Comparing 10 vendors in Zeolites Startups across 0 criteria.

Zeolites are inorganic materials widely used in the chemical industry as catalysts or adsorbents. They are also known as molecular sieves, as zeolites can selectively sort molecules using the size exclusion process. Zeolites can either be macroporous, mesoporous, or microporous, depending on the framework of the structural rings. Due to their excellent adsorption, cation exchange, dehydration-rehydration, and catalysis properties, zeolites are used for wastewater treatment , air purification , and soil treatment.

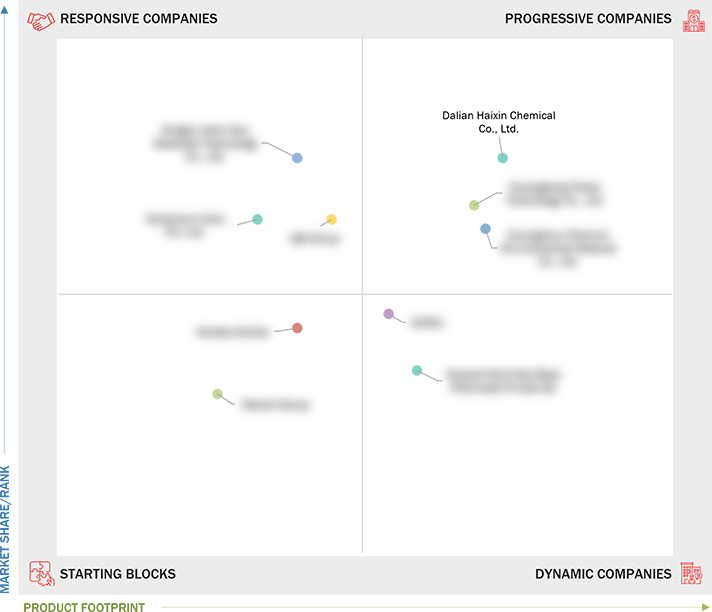

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Rising demand for synthetic zeolites from detergent industry

2.2.1.2 Growing demand for natural zeolites from agriculture sector

2.2.1.3 Rising use of zeolites for catalytic cracking in petroleum industry

2.2.2 Restraints

2.2.2.1 Toxic nature of synthetic zeolites

2.2.3 Opportunities

2.2.3.1 Growing demand for environment–friendly adsorbents

2.2.3.2 Growth in lithium extraction and battery recycling

2.2.4 Challenges

2.2.4.1 Availability of alternative adsorbents and catalysts

2.3 Trends/Disruptions Impacting Customer Business

2.4 Value Chain Analysis

2.5 Ecosystem Analysis

2.6 Investment and Funding Scenario

2.7 Technology Analysis

2.7.1 Key Technologies

2.7.2 Complementary Technologies

2.7.3 Adjacent Technologies

2.8 Patent Analysis

2.9 Trade Analysis

2.10 Porter’s Five Forces Analysis

2.10.1 Threat of New Entrants

2.10.2 Threat of Substitutes

2.10.3 Bargaining Power of Suppliers

2.10.4 Bargaining Power of Buyers

2.10.5 Intensity of Competitive Rivalry

3.1 Introduction

3.2 Key Player Strategies/Right to Win

3.3 Revenue Analysis

3.4 Market Share Analysis

3.5 Company Valuation and Financial Metrics

3.6 Brand/Product Comparison

3.7 Company Evaluation Matrix: Startups/SMEs

3.7.1 Progressive Companies

3.7.2 Responsive Companies

3.7.3 Dynamic Companies

3.7.4 Starting Blocks

3.7.5 Competitive Benchmarking: Startups/SMEs

3.7.5.1 Detailed list of key startups/SMEs

3.7.5.2 Competitive benchmarking of key startups/SMEs

3.8 Competitive Scenario

3.8.1 Product Launches

3.8.2 Deals

3.8.3 Expansions

4.1 Dalian Haixin Chemical Co., Ltd.

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 Guangzhou Chemxin Environmental Material Co., Ltd.

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 Guangdong Xintao Technology Co., Ltd.

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 Ningbo Jiahe New Materials Technology Co., Ltd.

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 IQE Group

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 Sorbchem India Pvt. Ltd.

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 GCMIL

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 Gujarat Multi Gas Base Chemicals Private Ltd.

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 Gordes Zeolite

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

4.10 Manek Group

4.10.1 Business overview

4.10.2 Products/Solutions/Services offered

4.10.3 Recent developments

reuters

reuters

Jan 2023

Jan 2023