Comparing 12 vendors in Point of Use Water Treatment Systems Startups across 0 criteria.

The point-of-use water treatment systems market is expanding due to rising concerns about water safety and health risks. These systems offer convenient and effective solutions for purifying drinking water, especially in regions with inconsistent water quality. Urbanization, growing awareness, and government initiatives promoting clean water are key factors driving adoption. Consumers prefer compact, easy-to-install devices that suit both residential and non-residential settings. Technological advancements and direct sales strategies further support market growth across emerging economies.

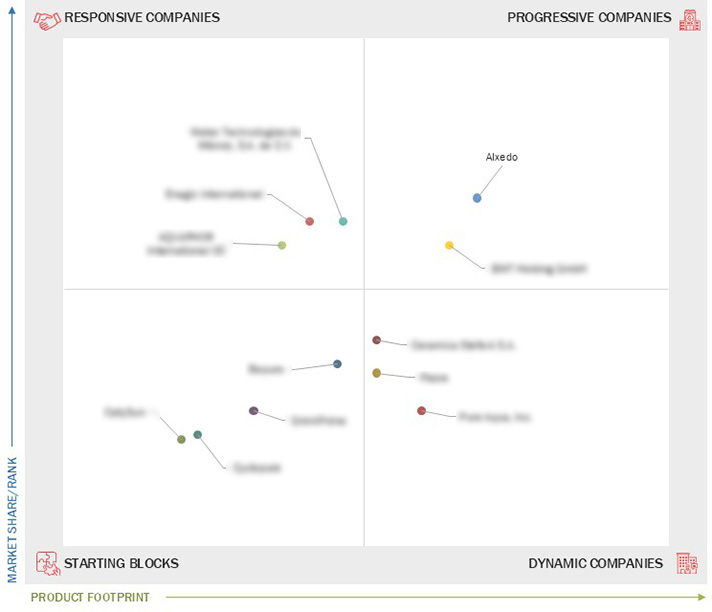

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Rising water pollution and untreated wastewater

2.2.1.2 Rapid population growth

2.2.1.3 Greater awareness about benefits of water treatment

2.2.1.4 Technological innovations

2.2.2 Restraints

2.2.2.1 High installation, equipment, and operation costs

2.2.2.2 High bottled water consumption and alternative water sources in urban areas

2.2.2.3 Water quality in different regions

2.2.3 Opportunities

2.2.3.1 Expanding middle-class population

2.2.3.2 Government and NGO support

2.2.4 Challenges

2.2.4.1 Aging infrastructure

2.2.4.2 Limited rural reach and maintenance barriers

2.3 Trends/Disruptions Impacting Customer Business

2.4 Value Chain Analysis

2.5 Ecosystem Analysis

2.6 Investment and Funding Scenario

2.7 Technology Analysis

2.7.1 Key Technologies

2.7.2 Complementary Technologies

2.7.3 Adjacent Technologies

2.8 Patent Analysis

2.9 Trade Analysis

2.10 Porter’s Five Forces Analysis

2.10.1 Threat of New Entrants

2.10.2 Threat of Substitutes

2.10.3 Bargaining Power of Suppliers

2.10.4 Bargaining Power of Buyers

2.10.5 Intensity of Competitive Rivalry

3.1 Introduction

3.2 Key Player Strategies/Right to Win

3.3 Revenue Analysis

3.4 Market Share Analysis

3.5 Company Valuation and Financial Metrics

3.6 Brand/Product Comparison

3.7 Company Evaluation Matrix: Startups/SMEs

3.7.1 Progressive Companies

3.7.2 Responsive Companies

3.7.3 Dynamic Companies

3.7.4 Starting Blocks

3.7.5 Competitive Benchmarking: Startups/SMEs

3.7.5.1 Detailed list of key startups/SMEs

3.7.5.2 Competitive benchmarking of key startups/SMEs

3.8 Competitive Scenario

3.8.1 Product Launches

3.8.2 Deals

3.8.3 Expansions

4.1 Alxedo

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 BWT AG

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 Water Technologies de México, S.A. de C.V.

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 Enagic International

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 AQUAPHOR International OÜ

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 Ceramica Stefani SA

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 PURE AQUA INC

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 Peore

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 Bepure

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

4.10 DrinkPrime

4.10.1 Business overview

4.10.2 Products/Solutions/Services offered

4.10.3 Recent developments

4.11 OptySun

4.11.1 Business overview

4.11.2 Products/Solutions/Services offered

4.11.3 Recent developments

4.12 Cyclopure

4.12.1 Business overview

4.12.2 Products/Solutions/Services offered

4.12.3 Recent developments

CYCLOPURE, INC.

CYCLOPURE, INC.

Jul 2025

Jul 2025