Comparing 15 vendors in Microfiltration Membranes Startups across 0 criteria.

The microfiltration membranes market is a critical segment within the filtration industry, serving diverse applications across water treatment, biopharmaceutical processing, and food & beverage industries. This technology operates within a pore size range of approximately 0.1 to 10 microns, effectively removing suspended solids, bacteria, and larger macromolecules from liquids. The market is driven by the escalating need for clean water, stringent regulatory frameworks, and advancements in membrane material technologies

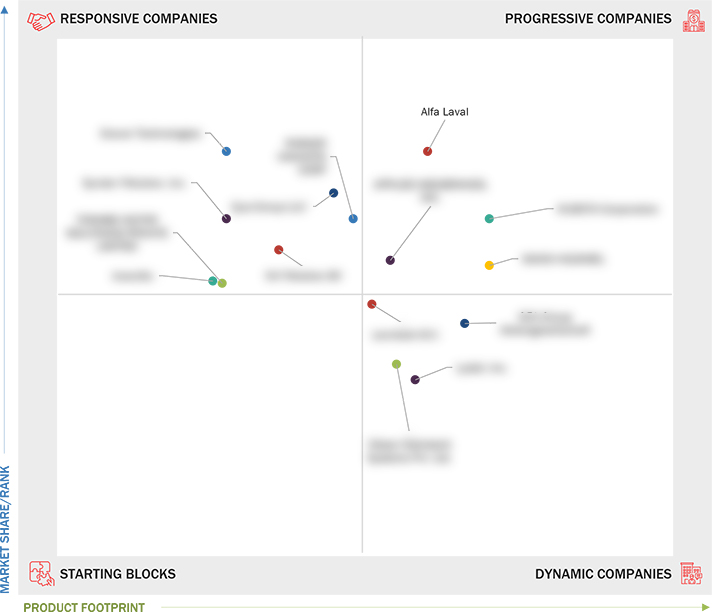

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Market Segmentation and Regional Spread

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.3.4 Currency Considered

1.3.5 Units Considered

1.4 Limitations

1.5 Stakeholders

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Increasing Awareness of Water & Wastewater Treatment

2.2.1.2 Stringent Wastewater Regulations

2.2.1.3 Selective Separation Technologies

2.2.2 Restraints

2.2.2.1 Reduced Membrane Performance Due to Fouling

2.2.2.2 High Capital Cost

2.2.3 Opportunities

2.2.3.1 Increasing Demand for Water Treatment in Developing

Countries

2.2.3.2 Rising Scarcity of Freshwater

2.2.4 Challenges

2.2.4.1 Lifespan and Efficiency of Membranes

2.3 Impact of Generative AI

2.3.1 Introduction

2.3.2 Impact of Gen AI on Microfiltration Membranes Market

2.4 Value Chain Analysis

2.4.1 Raw Material Suppliers

2.4.2 Manufacturers

2.4.3 Distributors and Retailers

2.4.4 End Users

2.5 Investment and Funding Scenario

2.6 Ecosystem Analysis

2.7 Technology Analysis

2.7.1 Key Technologies

2.7.2 Complementary Technologies

2.7.3 Adjacent Technologies

2.8 Patent Analysis

2.8.1 Methodology

2.8.2 Patents Granted Worldwide, 2014–2024

2.8.3 Patent Publication Trends

2.8.4 Insights

2.8.5 Legal Status of Patents

2.8.6 Jurisdiction Analysis

2.8.7 Top Applicants

2.8.8 List of Major Patents

2.9 Trade Analysis

2.9.1 Import Scenario (HS Code 84212900)

2.9.2 Export Scenario (HS Code 84212900)

2.10 Key Conferences and Events, 2025

2.11 Porter’s Five Forces Analysis

2.11.1 Threat of New Entrants

2.11.2 Threat of Substitutes

2.11.3 Bargaining Power of Suppliers

2.11.4 Bargaining Power of Buyers

2.11.5 Intensity of Competitive Rivalry

2.12 Macroeconomic Outlook

2.12.1 GDP Trends and Forecasts, By Country

3.1 Introduction

3.2 Key Player Strategies/Right to Win, 2021– 2025

3.3 Market Share Analysis, 2023

3.4 Revenue Analysis, 2020–2024

3.5 Brand Comparison

3.6 Company Evaluation Matrix: Key Players, 2023

3.6.1 Stars

3.6.2 Emerging Leaders

3.6.3 Pervasive Players

3.6.4 Participants

3.7 Company Evaluation Matrix: Startups/SMEs, 2023

3.7.1 Progressive Companies

3.7.2 Responsive Companies

3.7.3 Dynamic Companies

3.7.4 Starting Blocks

3.7.5 Competitive Benchmarking: Startups/SMEs, (2023)

3.7.5.1 Detailed List of Key Startups/SMEs

3.7.5.2 Competitive Benchmarking of Key Startups/SMEs

3.7.6 Valuation and Financial Metrics of Key Microfiltration Membrane

Vendors

3.8 Competitive Scenario and Trends

3.8.1 Product Launches

3.8.2 Deals

3.8.3 Expansions

4.1 ALFA LAVAL

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 APPLIED MEMBRANES, INC.

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 QUA GROUP LLC

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 GEA GROUP AKTIENGESELLSCHAFT

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 GRAVER TECHNOLOGIES

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 IMEMFLO

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 KUBOTA CORPORATION

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 MANN+HUMMEL

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 NX FILTRATION BV

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

4.10 PARKER HANNIFIN CORP

4.10.1 Business overview

4.10.2 Products/Solutions/Services offered

4.10.3 Recent developments

4.11 SYNDER FILTRATION, INC.

4.11.1 Business overview

4.11.2 Products/Solutions/Services offered

4.11.3 Recent developments

4.12 TOSHIBA WATER SOLUTIONS PRIVATE LIMITED

4.12.1 Business overview

4.12.2 Products/Solutions/Services offered

4.12.3 Recent developments

4.13 NILSAN NISHOTECH SYSTEMS PVT. LTD.

4.13.1 Business overview

4.13.2 Products/Solutions/Services offered

4.13.3 Recent developments

4.14 LENNTECH B.V.

4.14.1 Business overview

4.14.2 Products/Solutions/Services offered

4.14.3 Recent developments

4.15 LYDALL, INC.

4.15.1 Business overview

4.15.2 Products/Solutions/Services offered

4.15.3 Recent developments

teamduval.org

teamduval.org

Aug 2025

Aug 2025