Comparing 14 vendors in Medical Filtration Startups across 0 criteria.

The medical filtration market is experiencing substantial growth, driven by several critical factors including technological advancements and heightened awareness around infection control. This sector is playing an increasingly pivotal role in ensuring the sterility and safety of medical environments and products, especially in the face of global health challenges. The growing demand for advanced healthcare solutions is a primary driver, prompting significant innovations in filtration technologies. These innovations are essential to meet the complex requirements of modern healthcare, where filtration plays a crucial role in safeguarding patients and medical staff from infections and contaminants.

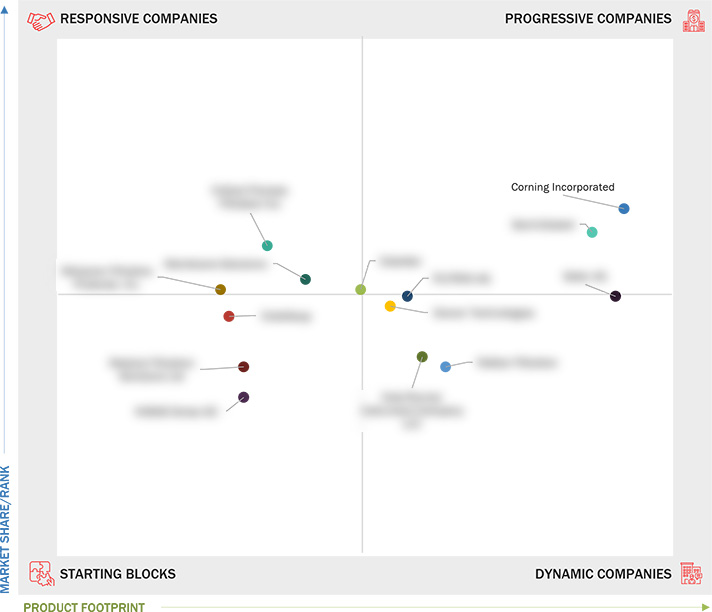

Market Leadership Quadrant

1.1 Study objectives

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.3.4 Currency Considered

1.3.5 Units Considered

1.4 Stakeholders

2.1 INTRODUCTION

2.2 MARKET DYNAMICS

2.3 DRIVERS

2.3.1 Increasing demand for advanced healthcare solutions

2.3.2 Rising awareness of infection control

2.3.3 Technological advancements

2.4 RESTRAINTS

2.4.1 High capital investments

2.4.2 Stringent regulatory compliance

2.5 OPPORTUNITIES

2.5.1 Growing healthcare investments in emerging economies

2.5.2 Adoption of single-use technologies

2.6 CHALLENGES

2.6.1 Speed and yield issues

2.7 VALUE CHAIN ANALYSIS

2.8 ECOSYSTEM ANALYSIS

2.9 INVESTMENT AND FUNDING SCENARIO

2.10 TECHNOLOGY ANALYSIS

2.10.1 KEY TECHNOLOGIES

2.10.2 COMPLEMENTARY TECHNOLOGIES

2.10.3 ADJACENT TECHNOLOGIES

3.1 OVERVIEW

3.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

3.3 REVENUE ANALYSIS, 2021–2023

3.4 MARKET SHARE ANALYSIS, 2023

3.5 COMPANY VALUATION AND FINANCIAL METRICS

3.6 PRODUCT COMPARISON

3.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

3.7.1 STARS

3.7.2 EMERGING LEADERS

3.7.3 PERVASIVE PLAYERS

3.7.4 PARTICIPANTS

3.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

3.8.1 PROGRESSIVE COMPANIES

3.8.2 RESPONSIVE COMPANIES

3.8.3 DYNAMIC COMPANIES

3.8.4 STARTING BLOCKS

3.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

3.8.5.1 Detailed list of key startups/SMEs

3.8.5.2 Competitive benchmarking of key startups/SMEs

3.9 COMPETITIVE SCENARIO

3.9.1 PRODUCT LAUNCHES

3.9.2 DEALS

3.9.3 EXPANSIONS

3.9.4 OTHER DEVELOPMENTS

4.1 Merck KGaA

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 3M

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 Danaher

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 Sartorius AG

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 Asahi Kasei Corporation

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 MANN+HUMMEL

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 Baxter

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 Veolia

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 Thermo Fisher Scientific Inc.

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

4.10 Donaldson Company Inc.

4.10.1 Business overview

4.10.2 Products/Solutions/Services offered

4.10.3 Recent developments

4.11 PARKER HANNIFIN CORP

4.11.1 Business overview

4.11.2 Products/Solutions/Services offered

4.11.3 Recent developments

4.12 Entegris

4.12.1 Business overview

4.12.2 Products/Solutions/Services offered

4.12.3 Recent developments

Adelaide Epic Ride

Adelaide Epic Ride

Dec 2025

Dec 2025