Comparing 9 vendors in Methanol Startups across 0 criteria.

Methanol is a clear liquid chemical used in thousands of everyday products, including plastics, paints, and fuels. Methanol is also an energy resource used in the marine, automotive, and electricity sectors and an emerging renewable energy resource. Methanol is used as a feedstock to manufacture many derivatives, such as formaldehyde, acetic acid, gasoline, biodiesel, methanol to olefins (MTO), methanol to propylene (MTP), and methyl methacrylate (MMA). There are two major feedstocks to produce methanol conventionally: natural gas and coal.

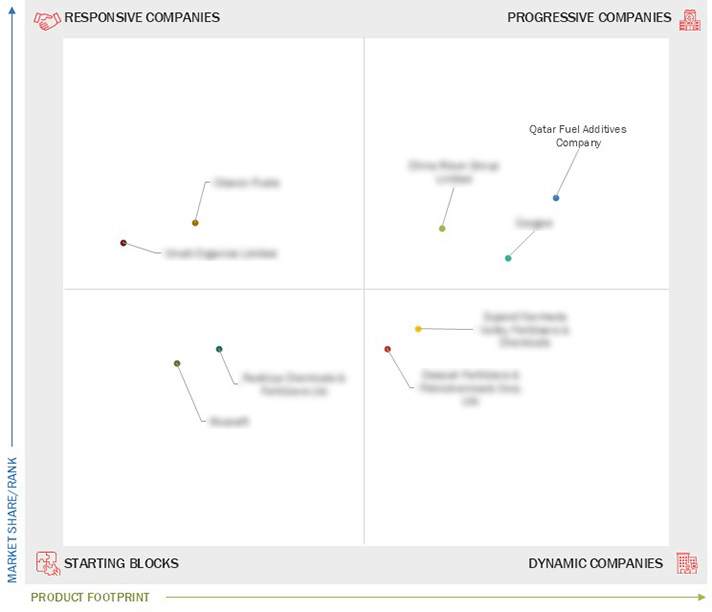

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Growing demand in traditional chemical and energy applications

2.2.1.2 Growing demand for methanol in fuel applications

2.2.2 Restraints

2.2.2.1 Use of fuel-grade ethanol

2.2.3 Opportunities

2.2.3.1 Use of methanol as an alternative fuel in marine and manufacturing industries

2.2.4 Challenges

2.2.4.1 Capital-intensive requirements for Using methanol

2.2.4.2 Strong competition from hydrogen, biofuels, and battery-electric solutions

2.3 Trends/Disruptions Impacting Customer Business

2.4 Value Chain Analysis

2.5 Ecosystem Analysis

2.6 Investment and Funding Scenario

2.7 Technology Analysis

2.7.1 Key Technologies

2.7.2 Complementary Technologies

2.7.3 Adjacent Technologies

2.8 Patent Analysis

2.9 Trade Analysis

2.10 Porter’s Five Forces Analysis

2.10.1 Threat of New Entrants

2.10.2 Threat of Substitutes

2.10.3 Bargaining Power of Suppliers

2.10.4 Bargaining Power of Buyers

2.10.5 Intensity of Competitive Rivalry

3.1 Introduction

3.2 Key Player Strategies/Right to Win

3.3 Revenue Analysis

3.4 Market Share Analysis

3.5 Company Valuation and Financial Metrics

3.6 Brand/Product Comparison

3.7 Company Evaluation Matrix: Startups/SMEs

3.7.1 Progressive Companies

3.7.2 Responsive Companies

3.7.3 Dynamic Companies

3.7.4 Starting Blocks

3.7.5 Competitive Benchmarking: Startups/SMEs

3.7.5.1 Detailed list of key startups/SMEs

3.7.5.2 Competitive benchmarking of key startups/SMEs

3.8 Competitive Scenario

3.8.1 Product Launches

3.8.2 Deals

3.8.3 Expansions

4.1 China Risun Group Limited

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 Coogee

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 Deepak Fertilisers & Petrochemicals Corp. Ltd

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 Gujarat Narmada Valley Fertilizers & Chemicals Limited (GNFC)

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 Oberon Fuels

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 Qatar Fuel Additives Company

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 Rashtriya Chemicals & Fertilizers Ltd

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 Rosneft - PJSC Rosneft

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 Vinati Organics Limited

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

ks_report

ks_report

Sep 2023

Sep 2023