Comparing 10 vendors in Food and Beverage Industry Pumps Startups across 0 criteria.

The Food and Beverage Industry Pumps market has witnessed robust evolution, driven by technological advancements and increasing demand for efficient processing solutions. Pumps play a critical role in the food and beverage sector, facilitating essential operations like transferring, mixing, and dispensing fluids with precision and hygiene.

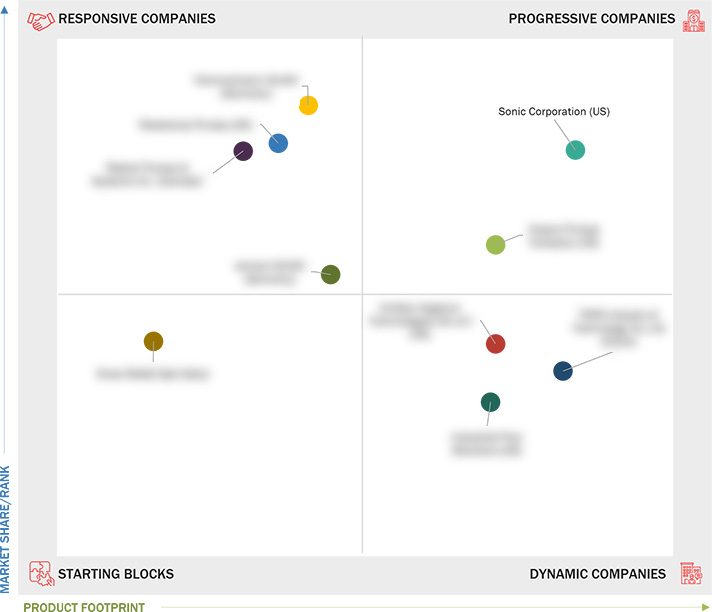

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Years Considered

1.4 Currency Considered

1.4.1 Volume Unit Considered

1.5 Stakeholders

1.6 Summary of Changes

2.1 Introduction

2.2 Macroeconomic Indicators

2.2.1 Global Food Supply Growth

2.2.2 Population, GDP Growth, and Urbanization

2.2.3 Increasing R&D Investment in Food & Beverage Sector

2.3 Market Dynamics

2.3.1 Drivers

2.3.1.1 Demand for advanced machinery with high productivity and

efficiency

2.3.1.2 Focus on reducing operating time and enhancing quality of

food products

2.3.1.3 Expansion of beverage industry and innovation in food

industry

2.3.2 Restraints

2.3.2.1 Cavitation effect in industrial pumps

2.3.2.2 Volatility in raw material prices and high operating costs

associated with equipment

2.3.3 Opportunities

2.3.3.1 Inflow of investments in food & beverage industry

2.3.3.2 Rise in regulations to meet food safety standards

2.3.4 Challenges

2.3.4.1 Increased competition from local players and unorganized

sector

2.3.4.2 Innovative tube materials enhance durability, chemical

resistance, and pump performance

2.3.4.3 Potential damage to products due to varied viscosity levels

2.4 Impact of Gen Ai on Food & Beverage Industry Pumps

2.4.1 Introduction

2.4.2 Use of Gen Ai in Food & Beverage Industry Pumps

2.4.3 Case Study Analysis

2.4.3.1 AI-enabled machine vision in food manufacturing

2.4.3.2 Robotics and automated dispensing in food & beverage

industry with Quantex pumps

2.4.4 Impact on Food & Beverage Industry Pumps Market

2.4.5 Adjacent Ecosystem Working on Gen Ai

3.1 Overview

3.2 Key Player Strategies/Right to Win

3.3 Segmental Revenue Analysis, 2021–2023

3.4 Market Share Analysis, 2023

3.5 Company Valuation and Financial Metrics

3.5.1 Company Valuation

3.5.2 Ev/EBITDA

3.6 Brand Comparison Analysis

3.7 [Auto-filled Placeholder: Reserved Section for Consistency]

3.8 Company Evaluation Matrix: Startups/SMEs, 2023

3.8.1 Progressive Companies

3.8.2 Responsive Companies

3.8.3 Dynamic Companies

3.8.4 Starting Blocks

3.8.5 Competitive Benchmarking

3.8.5.1 Detailed list of key startups/SMEs

3.8.5.2 Competitive benchmarking of key startups/SMEs

3.9 Competitive Scenario and Trends

3.9.1 Product Launches

3.9.2 Deals

3.9.3 Expansions

3.9.4 Others

4.1 SONIC CORPORATION

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 ENEA MATTEI SPA

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 UNIBLOC HYGIENIC TECHNOLOGIES US LLC

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 HAMMELMANN GMBH

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 AMPCO PUMPS COMPANY

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 ROTECH PUMPS & SYSTEMS INC.

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 AMIXON GMBH

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 INDUSTRIAL FLOW SOLUTIONS

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 TOPS INDUSTRY & TECHNOLOGY CO., LTD

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

4.10 Wastecorp Pumps

4.10.1 Business overview

4.10.2 Products/Solutions/Services offered

4.10.3 Recent developments

Pumps & Systems Magazine

Pumps & Systems Magazine

Apr 2023

Apr 2023