Comparing 5 vendors in AI in Remote Patient Monitoring (RPM) Startups across 0 criteria.

AI in RPM refers to the integration of artificial intelligence (AI) technologies into remote healthcare systems that continuously track, analyze, and interpret patient health data outside traditional clinical settings. It works through devices such as wearables or home monitors that collect health data, while AI helps detect changes, predict risks, and alert doctors when needed. AI processes this data in real time, identifying patterns, predicting potential health risks, and notifying healthcare providers, which enables early intervention, reduces hospital visits, and improves patient outcomes by providing timely and personalized care.

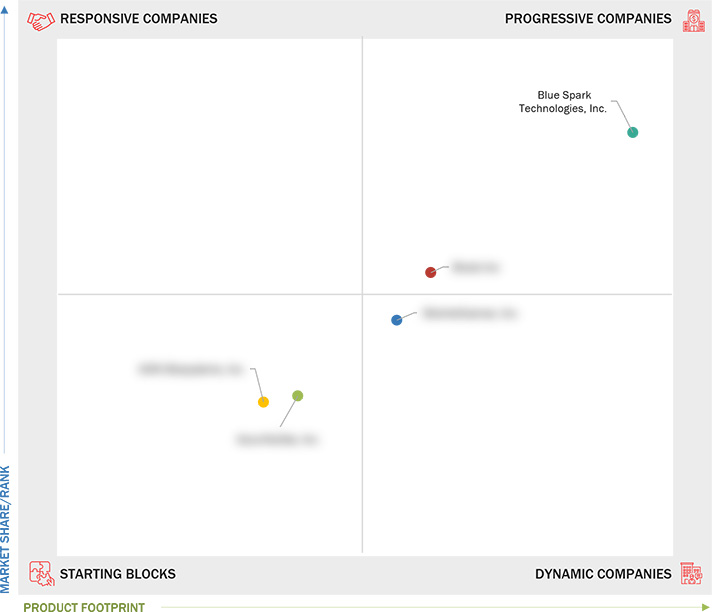

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Market Segmentation & Geographical Spread

1.3.2 Inclusions & Exclusions

1.3.3 Years Considered

1.3.4 Currency Considered

1.4 Stakeholders

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Expanding telehealth and remote patient monitoring markets

2.2.1.2 Increasing prevalence of chronic diseases

2.2.1.3 Focus on development and adoption of mHealth applications

2.2.1.4 Increased government support and favorable reimbursement

policies

2.2.1.5 Growing awareness about lifestyle management and home

healthcare

2.2.2 RestrAInts

2.2.2.1 Regulatory variations across regions

2.2.2.2 Shortage of skilled professionals to operate AI-based remote

patient monitoring tools

2.2.2.3 Data security concerns

2.2.3 Opportunities

2.2.3.1 Growing demand for personalized medicines and care plans

2.2.3.2 Increase in partnerships and collaborations among healthcare

providers and AI-based companies

2.2.3.3 Growth opportunities in emerging economies

2.2.3.4 Rising investment in AI-based remote patient monitoring

solutions

2.2.4 Challenges

2.2.4.1 Scarcity of high-quality healthcare data and privacy

concerns

2.2.4.2 Reluctance among healthcare professionals to adopt AI in

remote patient monitoring devices

2.2.4.3 Lack of interoperability

2.3 Trends/Disruptions Impacting Customer’s Business

2.4 Industry Trends

2.4.1 Shift to Value-Based and Patient-Centric Care

2.4.2 Innovations in Wearable Medical Technologies

2.5 Ecosystem Analysis

2.5.1 Role in Ecosystem

2.6 Value ChAIn Analysis

2.7 Technology Analysis

2.7.1 Key Technologies

2.7.1.1 Wearable devices and sensors

2.7.1.2 AI and ML

2.7.1.3 Predictive analytics

2.7.1.4 mHealth applications

2.7.1.5 Cloud computing

2.7.1.6 Digital health platforms

2.7.2 Adjacent Technologies

2.7.2.1 Point-of-care diagnostics

2.7.2.2 Smart home health devices

2.8 Trade Analysis

2.8.1 Trade Analysis for HSn Code 90189099

2.8.1.1 Import data for HSN code 90189099

2.8.1.2 Export data for HSN code 90189099

2.8.2 Trade Analysis for HSn Code 9021

2.8.2.1 Import data for HSN code 9021

2.8.2.2 Export data for HSN code 9021

2.8.3 Trade Analysis for HSn Code 9022

2.8.3.1 Import data for HSN code 9022

2.8.3.2 Export data for HSN code 9022

2.9 Pricing Analysis

2.9.1 Indicative Pricing for AI-Based Remote Patient Monitoring Devices,

By Key Player, 2023

2.9.2 Indicative Pricing for AI-Based Remote Patient Monitoring Devices,

By Region, 2023

2.10 Patent Analysis

2.10.1 Patent Publication Trends

2.10.2 Jurisdiction Analysis: Top Applicant Countries for AI-Based

Remote Patient Monitoring Device Patents

2.10.3 Top Patent Owners/Applicants in AI in Remote Patient Monitoring

Market

2.10.4 List of Key Patents/Patent Applications

2.11 Unmet Needs & End-User Expectations

2.11.1 Unmet Needs

2.11.2 End-User Expectations

2.12 Key Conferences & Events, 2025–2026

3.1 Introduction

3.2 Key Player Strategies/Right to Win

3.2.1 Overview of Strategies Adopted By Key Players for AI in Remote

Patient Monitoring Market

3.3 Revenue Analysis, 2019–2023

3.4 Market Share Analysis, 2023

3.5 Company Evaluation Matrix: Key Players, 2023

3.5.1 Stars

3.5.2 Emerging Leaders

3.5.3 Pervasive Players

3.5.4 Participants

3.6 Company Evaluation Matrix: Startups/SMEs, 2023

3.6.1 Progressive Companies

3.6.2 Responsive Companies

3.6.3 Dynamic Companies

3.6.4 Starting Blocks

3.6.5 Competitive Benchmarking: Startups/SMEs, 2023

3.6.5.1 DetAIled list of key startups/SMEs

3.7 Company Valuation & Financial Metrics

3.7.1 Financial Metrics

3.7.2 Company Valuation

3.8 Brand/Software Comparison

3.9 Competitive Scenario

3.9.1 Product Launches, Approvals, and Enhancements

3.9.2 Deals

3.9.3 Expansions

3.9.4 Other Developments

4.1 BIOINTELLISENSE, INC.

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 BLUE SPARK TECHNOLOGIES, INC.

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 ACCURKARDIA, INC.

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 AION BIOSYSTEMS, INC.

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 BROOK INC.

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

BioSpace

BioSpace

Nov 2024

Nov 2024