Comparing 10 vendors in Assisted Reproductive Technology Startups across 0 criteria.

Assisted Reproductive Technology (ART) deals with medical procedures and techniques designed to address infertility and improve the chances of conception. ART includes all fertility treatments in which eggs or embryos are handled outside the human body. These procedures involve the use of medical technology to assist with fertilization, embryo development, and implantation.

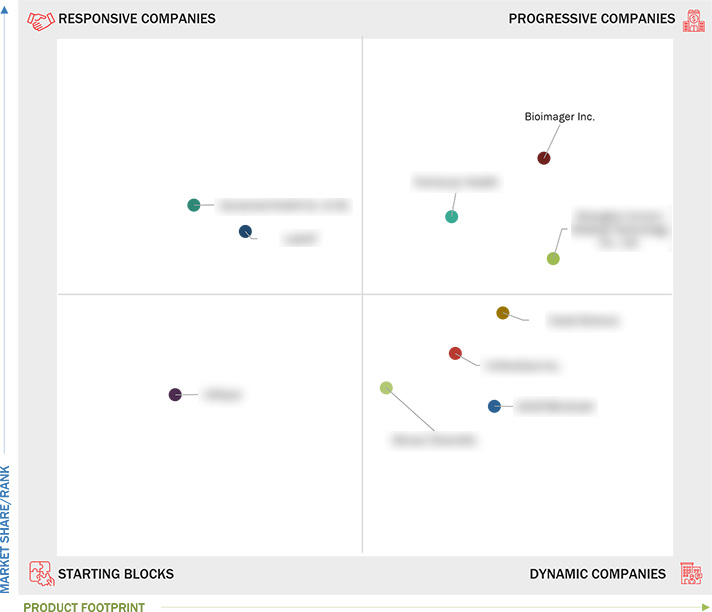

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Increasing median age of pregnancy

2.2.1.2 Rising infertility rate

2.2.1.3 Booming fertility industry

2.2.1.4 Evolving technological landscape

2.2.1.5 Favorable government initiatives

2.2.2 Restraints

2.2.2.1 High cost of IVF procedures

2.2.2.2 Social and ethical concerns in developing countries

2.2.2.3 Elevated risk of complications

2.2.3 Opportunities

2.2.3.1 Growth opportunities in emerging economies

2.2.3.2 Availability of diverse range of fertility treatment options

2.2.4 Challenges

2.2.4.1 Reduced efficacy of infertility treatments among patients of advanced age

2.3 Trends/Disruptions Impacting Customer Business

2.4 Value Chain Analysis

2.5 Ecosystem Analysis

2.6 Investment and Funding Scenario

2.7 Technology Analysis

2.7.1 Key Technologies

2.7.2 Complementary Technologies

2.7.3 Adjacent Technologies

2.8 Patent Analysis

2.9 Trade Analysis

2.10 Porter’s Five Forces Analysis

2.10.1 Threat of New Entrants

2.10.2 Threat of Substitutes

2.10.3 Bargaining Power of Suppliers

2.10.4 Bargaining Power of Buyers

2.10.5 Intensity of Competitive Rivalry

3.1 Introduction

3.2 Key Player Strategies/Right to Win

3.3 Revenue Analysis

3.4 Market Share Analysis

3.5 Company Valuation and Financial Metrics

3.6 Brand/Product Comparison

3.7 Company Evaluation Matrix: Startups/SMEs

3.7.1 Progressive Companies

3.7.2 Responsive Companies

3.7.3 Dynamic Companies

3.7.4 Starting Blocks

3.7.5 Competitive Benchmarking: Startups/SMEs

3.7.5.1 Detailed list of key startups/SMEs

3.7.5.2 Competitive benchmarking of key startups/SMEs

3.8 Competitive Scenario

3.8.1 Product Launches

3.8.2 Deals

3.8.3 Others Developments

4.1 Bioimager Inc.

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 Shanghai Unicorn Medical Technology Co., Ltd.

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 Fairhaven Health

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 LabIVF

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 Gynemed GmbH & Co. KG

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 InVitroCare Inc.

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 Shivani Scientific

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 Coast Science

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 MINITÜB GmbH

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

4.10 IVFtech

4.10.1 Business overview

4.10.2 Products/Solutions/Services offered

4.10.3 Recent developments