Comparing 9 vendors in Dental Implants and Prosthetics Startups across 0 criteria.

The dental implants and prosthetics market is experiencing a significant transformation driven by technological advancements, increasing demand for cosmetic dental procedures, and the growing prevalence of dental ailments such as edentulism. From the global perspective, the market is witnessing robust growth, bolstered by a rising awareness of dental care and the accessibility of advanced dental services in emerging economies.

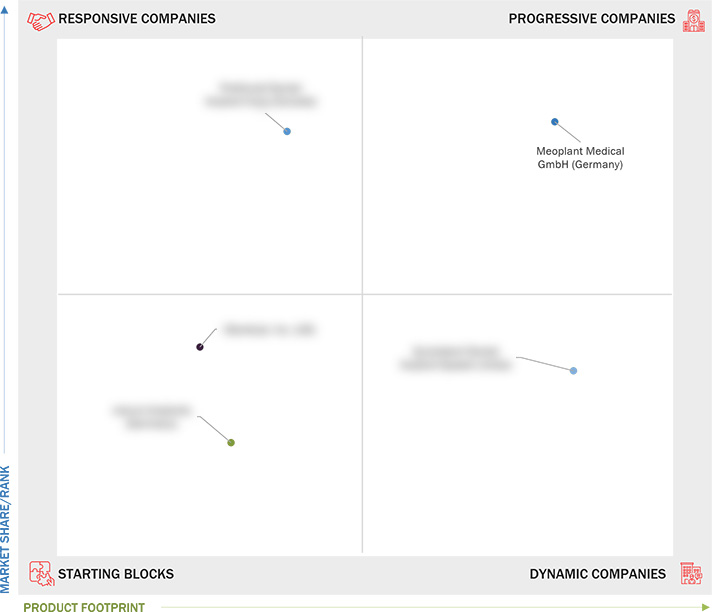

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation and Regions Covered

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Stakeholders

1.6 Summary of Changes

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Increasing Patient Pool for Dental Treatments

2.2.1.2 Increasing Demand for Advanced Cosmetic Dental Procedures

2.2.1.3 Growing Preference for Same-Day Dentistry

2.2.1.4 Rising Focus on Aesthetics

2.2.2 Restraints

2.2.2.1 High Cost of Dental Implants and Limited Reimbursement

2.2.2.2 Higher Risk of Tooth Loss Associated with Dental Bridges

2.2.3 Opportunities

2.2.3.1 Growth Potential in Emerging Economies

2.2.3.2 Rapid Growth of Dental Service Organizations

2.2.4 Challenges

2.2.4.1 Dearth of Trained Dental Practitioners

2.2.4.2 Pricing Pressure

2.3 Trends/Disruptions Impacting Customer Business

2.4 Value Chain Analysis

2.5 Supply Chain Analysis

2.6 Ecosystem Analysis

2.7 Investment and Funding Scenario

2.8 Technology Analysis

2.8.1 Key Technologies

2.8.1.1 Immediacy Solutions/Immediate Loading

2.8.1.2 Novel Biocompatible Materials

2.8.1.3 Apically Tapered Implants

2.8.2 Complementary Technologies

2.8.2.1 Implant Coatings

2.8.2.1.1 Antibacterial Coatings

2.8.2.1.2 Osseointegration-Enhancing Coatings

2.8.2.1.3 Combination Coatings

2.8.2.2 Osseointegrative Surface Technology

2.8.3 Adjacent Technologies

2.8.3.1 Cone-Beam Computed Tomography

2.9 Industry Trends

2.9.1 Market Consolidation

2.9.2 Industry-Academia Collaborations

2.9.3 High Investments in Dental Practices

2.9.4 Bioactive Implants

2.10 Patent Analysis

2.10.1 Patent Publication Trends

2.10.2 Jurisdiction Analysis

2.11 Trade Analysis

2.11.1 Trade Analysis for Dental Implant Products

2.11.2 Trade Analysis for Dental Prosthetic Products

2.12 Key Conferences and Events, 2025–2026

2.13 Porter’s Five Forces Analysis

2.13.1 Bargaining Power of Suppliers

2.13.2 Bargaining Power of Buyers

2.13.3 Threat of New Entrants

2.13.4 Threat of Substitutes

2.13.5 Intensity of Competitive Rivalry

2.14 Adjacent Market Analysis

2.15 Reimbursement Scenario

2.16 Unmet Needs/End-User Expectations

2.17 Impact of AI/Generative AI on Dental Implants and Prosthetics Market

2.17.1 Introduction

2.17.2 Market Potential of AI in Market

3.1 Introduction

3.2 Key Player Strategies/Right to Win, 2024

3.2.1 Overview of Strategies Adopted By Key Players in Dental Implants and Prosthetics Market

3.3 Revenue Analysis, 2018–2023

3.4 Market Share Analysis (Overall Market), 2024

3.4.1 Ranking of Key Market Players

3.5 Company Valuation and Financial Metrics

3.5.1 Company Valuation

3.5.2 Financial Metrics

3.6 Dental Implants Market

3.6.1 Brand/Product Comparison

3.7 Dental Prosthetics Market

3.7.1 Brand/Product Comparison

3.8 [Auto-filled Placeholder: Reserved Section for Consistency]

3.9 Company Evaluation Matrix (Dental Implants Market): Startups/SMEs, 2024

3.9.1 Progressive Companies

3.9.2 Responsive Companies

3.9.3 Dynamic Companies

3.9.4 Starting Blocks

3.9.5 Competitive Benchmarking

3.9.5.1 Detailed List of Key Startups/SMEs

3.9.5.2 Competitive Benchmarking of Key Startups/SMEs

3.10 Company Evaluation Matrix (Dental Prosthetics Market): Startups/SMEs, 2024

3.10.1 Progressive Companies

3.10.2 Responsive Companies

3.10.3 Dynamic Companies

3.10.4 Starting Blocks

3.10.5 Competitive Benchmarking

3.10.5.1 Detailed List of Key Startups/SMEs

3.10.5.2 Competitive Benchmarking of Key Startups/SMEs

3.11 Dental Implants and Prosthetics Market: Company Footprint

3.12 Dental Implants and Prosthetics Market: R&D Expenditure

3.13 Competitive Scenario

3.13.1 Product Launches and Approvals

3.13.2 Deals

3.13.3 Expansions

3.13.4 Other Developments

4.1 PREFERRED DENTAL IMPLANT CORP (CANADA)

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 iDENTICAL, INC. (US)

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 NATURE IMPLANTS (GERMANY)

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 MEOPLANT MEDICAL GmbH (GERMANY)

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 QUICKDENT DENTAL IMPLANT SYSTEM (INDIA)

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 DDS Lab (US)

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 Amt Medical SRL (Italy)

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 Acero Crowns (US)

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 Star Dental Crown (India)

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments