Comparing 9 vendors in Mining Lubricants Startups across 0 criteria.

The mining lubricants market is pivotal for the global mining sector, focusing on the development and supply of specialized lubricants that ensure the optimal performance of heavy machinery used in mining operations. These lubricants are essential in minimizing friction, reducing wear and tear, and guaranteeing the smooth functioning of equipment such as excavators, drills, and conveyors under extreme conditions. The market is primarily driven by the escalating demand for high-performance machinery lubricants and the continuous expansion of the mining industry. High-performance lubricants, notably those that allow extended drainage intervals, provide significant cost savings to mining companies by reducing maintenance frequencies and enhancing operational efficiencies.

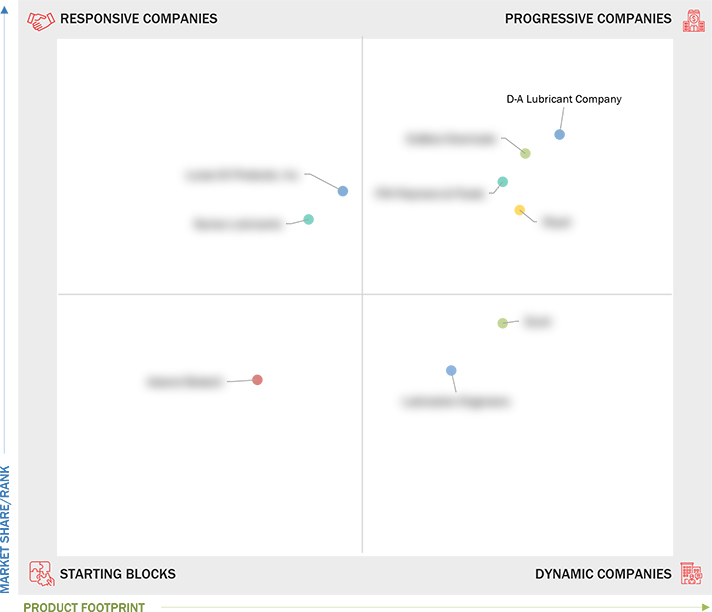

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.3.4 Currency Considered

1.3.5 Unit Considered

1.4 Limitations

1.5 Stakeholders

1.6 Summary of Changes

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Expanding mining industry

2.2.1.2 Increased demand for specialized lubricants for high-

performance machinery

2.2.1.3 Rising demand for higher power-rated mining equipment with

larger sump size

2.2.1.4 Impact of changing US energy policy on mining industry

2.2.2 Restraints

2.2.2.1 Volatility in raw material prices

2.2.2.2 High costs of synthetic mining lubricants

2.2.3 Opportunities

2.2.3.1 Growing demand for bio-based and biodegradable mining

lubricants

2.2.3.2 Extended drainage intervals of high-performance lubricants

2.2.3.3 Supportive government policies related to modernize and

boost mining activities

2.2.4 Challenges

2.2.4.1 Electrification of mining machinery

2.3 Global Macroeconomic Outlook

2.3.1 GDP

2.3.2 Research and Development (R&D) Expenditure

2.3.3 Growth of Coal Mining Industry

2.4 Supply Chain Analysis

2.5 Ecosystem Analysis

2.6 Porter’s Five Forces Analysis

2.6.1 Bargaining Power of Suppliers

2.6.2 Bargaining Power of Buyers

2.6.3 Threat of New Entrants

2.6.4 Threat of Substitutes

2.6.5 Intensity of Competitive Rivalry

2.7 Key Conferences and Events, 2025–2026

2.8 Patent Analysis

2.8.1 Methodology

2.9 Technology Analysis

2.9.1 Key Technologies

2.9.1.1 Bio-based mining lubricants

2.9.2 Adjacent Technologies

2.9.2.1 Re-refining technology

2.10 Trade Analysis

2.10.1 Import Scenario (HS Code 2710)

2.10.2 Export Scenario (HS Code 2710)

2.11 Trends/Disruptions Impacting Customer Business

2.12 Impact of Generative Ai on Mining Lubricants Market

2.12.1 Introduction

2.12.2 Predictive Maintenance

2.12.3 Supply Chain Optimization

2.12.4 Cost Savings

3.1 Introduction

3.2 Key Player Strategies/Right to Win

3.3 Revenue Analysis

3.3.1 Revenue Analysis of Top-5 Players

3.4 Ranking Analysis

3.5 Market Share Analysis

3.6 Brand/Product Comparison

3.7 Company Evaluation Matrix: Key Players, 2024

3.7.1 Stars

3.7.2 Emerging Leaders

3.7.3 Pervasive Players

3.7.4 Participants

3.8 Company Evaluation Matrix: Startups/SMEs, 2024

3.8.1 Progressive Companies

3.8.2 Responsive Companies

3.8.3 Dynamic Companies

3.8.4 Starting Blocks

3.8.5 Competitive Benchmarking: Startups/SMEs, 2024

3.8.5.1 Detailed list of key startups/SMEs

3.8.5.2 Competitive benchmarking of key startups/SMEs

3.9 Competitive Scenario

3.9.1 Deals

3.9.2 Expansions

3.10 Company Valuation and Financial Metrics

4.1 ROYAL

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 LUBRICATION ENGINEERS

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 ITW POLYMERS & FLUIDS

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 EUROL

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 LUCAS OIL PRODUCTS, INC.

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 RYMAX LUBRICANTS

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 D-A LUBRICANT COMPANY

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 ASIANOL BIOTECH

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 DUBOIS CHEMICALS

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

himalayas.app

himalayas.app

Jul 2025

Jul 2025