Comparing 11 vendors in Nonwoven Fabrics Startups across 0 criteria.

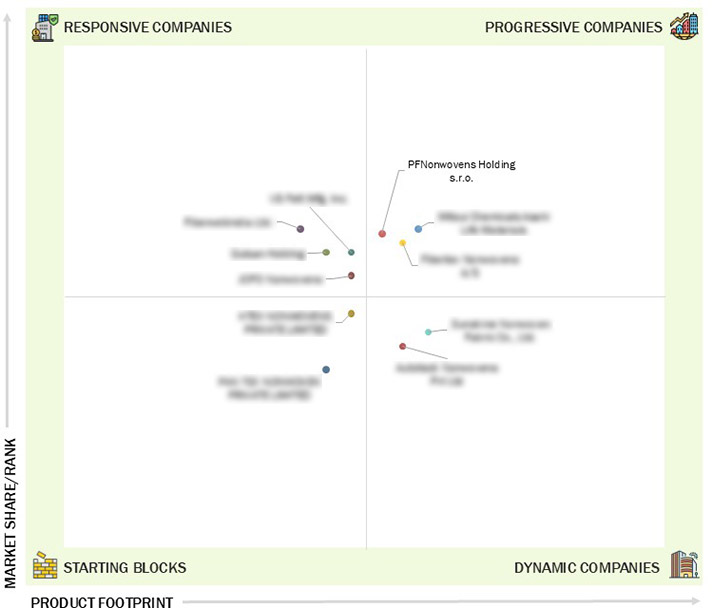

The nonwoven fabrics market is driven by innovation and strategic positioning among startups and SMEs. These companies are evaluated based on product excellence and business performance, and are categorized into progressive, responsive, dynamic, and starting block groups. Progressive firms lead in both product and business capabilities, supported by strong partnerships and marketing. Responsive companies focus on specific technologies and strategic collaborations. Dynamic players bring disruptive innovations but need stronger business foundations. Starting block companies offer niche products and are working to establish market presence. This segmentation highlights the diverse approaches shaping the future of nonwoven fabric solutions.

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.3.4 Currency Considered

1.3.5 Units Considered

1.4 Limitations

1.5 Stakeholders

1.6 Summary of Changes

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Surging demand in hygiene and medical applications

2.2.1.2 Increasing Use of lightweight nonwoven fabrics in automotive

industry

2.2.1.3 Rising adoption of nonwovens in sustainable building and

construction projects

2.2.2 Restraints

2.2.2.1 Regulatory pressures restricting Use of plastic-based

nonwovens

2.2.2.2 Volatile raw material prices

2.2.3 Opportunities

2.2.3.1 Growing demand for advanced filtration across air and water

purification applications

2.2.3.2 Rising demand for biodegradable nonwovens driven by

sustainability regulations and circular economy goals

2.2.4 Challenges

2.2.4.1 High investments for installation of recycling

infrastructure

2.2.4.2 Competitive pressure from woven and knitted fabrics

2.3 Trends/Disruptions Impacting Customer Business

2.3.1 Trends/Disruptions Impacting Customer Business

2.4 Ecosystem Analysis

2.5 Value Chain Analysis

2.6 Technology Analysis

2.6.1 Key Technologies:

2.6.2 Complementary Technologies

2.6.3 Adjacent Technologies

2.7 Patent Analysis

2.7.1 Introduction

2.7.2 Methodology

2.7.3 Nonwoven Fabrics Market, Patent Analysis, 2015–2024

2.8 Key Conferences and Events, 2025–2026

2.9 Impact of Gen AI/AI on Nonwoven Fabrics Market

2.9.1 Introduction

2.10 Porter’s Five Forces Analysis

2.10.1 Threat of New Entrants

2.10.2 Threat of Substitutes

2.10.3 Bargaining Power of Suppliers

2.10.4 Bargaining Power of Buyers

2.10.5 Intensity of Competitive Rivalry

2.11 Macroeconomic Analysis

2.11.1 Introduction

2.11.2 GDP Trends and Forecasts

2.12 Impact of US Tariffs on Nonwoven Fabrics Market

2.12.1 Introduction

2.12.2 Key Tariff Rates

2.12.3 Price Impact Analysis

2.12.4 Impact on Country/Region

2.12.4.1 US

2.12.4.2 China

2.12.4.3 Japan

2.12.5 End-Use Industry Impact

3.1 Overview

3.2 Key Player Strategies, January 2020–June 2025

3.3 Market Share Analysis, 2024

3.4 Revenue Analysis, 2020–2024

3.5 Company Valuation and Financial Metrics, 2025

3.6 Product/Brand Comparison

3.7 Company Evaluation Matrix: Startups/SMEs, 2024

3.7.1 Progressive Companies

3.7.2 Responsive Companies

3.7.3 Dynamic Companies

3.7.4 Starting Blocks

3.7.5 Competitive Benchmarking: Startups/SMEs, 2024

3.7.5.1 Detailed list of key startups/SMEs

3.7.5.2 Competitive benchmarking of key startups/SMEs

3.8 Competitive Scenario

3.8.1 Product Launches

3.8.2 Deals

3.8.3 Expansions

4.1 MITSUI CHEMICALS ASAHI LIFE MATERIALSE

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 PFNONWOVENS HOLDING S.R.O.

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 FIBERWEBINDIA LTD.

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 US FELT MFG. INC.

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 AUTOTECH NONWOVENS PVT LTD

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 SUNSHINE NONWOVEN FABRIC CO., LTD.

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 FIBERTEX NONWOVENS A/S

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 GULSAN HOLDING

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 JOFO NONWOVENS

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

4.10 PAN TEX NONWOVEN PRIVATE LIMITED

4.10.1 Business overview

4.10.2 Products/Solutions/Services offered

4.10.3 Recent developments

4.11 KTEX NONWOVENS PRIVATE LIMITED

4.11.1 Business overview

4.11.2 Products/Solutions/Services offered

4.11.3 Recent developments

Nonwovens Industry

Nonwovens Industry

Jun 2024

Jun 2024