Comparing 7 vendors in Life Science Analytics Startups across 0 criteria.

Life science analytics is the efficient use of data and related business insights developed through statistical, quantitative, predictive, comparative, cognitive, and other emerging applied analytical models. Life science analytics tools help reveal and understand historical data patterns, predict future outcomes, and provide actionable insights to drive fact-based decision-making for improved performance of life science organizations.

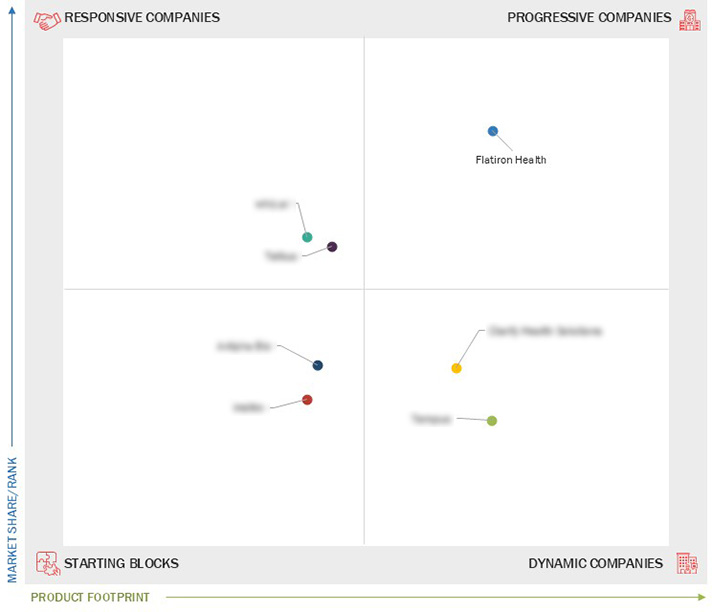

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions & Exclusions

1.3.3 Years Considered

1.3.4 Currency Considered

1.4 Stakeholders

1.5 Summary of Changes

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Rising pressure to curb healthcare spending

2.2.1.2 Need for improved data standardization

2.2.1.3 Technological advancements in analytical solutions

2.2.1.4 Heterogeneity and complexity of big data in life sciences

2.2.1.5 Growing adoption of analytical solutions in clinical trials

2.2.1.6 Increasing R&D expenditure in pharmaceutical &

bIoTechnology companies

2.2.2 Restraints

2.2.2.1 High implementation costs of advanced analytical solutions

2.2.2.2 Data privacy concerns

2.2.3 Opportunities

2.2.3.1 Growing focus on value-based care

2.2.3.2 Use of analytics in precision & personalized medicine

2.2.3.3 Big data analytics for R&D productivity

2.2.3.4 Growing adoption of cloud-based analytics

2.2.4 Challenges

2.2.4.1 Issues associated with data integration

2.2.4.2 Shortage of skilled personnel

2.2.4.3 Reluctance to adopt life science analytics solutions in

emerging countries

2.3 Industry Trends

2.3.1 Growing Adoption of Analytics in Commercial Operations

2.3.2 Leveraging Data & Analytics to Accelerate Drug Discovery &

Development

2.3.3 Focus on Real-Time Data Analytics

2.4 Technology Analysis

2.4.1 Key Technologies

2.4.1.1 Artificial intelligence and machine learning

2.4.1.2 Big data analytics

2.4.1.3 Quantum computing

2.4.2 Complementary Technologies

2.4.2.1 Bioinformatics tools

2.4.2.2 Internet of Things

2.4.3 Adjacent Technologies

2.4.3.1 Blockchain

2.5 Ecosystem Analysis

2.6 Value Chain Analysis

2.7 Porter’s Five Forces Analysis

2.7.1 Threat of New Entrants

2.7.2 Threat of Substitutes

2.7.3 Bargaining Power of Suppliers

2.7.4 Bargaining Power of Buyers

2.7.5 Intensity of Competitive Rivalry

3.1 Overview

3.2 Key Player Strategies/Right to Win

3.2.1 Overview of Strategies Adopted By Players in Life Science

Analytics Market

3.3 Revenue Analysis

3.4 Market Share Analysis

3.5 Company Evaluation Matrix: Startups/SMEs, 2024

3.5.1 Progressive Companies

3.5.2 Responsive Companies

3.5.3 Dynamic Companies

3.5.4 Starting Blocks

3.5.5 Competitive Benchmarking

3.6 Brand/Software Comparative Analysis

3.7 Company Valuation and Financial Metrics

3.8 Year-to-Date (YTD) Price Total Return and 5-Year Stock Beta of Life

Science Analytical Vendors

3.9 Competitive Scenario

3.9.1 Product Launches & Enhancements

3.9.2 Deals

4.1 Flatiron Health

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 whiz.ai

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 Tellius

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 Clarify Health Solutions

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 Tempus

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 insitro

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 A-Alpha Bio

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

HealthTree Foundation

HealthTree Foundation

Nov 2025

Nov 2025