Comparing 7 vendors in Titanium Startups across 0 criteria.

The global titanium market comprises titanium dioxide and titanium metal. It was first commercially used in Norway for industrial purposes. Titanium dioxide—when utilized in the form of pigment—is called titanium white, Pigment White 6 (PW6), or CI 7789. Titanium dioxide is mainly sourced from the mineral ilmenite (titanium–iron oxide mineral), mineral rutile, and anatase. The mass tone of titanium white is neither warm nor cool and lies between lead white and zinc white. Hence, it has a tinting strength superior to either of the other whites and a drying time that is slower than that of lead white but faster than that of zinc white. Currently, titanium dioxide is the world's primary pigment for providing whiteness, brightness, and opacity.

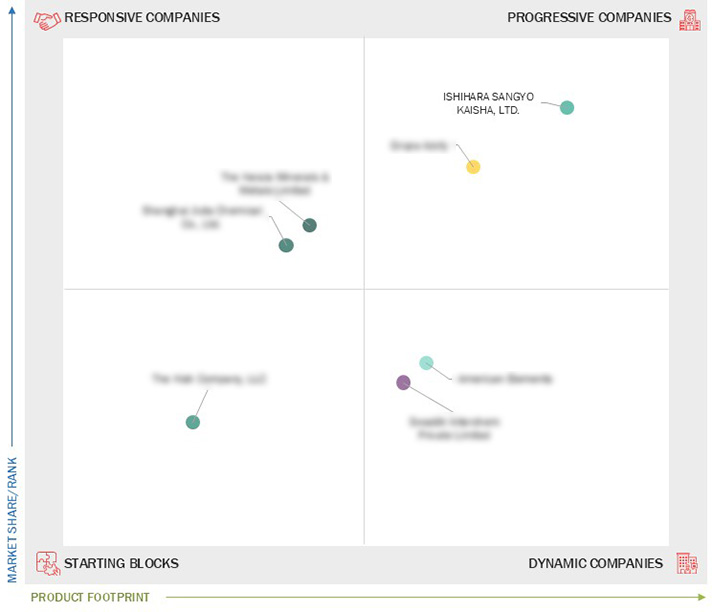

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Increasing use of titanium dioxide in paints & coatings industry

2.2.1.2 Increasing number of aircraft deliveries

2.2.1.3 Growing demand for titanium from medical industry

2.2.1.4 Surging demand for lightweight vehicles

2.2.2 Restraints

2.2.2.1 Stringent environmental policies regarding production of titanium dioxide

2.2.2.2 Complex manufacturing process

2.2.3 Opportunities

2.2.3.1 Efficient use of titanium dioxide in lithium-ion battery components

2.2.3.2 Growing adoption of titanium powder in additive manufacturing

2.2.3.3 Potential use in advancing sustainable packaging and printing solutions

2.2.3.4 Increasing demand for titanium in clean energy production

2.2.4 Challenges

2.2.4.1 Uncertainty about safety of titanium dioxide

2.2.4.2 Fluctuations in prices of raw materials

2.2.4.3 Maintenance of uninterrupted supply chain

2.3 Trends/Disruptions Impacting Customer Business

2.4 Value Chain Analysis

2.5 Ecosystem Analysis

2.6 Investment and Funding Scenario

2.7 Technology Analysis

2.7.1 Key Technologies

2.7.2 Complementary Technologies

2.7.3 Adjacent Technologies

2.8 Patent Analysis

2.9 Trade Analysis

2.10 Porter’s Five Forces Analysis

2.10.1 Threat of New Entrants

2.10.2 Threat of Substitutes

2.10.3 Bargaining Power of Suppliers

2.10.4 Bargaining Power of Buyers

2.10.5 Intensity of Competitive Rivalry

3.1 Introduction

3.2 Key Player Strategies/Right to Win

3.3 Revenue Analysis

3.4 Market Share Analysis

3.5 Company Valuation and Financial Metrics

3.6 Brand/Product Comparison

3.7 Company Evaluation Matrix: Startups/SMEs

3.7.1 Progressive Companies

3.7.2 Responsive Companies

3.7.3 Dynamic Companies

3.7.4 Starting Blocks

3.7.5 Competitive Benchmarking: Startups/SMEs

3.7.5.1 Detailed list of key startups/SMEs

3.7.5.2 Competitive benchmarking of key startups/SMEs

3.8 Competitive Scenario

3.8.1 Product Launches

3.8.2 Deals

3.8.3 Expansions

3.8.4 Other Developments

4.1 ISHIHARA SANGYO KAISHA, LTD.

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 Grupa Azoty

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 Shanghai Jiuta Chemical Co., Ltd.

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 The Kerala Minerals & Metals Limited

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 Swastik Interchem Private Limited

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 American Elements

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 The Kish Company, LLC

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

American Elements

American Elements

Dec 2024

Dec 2024