Comparing 11 vendors in Medical Tubing Startups across 0 criteria.

Medical tubing refers to flexible, hollow channels used in healthcare for fluid and gas transport, drainage, and drug delivery applications. It is a critical component in medical devices comprising catheters, IV sets, feeding tubes, and respiratory equipment. These tubes are made from materials like PVC, silicone, polyethylene, and thermoplastic elastomers, ensuring biocompatibility, flexibility, and durability. The medical tubing market is driven by the rising prevalence of chronic diseases, increasing surgical procedures, and the growing demand for minimally invasive medical devices.

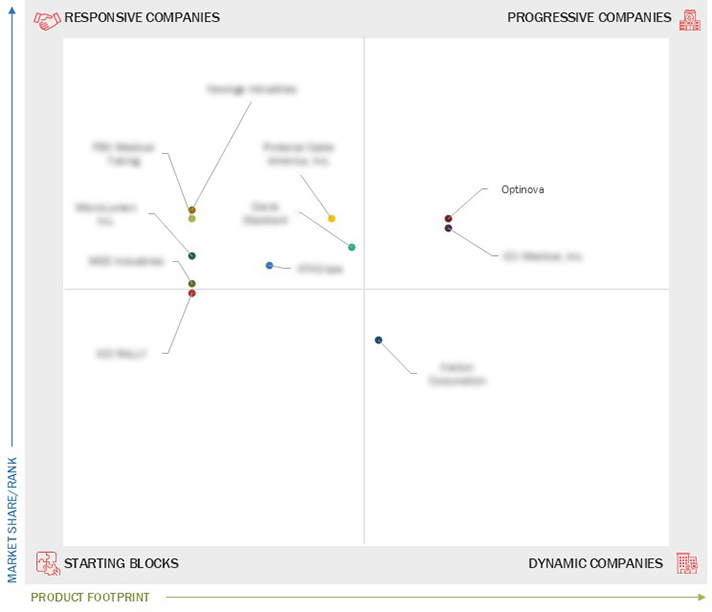

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Growing geriatric population

2.2.1.2 Increasing demand for minimally invasive medical procedures

2.2.1.3 Advancements in extrusion technology

2.2.1.4 Stringent quality standards and regulations

2.2.2 Restraints

2.2.2.1 Limited material compatibility

2.2.2.2 Environmental and disposal concerns

2.2.3 Opportunities

2.2.3.1 Advancements in biocompatible and smart materials

2.2.3.2 Increasing government expenditure to upgrade and develop healthcare infrastructure

2.2.4 Challenges

2.2.4.1 High production costs and marketing complexities

2.3 Trends/Disruptions Impacting Customer Business

2.4 Value Chain Analysis

2.5 Ecosystem Analysis

2.6 Investment and Funding Scenario

2.7 Technology Analysis

2.7.1 Key Technologies

2.7.2 Complementary Technologies

2.7.3 Adjacent Technologies

2.8 Patent Analysis

2.9 Trade Analysis

2.10 Porter’s Five Forces Analysis

2.10.1 Threat of New Entrants

2.10.2 Threat of Substitutes

2.10.3 Bargaining Power of Suppliers

2.10.4 Bargaining Power of Buyers

2.10.5 Intensity of Competitive Rivalry

3.1 Overview

3.2 Key Player Strategies/Right to Win, 2020-2025

3.3 Revenue Analysis

3.4 Market Share Analysis

3.5 Company Valuation and Financial Metrics

3.6 Brand Comparison

3.6.1 Medical Tubing Market: Brand Comparison

3.6.2 Bio-Sil Tubing

3.6.3 Helixflex

3.6.4 Isoplast Etpu Medical Tubing

3.6.5 Gore Sta-Pure Pump Tubing Series PFL

3.7 Company Evaluation and Matrix: Startups/SMEs, 2023

3.7.1 Progressive Companies

3.7.2 Responsive Companies

3.7.3 Dynamic Companies

3.7.4 Starting Blocks

3.7.5 Competitive Benchmarking: Startups/SMEs, (2023)

3.7.5.1 Detailed List of Key Startups/SMEs

3.7.5.2 Competitive Benchmarking of Key Startups/SMEs

3.8 Competitive Scenario

3.8.1 Product Launches

3.8.2 Deals

3.8.3 Other Developments

4.1 ATAG SPA

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 DAVIS STANDARD

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 FBK MEDICAL TUBING

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 PROTERIAL CABLE AMERICA, INC.

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 ICO RALLY

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 ICU MEDICAL, INC.

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 KRATON CORPORATION

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 MICROLUMEN INC.

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 MDC INDUSTRIES

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

4.10 NEWAGE INDUSTRIES

4.10.1 Business overview

4.10.2 Products/Solutions/Services offered

4.10.3 Recent developments

4.11 OPTINOVA

4.11.1 Business overview

4.11.2 Products/Solutions/Services offered

4.11.3 Recent developments

marketbeat

marketbeat

Feb 2026

Feb 2026