Comparing 15 vendors in Transmission Fluids Startups across 0 criteria.

The transmission fluids market has seen substantial transformation driven by technological advancements and market dynamics. As of 2024, key drivers in this sector include the expanding automotive industry, particularly with the increasing production of vehicles and the adoption of new transmission technologies. These advancements satisfy the growing demand for fuel-efficient and high-performance cars. Furthermore, stringent emission regulations are pressing manufacturers to innovate and produce environmentally friendly fluids, aligning product offerings with global sustainability goals.

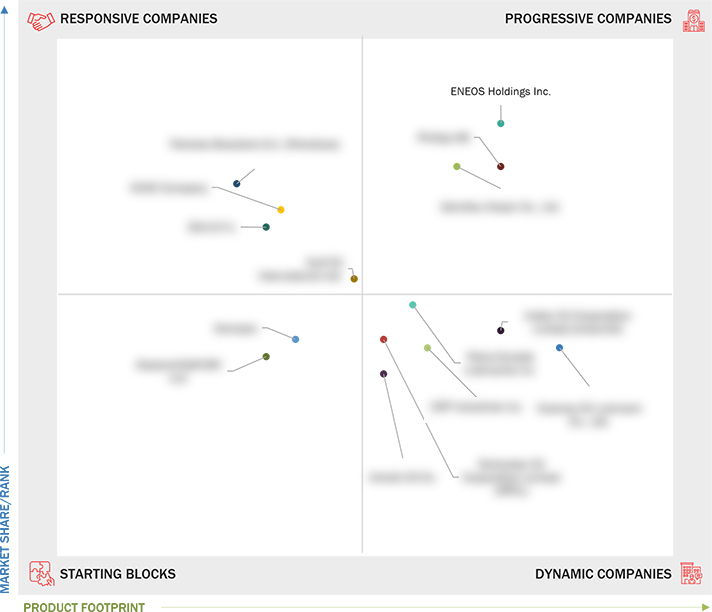

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.3.4 Currency Considered

1.3.5 Unit Considered

1.4 Stakeholders

1.5 Summary of Changes

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Expanding automotive industry

2.2.1.2 Advancements in transmission technologies

2.2.1.3 Implementation of stringent emission regulations

2.2.1.4 Growing vehicle longevity and expansion of aftermarket

services

2.2.2 Restraints

2.2.2.1 Fluctuating crude oil prices

2.2.2.2 Growing environmental concerns and challenge of fluid

disposal

2.2.3 Opportunities

2.2.3.1 Rising demand for electric and hybrid vehicles

2.2.3.2 Growing demand in emerging markets

2.2.3.3 Development of fluids for autonomous vehicles

2.2.4 Challenges

2.2.4.1 Increasing complexity of modern transmission systems

2.2.4.2 Competition from alternative lubricants

2.3 Porter’s Five Forces Analysis

2.3.1 Threat of New Entrants

2.3.2 Threat of Substitutes

2.3.3 Bargaining Power of Suppliers

2.3.4 Bargaining Power of Buyers

2.3.5 Intensity of Competitive Rivalry

2.4 Macroeconomic Indicators

2.4.1 GDP Trends and Forecast of Most Prominent Economies

2.5 Supply Chain Analysis

2.6 Trends/Disruptions Impacting Customer Business

2.7 Ecosystem Analysis

2.8 Technology Analysis

2.8.1 Key Technologies

2.8.1.1 Synthetic fluid technology

2.8.1.2 Friction modifier technology

2.8.2 Complementary Technologies

2.8.2.1 Advanced transmission cooling systems

2.8.2.2 Additive package technology

2.9 Trade Analysis

2.9.1 Import Scenario (HS Code 2710)

2.9.2 Export Scenario (HS Code 2710)

2.10 Key Conferences and Events, 2025

2.11 Investment and Funding Scenario

2.12 Patent Analysis

2.12.1 Approach

2.12.2 Patent Types

2.12.3 Top Applicants

2.12.4 Jurisdiction Analysis

2.13 Impact of AI/Gen AI on Transmission Fluids Market

3.1 Overview

3.2 Key Player Strategies/Right to Win

3.3 Market Share Analysis

3.4 Revenue Analysis

3.5 Company Evaluation Matrix: Key Players, 2023

3.5.1 Stars

3.5.2 Emerging Leaders

3.5.3 Pervasive Players

3.5.4 Participants

3.6 Company Evaluation Matrix: Startups/SMEs, 2023

3.6.1 Progressive Companies

3.6.2 Responsive Companies

3.6.3 Dynamic Companies

3.6.4 Starting Blocks

3.6.5 Competitive Benchmarking: Startups/SMEs, 2023

3.6.5.1 Detailed list of key startups/SMEs

3.6.5.2 Competitive benchmarking of key startups/SMEs

3.7 Brand/Product Comparison

3.8 Company Valuation and Financial Metrics

3.9 Competitive Scenario

3.9.1 Product Launches

3.9.2 Deals

4.1 ENEOS HOLDINGS, INC.

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 IDEMITSU KOSAN CO., LTD.

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 ENOC COMPANY

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 PETROLEO BRASILEIRO S.A. (PETROBRAS)

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 ENI S.P.A.

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 GAZPROMNEFT-SM LLC

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 GULF OIL INTERNATIONAL LTD.

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 PHILLIPS

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 INDIAN OIL CORPORATION LIMITED

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

4.10 COSMO OIL LUBRICANTS CO., LTD.

4.10.1 Business overview

4.10.2 Products/Solutions/Services offered

4.10.3 Recent developments

4.11 HINDUSTAN OIL CORPORATION LIMITED (HPCL)

4.11.1 Business overview

4.11.2 Products/Solutions/Services offered

4.11.3 Recent developments

4.12 AMALIE OIL CO.

4.12.1 Business overview

4.12.2 Products/Solutions/Services offered

4.12.3 Recent developments

4.13 KEMIPEX

4.13.1 Business overview

4.13.2 Products/Solutions/Services offered

4.13.3 Recent developments

4.14 PETRO-CANADA LUBRICANTS INC.

4.14.1 Business overview

4.14.2 Products/Solutions/Services offered

4.14.3 Recent developments

4.15 CRP INDUSTRIES INC.

4.15.1 Business overview

4.15.2 Products/Solutions/Services offered

4.15.3 Recent developments

Glydways

Glydways

May 2024

May 2024