Comparing 24 vendors in AI in Drug Discovery across 0 criteria.

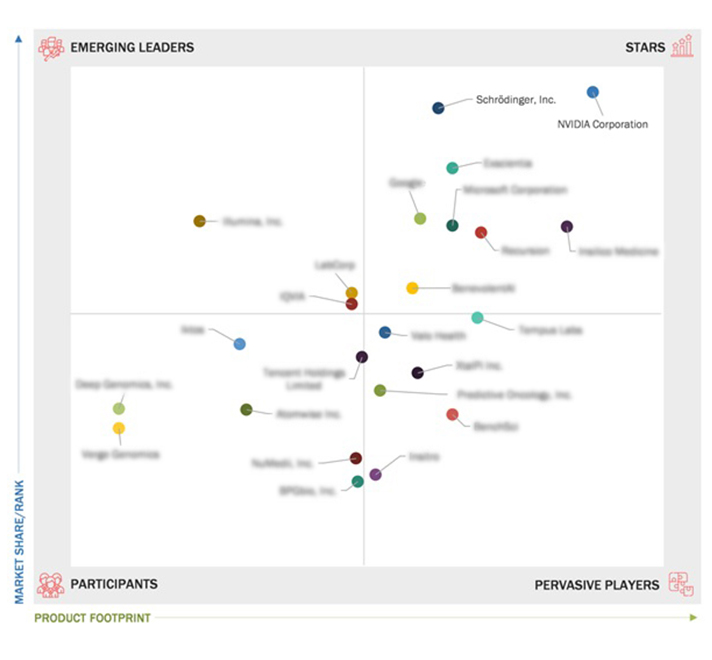

The Artificial Intelligence (AI) in drug discovery Companies Quadrant is a comprehensive industry analysis that provides valuable insights into the global market for Artificial Intelligence (AI) in drug discovery. This quadrant offers a detailed evaluation of key market players, technological advancements, product innovations, and emerging trends shaping the industry. MarketsandMarkets 360 Quadrants evaluated over 40 companies of which the Top 24 Artificial Intelligence (AI) in drug discovery Companies were categorized and recognized as the quadrant leaders.

