Comparing 8 vendors in Central lab Services/Clinical Trial Lab Services Startups across 0 criteria.

Central Lab Services, also known as Clinical Trial Lab Services, refers to specialized laboratories responsible for the standardized analysis and management of biological samples collected during clinical trials. These laboratories ensure precision, accuracy, and consistency across multiple trial sites by implementing uniform testing methodologies, regulatory compliance, and advanced analytical techniques carried out in different phases where different groups of participants are required. Central labs support clinical trials by providing essential services such as biomarker analysis, safety testing, pharmacokinetics, and efficacy assessments, ultimately contributing to reliable and reproducible clinical trial outcomes.

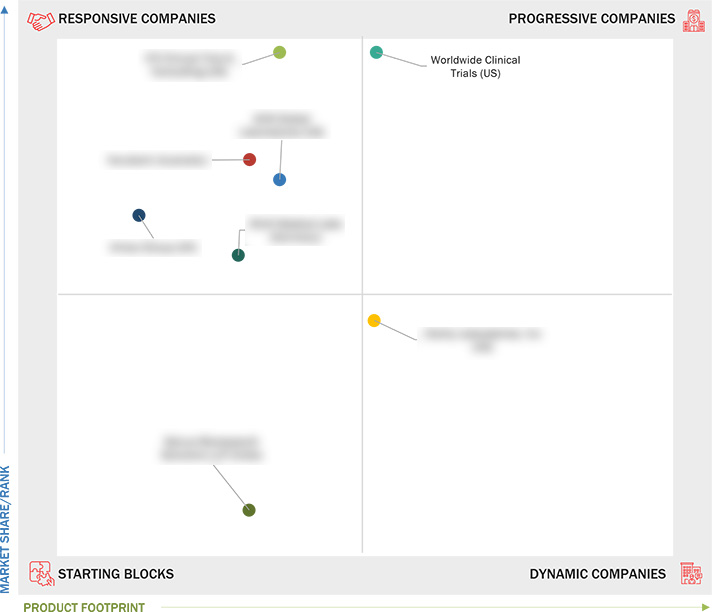

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Increasing Number of Clinical Trials

2.2.1.2 Rising Investments in Research & Development

2.2.1.3 Growing Prevalence of Rare Diseases

2.2.1.4 Favorable Government Initiatives

2.2.2 Restraints

2.2.2.1 High Costs Associated with Clinical Trials

2.2.2.2 Shortage of Skilled Professionals

2.2.3 Opportunities

2.2.3.1 Emerging Markets Worldwide

2.2.3.2 Decentralized and Virtual Clinical Trials

2.2.4 Challenges

2.2.4.1 Regulatory Complexities

2.2.4.2 Limited Patient Diversity

2.2.4.3 Cybersecurity and Intellectual Property Concerns

2.3 Trends/Disruptions Impacting Customer Business

2.4 Value Chain Analysis

2.5 Ecosystem Analysis

2.6 Investment and Funding Scenario

2.7 Technology Analysis

2.7.1 Key Technologies

2.7.2 Complementary Technologies

2.7.3 Adjacent Technologies

2.8 Patent Analysis

2.9 Trade Analysis

2.10 Porter’s Five Forces Analysis

2.10.1 Threat of New Entrants

2.10.2 Threat of Substitutes

2.10.3 Bargaining Power of Suppliers

2.10.4 Bargaining Power of Buyers

2.10.5 Intensity of Competitive Rivalry

3.1 Introduction

3.2 Key Player Strategies/Right to Win

3.3 Revenue Analysis

3.4 Market Share Analysis

3.5 Company Valuation and Financial Metrics

3.6 Brand/Product Comparison

3.7 Company Evaluation Matrix: Startups/SMEs

3.7.1 Progressive Companies

3.7.2 Responsive Companies

3.7.3 Dynamic Companies

3.7.4 Starting Blocks

3.7.5 Competitive Benchmarking: Startups/SMEs

3.7.5.1 Detailed list of key startups/SMEs

3.7.5.2 Competitive benchmarking of key startups/SMEs

3.8 Competitive Scenario

3.8.1 Product Launches

3.8.2 Deals

3.8.3 Expansions

3.8.4 Other Developments

4.1 ACM Global Laboratories

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 ALMAC GROUP

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 CTI Clinical Trial & Consulting

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 Clarity Laboratories, Inc

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 MLM Medical Labs

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 Novotech

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 Salvus Bioresearch Solutions LLP.

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 Worldwide Clinical Trials

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

North Penn Now

North Penn Now

Oct 2025

Oct 2025