Comparing 3 vendors in Screw Compressor Startups across 0 criteria.

The screw compressor market has been experiencing significant growth driven by a multitude of factors reshaping its landscape. Primarily, the strong emphasis on sustainability goals coupled with the demand for long-term energy savings has fueled the market's expansion. This acceleration can be attributed to screw compressors' ability to provide energy-efficient solutions, which have become paramount amidst stringent environmental regulations and growing industrialization in emerging economies. The thriving global manufacturing sector further amplifies this need, as industries are pressured to adopt equipment that minimizes energy consumption and operational costs.

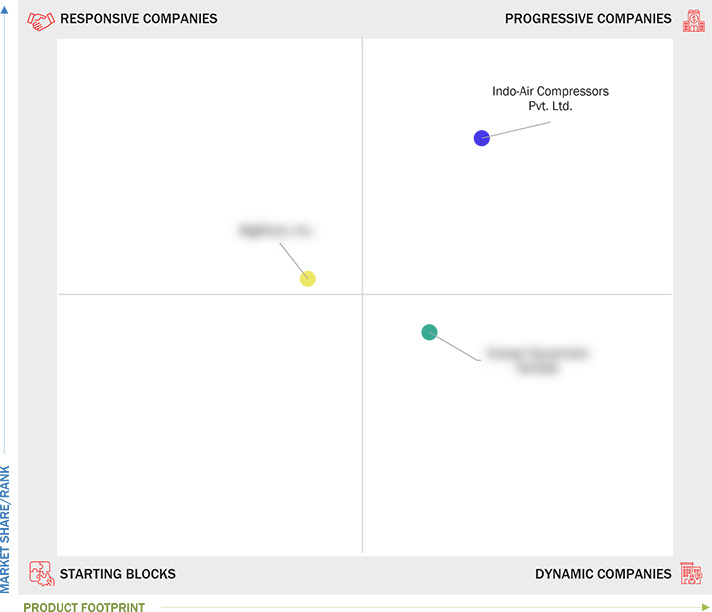

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Unit Considered

1.5 Currency Considered

1.6 Limitations

1.7 Stakeholders

1.8 Summary of Changes

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Strong focus of businesses on achieving sustainability

goals and long-term energy savings

2.2.1.2 Surging demand for energy-efficient solutions due to

stringent regulations

2.2.1.3 Rapid industrialization in emerging economies and thriving

manufacturing sector globally

2.2.2 Restraints

2.2.2.1 High installation and ownership costs

2.2.2.2 Fluctuating prices of raw materials

2.2.3 Opportunities

2.2.3.1 Growing demand for oil-free compressors in oil & gas and

chemicals & petrochemical sectors

2.2.3.2 Industrial automation and smart manufacturing

2.2.3.3 Increasing investments in infrastructure development and

clean energy projects

2.2.4 Challenges

2.2.4.1 Rising cost of sustainability and regulatory compliance in

screw compressors

2.3 Trends/Disruptions Impacting Customer Business

2.4 Value Chain Analysis

2.5 Ecosystem Analysis

2.6 Technology Analysis

2.6.1 Key Technologies

2.6.1.1 Advanced cooling technologies

2.6.1.2 IOT-based monitoring systems

2.6.2 Complementary Technologies

2.6.2.1 Variable frequency drivers

2.7 Trade Analysis

2.7.1 Import Scenario (HS Code 8414)

2.7.2 Export Scenario (HS Code 8414)

2.8 Patent Analysis

2.9 Key Conferences and Events, 2025

2.10 Investment and Funding Scenario, 2024

2.11 Porter’s Five Forces Analysis

2.11.1 Threat of Substitutes

2.11.2 Bargaining Power of Suppliers

2.11.3 Bargaining Power of Buyers

2.11.4 Threat of New Entrants

2.11.5 Intensity of Competitive Rivalry

2.12 Impact of Generative Ai/Ai on Screw Compressor Market

2.12.1 Use Cases of Generative Ai/Ai in Screw Compressor Market

2.12.2 Impact of Generative Ai/Ai on Key End Users, By Region

2.13 Global Macroeconomic Outlook

2.13.1 Introduction

2.13.2 GDP Trends and Forecast

2.13.3 Impact of Inflation on Screw Compressor Market

3.1 Overview

3.2 Key Player Strategies/Right to Win, 2020–2025

3.3 Revenue Analysis, 2019–2023

3.4 Market Share Analysis, 2024

3.5 Company Valuation and Financial Metrics, 2025

3.6 Brand Comparison

3.7 Company Evaluation Matrix: Key Players, 2024

3.7.1 Stars

3.7.2 Emerging Leaders

3.7.3 Pervasive Players

3.7.4 Participants

3.8 Company Evaluation Matrix: Startups/SMEs, 2024

3.8.1 Progressive Companies

3.8.2 Responsive Companies

3.8.3 Dynamic Companies

3.8.4 Starting Blocks

3.8.5 Competitive Benchmarking: Startups/SMEs, 2024

3.8.5.1 Detailed list of key startups/SMEs

3.8.5.2 Competitive benchmarking of key startups/SMEs

3.9 Competitive Scenario

3.9.1 Product Launches

3.9.2 Deals

3.9.3 Expansions

3.9.4 Other Developments

4.1 INDO-AIR COMPRESSORS PVT. LTD.

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 BIGRENTZ, INC.

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 COOPER EQUIPEMENT RENTALS

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments