Comparing 5 vendors in Power Quality Equipment Startups across 0 criteria.

Power quality equipment plays a critical role in maintaining the stability and efficiency of electrical networks by mitigating power disturbances and ensuring a consistent flow of electricity. These devices are designed to enhance the quality of power being transmitted by identifying and eliminating sources of electrical disturbances that can negatively impact connected loads. Power quality issues such as voltage sags, swells, harmonics, and transients can disrupt operations, leading to equipment malfunctions, downtime, and financial losses, particularly in industries reliant on automated processes and sensitive electronic systems.

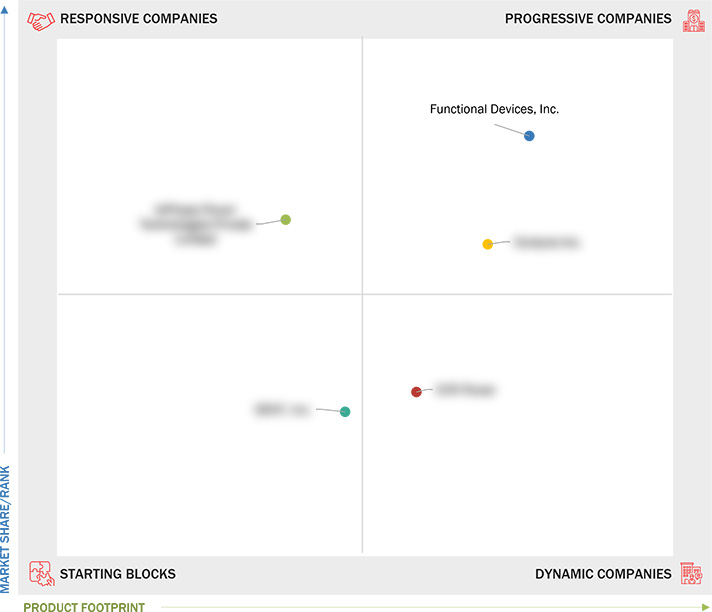

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Growing demand for uninterrupted power supply

2.2.1.2 Increasing adoption of renewable energy sources

2.2.1.3 Increasing industrial automation & electrification

2.2.2 Restraints

2.2.2.1 High initial investment & maintenance costs

2.2.2.2 Competition from alternative technologies

2.2.3 Opportunities

2.2.3.1 Surge in battery energy storage systems

2.2.3.2 Growing demand for modular & scalable solutions

2.2.3.3 Adoption of hybrid & renewable energy microgrids

2.2.4 Challenges

2.2.4.1 Interoperability issues in smart grid systems

2.2.4.2 Growing preference for cloud-based energy management

2.3 Trends/Disruptions Impacting Customer Business

2.4 Value Chain Analysis

2.5 Ecosystem Analysis

2.6 Investment and Funding Scenario

2.7 Technology Analysis

2.7.1 Key Technologies

2.7.2 Complementary Technologies

2.7.3 Adjacent Technologies

2.8 Patent Analysis

2.9 Trade Analysis

2.10 Porter’s Five Forces Analysis

2.10.1 Threat of New Entrants

2.10.2 Threat of Substitutes

2.10.3 Bargaining Power of Suppliers

2.10.4 Bargaining Power of Buyers

2.10.5 Intensity of Competitive Rivalry

3.1 Introduction

3.2 Key Player Strategies/Right to Win

3.3 Revenue Analysis

3.4 Market Share Analysis

3.5 Company Valuation and Financial Metrics

3.6 Brand/Product Comparison

3.7 Company Evaluation Matrix: Startups/SMEs

3.7.1 Progressive Companies

3.7.2 Responsive Companies

3.7.3 Dynamic Companies

3.7.4 Starting Blocks

3.7.5 Competitive Benchmarking: Startups/SMEs

3.7.5.1 Detailed list of key startups/SMEs

3.7.5.2 Competitive benchmarking of key startups/SMEs

3.8 Competitive Scenario

3.8.1 Product Launches

3.8.2 Deals

3.8.3 Expansions

4.1 Functional Devices, Inc.

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 Cordyne Inc.

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 InPhase Power Technologies Private Limited

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 EVR Power

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 Dent, Inc.

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

TradingView

TradingView

Apr 2025

Apr 2025