Comparing 4 vendors in ASEAN Point of Care Diagnostics Startups across 0 criteria.

The ASEAN point of care diagnostics market is poised for significant growth, reflecting its critical role in enhancing healthcare delivery by enabling rapid and decentralized testing. POC diagnostics provide quick results and enhanced treatment decision-making. The market is driven by several key factors, including the rising incidence of infectious diseases and the increasing prevalence of target conditions, which have heightened the demand for rapid & accessible diagnostic solutions.

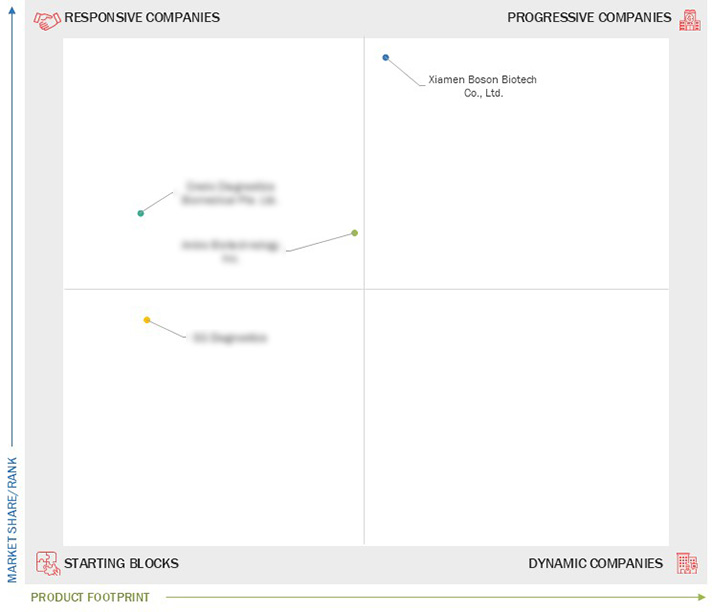

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Rising incidence of infectious diseases

2.2.1.2 Increasing prevalence of chronic diseases

2.2.1.3 Favorable government initiatives for POC testing

2.2.1.4 Rising number of public-private partnerships (PPPs)

2.2.2 Restraints

2.2.2.1 Pricing pressure on manufacturers

2.2.2.2 Stringent regulatory approval process for product commercialization

2.2.3 Opportunities

2.2.3.1 Gradual shift toward decentralized healthcare systems

2.2.3.2 Availability of POC tests with multiplexing capabilities

2.2.4 Challenges

2.2.4.1 Shortage of skilled healthcare providers

2.2.4.2 Premium pricing of novel platforms

2.3 Trends/Disruptions Impacting Customer Business

2.4 Value Chain Analysis

2.5 Ecosystem Analysis

2.6 Investment and Funding Scenario

2.7 Technology Analysis

2.7.1 Key Technologies

2.7.2 Complementary Technologies

2.7.3 Adjacent Technologies

2.8 Patent Analysis

2.9 Trade Analysis

2.10 Porter’s Five Forces Analysis

2.10.1 Threat of New Entrants

2.10.2 Threat of Substitutes

2.10.3 Bargaining Power of Suppliers

2.10.4 Bargaining Power of Buyers

2.10.5 Intensity of Competitive Rivalry

3.1 Introduction

3.2 Key Player Strategies/Right to Win

3.3 Revenue Analysis

3.4 Market Share Analysis

3.5 Company Valuation and Financial Metrics

3.6 Brand/Product Comparison

3.7 Company Evaluation Matrix: Startups/SMEs

3.7.1 Progressive Companies

3.7.2 Responsive Companies

3.7.3 Dynamic Companies

3.7.4 Starting Blocks

3.7.5 Competitive Benchmarking: Startups/SMEs

3.7.5.1 Detailed list of key startups/SMEs

3.7.5.2 Competitive benchmarking of key startups/SMEs

3.8 Competitive Scenario

3.8.1 Product Launches and Approvals

3.8.2 Deals

3.8.3 Expansions

4.1 Anbio Biotechnology Inc.

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 Credo Diagnostics Biomedical Pte. Ltd.

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 SG Diagnostics

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 Xiamen Boson Biotech Co., Ltd.

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments