Comparing 5 vendors in Hospital Information System Startups across 0 criteria.

HIS is a comprehensive, integrated software solution designed to manage and streamline hospital operations, encompassing medical, administrative, financial, and legal functions. By consolidating patient health records and hospital processes onto a unified platform, HIS enhances efficiency, reduces errors, and improves the quality of patient care.

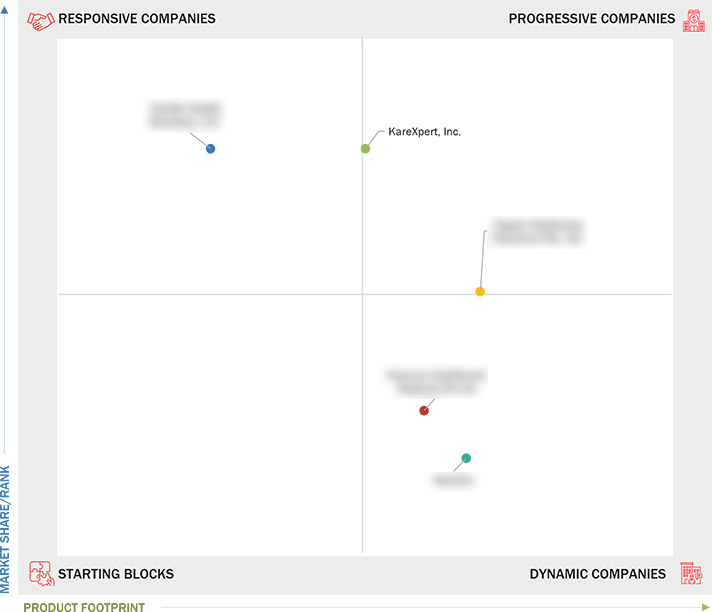

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Increasing adoption of electronic health records (EHRs) in hospitals & clinics

2.2.1.2 Increasing emphasis on collaborative care

2.2.1.3 Integrating data analytics into HIS to boost patient care, operational efficiency, and decision-making

2.2.1.4 Regulatory guidelines to propel HIS adoption

2.2.1.5 Rising imperative to control surging healthcare expenditures

2.2.2 Restraints

2.2.2.1 Lack of adoption of HIS due to resistance towards modern infrastructure

2.2.2.2 Customer support difficulties

2.2.2.3 Reduced time allotted for HIS software usage and training

2.2.3 Opportunities

2.2.3.1 Increasing benefits of cloud-based solutions

2.2.3.2 Rising integration of AI

2.2.3.3 Leveraging mHealth innovation

2.2.3.4 Growth in emerging economies

2.2.4 Challenges

2.2.4.1 Privacy and security concerns

2.2.4.2 Design, development, and maintenance of HIS

2.2.4.3 Shortage of skilled IT professionals

2.3 Trends/Disruptions Impacting Customer Business

2.4 Value Chain Analysis

2.5 Ecosystem Analysis

2.6 Investment and Funding Scenario

2.7 Technology Analysis

2.7.1 Key Technologies

2.7.2 Complementary Technologies

2.7.3 Adjacent Technologies

2.8 Patent Analysis

2.9 Trade Analysis

2.10 Porter’s Five Forces Analysis

2.10.1 Threat of New Entrants

2.10.2 Threat of Substitutes

2.10.3 Bargaining Power of Suppliers

2.10.4 Bargaining Power of Buyers

2.10.5 Intensity of Competitive Rivalry

3.1 Introduction

3.2 Key Player Strategies/Right to Win

3.3 Revenue Analysis

3.4 Market Share Analysis

3.5 Company Valuation and Financial Metrics

3.6 Brand/Product Comparison

3.7 Company Evaluation Matrix: Startups/SMEs

3.7.1 Progressive Companies

3.7.2 Responsive Companies

3.7.3 Dynamic Companies

3.7.4 Starting Blocks

3.7.5 Competitive Benchmarking: Startups/SMEs

3.7.5.1 Detailed list of key startups/SMEs

3.7.5.2 Competitive benchmarking of key startups/SMEs

3.8 Competitive Scenario

3.8.1 Product Launches

3.8.2 Deals

3.8.3 Expansions

3.8.4 Other Developments

4.1 Conifer Health Solutions, LLC.

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 KareXpert, Inc.

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 Kranium Healthcare Systems

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 MocDoc

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 NAPIER HEALTHCARE SOLUTIONS Pte. Ltd.

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

NewsDrum

NewsDrum

Jul 2025

Jul 2025