Comparing 3 vendors in Variable Frequency Drive Startups across 0 criteria.

The global variable frequency drive (VFD) market is experiencing robust growth as industries increasingly seek methods to enhance energy efficiency and minimize operational costs. VFDs are essential devices that adjust the speed and torque of electric motors by modulating the power supply's frequency and voltage. This capability is particularly critical in applications like fans, pumps, and compressors, where demand fluctuates and can be met more efficiently with variable speed drives.

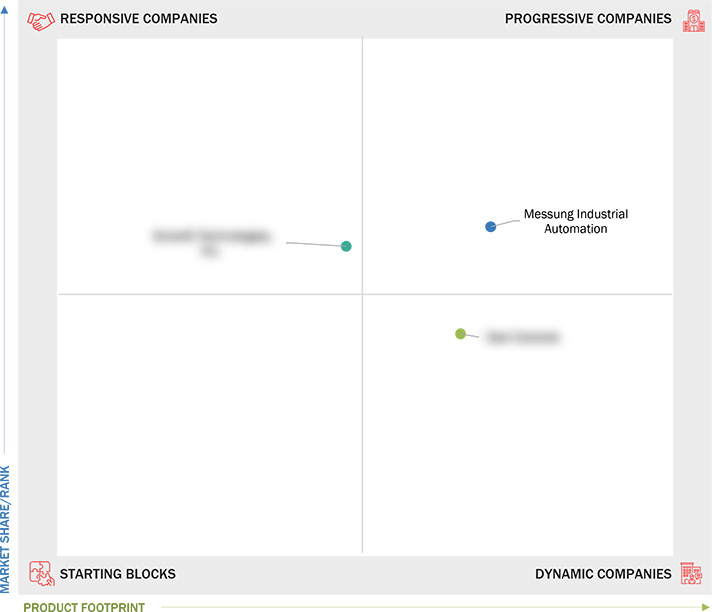

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Stakeholders

1.6 Summary of Changes

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Rising need for enhancing energy efficiency and decreasing energy consumption

2.2.1.2 Increasing need for motion control systems in automated production plants

2.2.1.3 Growing need for energy efficiency and process optimization in chemicals industry

2.2.2 Restraints

2.2.2.1 High installation and maintenance costs

2.2.2.2 Stagnant growth of oil & gas industry

2.2.3 Opportunities

2.2.3.1 Government regulations for sustainability

2.2.3.2 Growing use of Industrial Internet of Things and robotics technologies

2.2.4 Challenges

2.2.4.1 Lack of skilled workforce for installation, programming, and maintenance of variable frequency drives

2.3 Trends/Disruptions Impacting Customer Business

2.4 Value Chain Analysis

2.4.1 Raw Material Providers/Component Manufacturers/Suppliers

2.4.2 Variable Frequency Drive Manufacturers/Assemblers

2.4.3 Distributors/Resellers

2.4.4 End Users

2.4.5 Maintenance/Service Providers

2.5 Ecosystem Analysis

2.6 Regulatory Landscape

2.7 Technology Analysis

2.7.1 Key Technology

2.7.1.1 Direct torque control

2.7.2 Adjacent Technology

2.7.2.1 Harmonic filtering

2.7.3 Complementary Technology

2.7.3.1 Internet of Things

2.8 Market Sizing Assumptions

2.9 Trade Analysis

2.9.1 Import Scenario (HS Code 850110)

2.9.2 Export Scenario (HS Code 850110)

2.9.3 Import Scenario (HS Code 850120)

2.9.4 Export Scenario (HS Code 850120)

2.10 Patent Analysis

2.11 Key Conferences and Events, 2025

2.12 Investment and Funding Scenario

2.13 End-User Expectations

2.14 Porter’s Five Forces Analysis

2.14.1 Threat of Substitutes

2.14.2 Bargaining Power of Suppliers

2.14.3 Bargaining Power of Buyers

2.14.4 Threat of New Entrants

2.14.5 Intensity of Competitive Rivalry

2.15 Strategic Recommendations

2.16 Impact of AI/Generative AI in Variable Frequency Drive Market

2.16.1 Adoption of AI/Generative AI in Variable Frequency Drive Market

2.16.2 Impact of AI/Generative AI on Drive Types, By Region

2.16.3 Impact of AI/Generative AI on Variable Frequency Drive Market, By Region

2.17 Macroeconomic Outlook

2.17.1 Introduction

2.17.2 GDP Trends and Forecast

2.17.3 Inflation

3.1 Overview

3.2 Key Player Strategies/Right to Win, 2020–2025

3.3 Revenue Analysis, 2019–2023

3.4 Market Share Analysis, 2023

3.5 Company Valuation and Financial Metrics, 2025

3.6 Brand/Product Comparison

3.7 Company Leadership Assessment

3.8 Company Evaluation Matrix: Startups/SMEs, 2023

3.8.1 Progressive Companies

3.8.2 Responsive Companies

3.8.3 Dynamic Companies

3.8.4 Starting Blocks

3.8.5 Competitive Benchmarking: Startups/SMEs, 2023

3.8.5.1 List of Key Startups/SMEs

3.8.5.2 Competitive Benchmarking of Key Startups/SMEs

3.9 Competitive Scenario

3.9.1 Product Launches

3.9.2 Deals

3.9.3 Expansions

3.9.4 Other Developments

4.1 DART CONTROLS

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 SMARTD TECHNOLOGIES, INC.

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 MESSUNG INTERNATIONAL AUTOMATION

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments