strategies/Right to Win

3.3 Revenue Analysis

3.4 Market Share Analysis

3.5 Brand/Product Comparison

3.5.1 Cryogenic Tanks (Linde Plc)

3.5.2 Earth Sheltered LNG Underground Tank (Ihi Corporation)

3.5.3 Single-Containment Tank (Wärtsilä)

3.6 Company Evaluation Matrix: Key Players, 2023

3.6.1 Stars

3.6.2 Emerging Leaders

3.6.3 Pervasive Players

3.6.4 Participants

3.6.5 Company Footprint: Key Players, 2023

3.6.5.1 Company footprint

3.6.5.2 Type footprint

3.6.5.3 Material footprint

3.6.5.4 End-Use industry footprint

3.6.5.5 Region footprint

3.7 Company Valuation and Financial Metrics

3.8 Competitive Scenario

3.8.1 Product Launches

3.8.2 Deals

4.1 LINDE PLC

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 MCDERMOTT

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 WÄRTSILÄ

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 IHI CORPORATION

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 AIR WATER INC.

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 CIMC ENRIC HOLDINGS LIMITED

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 CHART INDUSTRIES

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 ISISAN A.S.

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 CRYOLOR

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

4.10 INOX INDIA LIMITED

4.10.1 Business overview

4.10.2 Products/Solutions/Services offered

4.10.3 Recent developments

4.11 VINCI CONSTRUCTION

4.11.1 Business overview

4.11.2 Products/Solutions/Services offered

4.11.3 Recent developments

AD HOC NEWS

AD HOC NEWS

Jan 2026

Jan 2026