Market Leadership Quadrant

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED

2.1 DRIVERS

2.1.1 Growing cross-industry collaborations and partnerships

2.1.2 Growing need to reduce time and cost of drug discovery and development

2.1.3 Patent expiry of several drugs

2.2 RESTRAINTS

2.2.1 Shortage of AI workforce and ambiguous regulatory guidelines for medical software

2.3 OPPORTUNITIES

2.3.1 Growing biotechnology industry

2.3.2 Emerging markets

2.3.3 Focus on developing human-aware AI systems

2.4 CHALLENGES

2.4.1 Limited availability of data sets

2.5 PORTER’S FIVE FORCES ANALYSIS

2.5.1 INTENSITY OF COMPETITIVE RIVALRY

2.5.2 BARGAINING POWER OF BUYERS

2.5.3 BARGAINING POWER OF SUPPLIERS

2.5.4 THREAT OF SUBSTITUTES

2.5.5 THREAT OF NEW ENTRANTS

2.6 ECOSYSTEM/MARKET MAP

3.1 KEY PLAYER STRATEGIES/RIGHT TO WIN

3.2 REVENUE ANALYSIS

3.3 MARKET SHARE ANALYSIS

3.4 COMPANY EVALUATION MATRIX

3.4.1 STARS

3.4.2 EMERGING LEADERS

3.4.3 PERVASIVE PLAYERS

3.4.4 PARTICIPANTS

3.4.5 COMPANY FOOTPRINT

3.6 COMPETITIVE SCENARIOS AND TRENDS

3.6.1 PRODUCT LAUNCHES & ENHANCEMENTS

3.6.2 DEALS

3.6.3 OTHER DEVELOPMENTS

4.1 KEY PLAYERS

4.1.1 NVIDIA CORPORATION

4.1.1.1 Business overview

4.1.1.2 Products/Solutions/Services offered

4.1.1.3 Recent developments

4.1.1.4 MnM view

4.1.1.4.1 Key Strengths/Right to win

4.1.1.4.2 Strategic choices made

4.1.1.4.3 Weaknesses & competitive threats

4.1.2 EXSCIENTIA

4.1.2.1 Business overview

4.1.2.2 Products/Solutions/Services offered

4.1.2.3 Recent developments

4.1.2.4 MnM view

4.1.2.4.1 Key Strengths/Right to win

4.1.2.4.2 Strategic choices made

4.1.2.4.3 Weaknesses & competitive threats

4.1.3 GOOGLE

4.1.3.1 Business overview

4.1.3.2 Products/Solutions/Services offered

4.1.3.3 Recent developments

4.1.3.4 MnM view

4.1.3.4.1 Key Strengths/Right to win

4.1.3.4.2 Strategic choices made

4.1.3.4.3 Weaknesses & competitive threats

4.1.4 BENEVOLENTAI

4.1.4.1 Business overview

4.1.4.2 Products/Solutions/Services offered

4.1.4.3 Recent developments

4.1.4.4 MnM view

4.1.4.4.1 Key Strengths/Right to win

4.1.4.4.2 Strategic choices made

4.1.4.4.3 Weaknesses & competitive threats

4.1.5 RECURSION

4.1.5.1 Business overview

4.1.5.2 Products/Solutions/Services offered

4.1.5.3 Recent developments

4.1.5.4 MnM view

4.1.5.4.1 Key Strengths/Right to win

4.1.5.4.2 Strategic choices made

4.1.5.4.3 Weaknesses & competitive threats

4.1.6 INSILICO MEDICINE

4.1.6.1 Business overview

4.1.6.2 Products/Solutions/Services offered

4.1.6.3 Recent developments

4.1.7 SCHRÖDINGER, INC.

4.1.7.1 Business overview

4.1.7.2 Products/Solutions/Services offered

4.1.7.3 Recent developments

4.1.8 MICROSOFT CORPORATION

4.1.8.1 Business overview

4.1.8.2 Products/Solutions/Services offered

4.1.8.3 Recent developments

4.1.9 ATOMWISE INC.

4.1.9.1 Business overview

4.1.9.2 Products/Solutions/Services offered

4.1.9.3 Recent developments

4.1.10 ILLUMINA, INC.

4.1.10.1 Business overview

4.1.10.2 Products/Solutions/Services offered

4.1.10.3 Recent developments

4.1.11 NUMEDII, INC.

4.1.11.1 Business overview

4.1.11.2 Products/Solutions/Services offered

4.1.12 XTALPI INC.

4.1.12.1 Business overview

4.1.12.2 Products/Solutions/Services offered

4.1.12.3 Recent developments

4.1.13 IKTOS

4.1.13.1 Business overview

4.1.13.2 Products/Solutions/Services offered

4.1.13.3 Recent developments

4.1.14 TEMPUS LABS

4.1.14.1 Business overview

4.1.14.2 Products/Solutions/Services offered

4.1.14.3 Recent developments

4.1.15 DEEP GENOMICS, INC.

4.1.15.1 Business overview

4.1.15.2 Products/Solutions/Services offered

4.1.15.3 Recent developments

4.1.16 VERGE GENOMICS

4.1.16.1 Business overview

4.1.16.2 Products/Solutions/Services offered

4.1.16.3 Recent developments

4.1.17 BENCHSCI

4.1.17.1 Business overview

4.1.17.2 Products/Solutions/Services offered

4.1.17.3 Recent developments

4.1.18 INSITRO

4.1.18.1 Business overview

4.1.18.2 Products/Solutions/Services offered

4.1.18.3 Recent developments

4.1.19 VALO HEALTH

4.1.19.1 Business overview

4.1.19.2 Products/Solutions/Services offered

4.1.19.3 Recent developments

4.1.20 BPGBIO, INC.

4.1.20.1 Business overview

4.1.20.2 Products/Solutions/Services offered

4.1.20.3 Recent development

4.2 OTHER EMERGING PLAYERS

4.2.1 PREDICTIVE ONCOLOGY, INC.

4.2.2 IQVIA INC.

4.2.3 TENCENT HOLDINGS LIMITED

4.2.4 BIOAGE LABS

4.2.5 ARIA PHARMACEUTICALS, IN

azorobotics

azorobotics

Apr 2024

Apr 2024