Comparing 6 vendors in Insulin Delivery Device Startups across 0 criteria.

The market for insulin delivery devices is expanding, driven by the increasing global prevalence of diabetes and a growing emphasis on patient convenience and self-management. Innovation is steering the market away from traditional syringes towards more advanced options. Devices like insulin pens and pumps are gaining popularity due to their user-friendliness, accuracy, and improved clinical outcomes. The trend is moving towards integrated systems that combine delivery devices with continuous glucose monitoring and smart technology, offering more personalized and automated diabetes care.

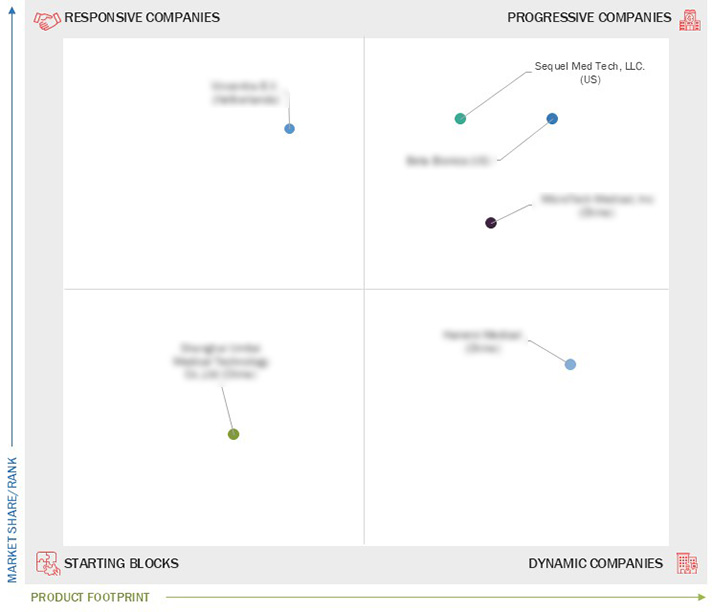

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Growth in prevalence of diabetic population

2.2.1.2 Technological advancements in insulin delivery devices

2.2.1.3 Government support and favorable reimbursement schemes

2.2.2 Restraints

2.2.2.1 High cost and lack of reimbursement in emerging economies.

2.2.2.2 Needle anxiety in patients to affect growth of pen needles and syringes market

2.2.2.3 Oral insulin as alternative drug delivery method

2.2.3 Opportunities

2.2.3.1 Increase in research & development activities and strategic partnerships

2.2.3.2 Increase in healthcare expenditure on diabetes care

2.2.3.3 Advances in insulin syringe and needle technology

2.2.3.4 Mandates pertaining to safety-engineered medical needles

2.2.4 Challenges

2.2.4.1 Needlestick injuries and misuse of injection pens

2.2.4.2 Lack of interoperability among insulin delivery devices

2.3 Trends/Disruptions Impacting Customer Business

2.4 Value Chain Analysis

2.5 Ecosystem Analysis

2.6 Investment and Funding Scenario

2.7 Technology Analysis

2.7.1 Key Technologies

2.7.2 Complementary Technologies

2.7.3 Adjacent Technologies

2.8 Patent Analysis

2.9 Trade Analysis

2.10 Porter’s Five Forces Analysis

2.10.1 Threat of New Entrants

2.10.2 Threat of Substitutes

2.10.3 Bargaining Power of Suppliers

2.10.4 Bargaining Power of Buyers

2.10.5 Intensity of Competitive Rivalry

3.1 Introduction

3.2 Key Player Strategies/Right to Win

3.3 Revenue Analysis

3.4 Market Share Analysis

3.5 Company Valuation and Financial Metrics

3.6 Brand/Product Comparison

3.7 Company Evaluation Matrix: Startups/SMEs

3.7.1 Progressive Companies

3.7.2 Responsive Companies

3.7.3 Dynamic Companies

3.7.4 Starting Blocks

3.7.5 Competitive Benchmarking: Startups/SMEs

3.7.5.1 Detailed list of key startups/SMEs

3.7.5.2 Competitive benchmarking of key startups/SMEs

3.8 Competitive Scenario

3.8.1 Product Launches and Approvals

3.8.2 Deals

3.8.3 Expansions

3.8.4 Other Developments

4.1 Sequel Med Tech, LLC

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 BETA BIONICS

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 MicroTech Medical, Inc

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 Vincentra B.V.

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 Hanerxi Medical

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 Shanghai Umitai Medical Technology Co.,Ltd

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments