Comparing 15 vendors in Mass Spectrometry Startups across 0 criteria.

The mass spectrometry market demonstrates robust potential, primarily driven by advancements in analytical techniques and increasing regulatory emphasis on environmental testing. As a sophisticated method used to assess the chemical composition of substances, mass spectrometry's versatility spans across diverse sectors including pharmaceuticals, biotechnology, environmental testing, and forensics.

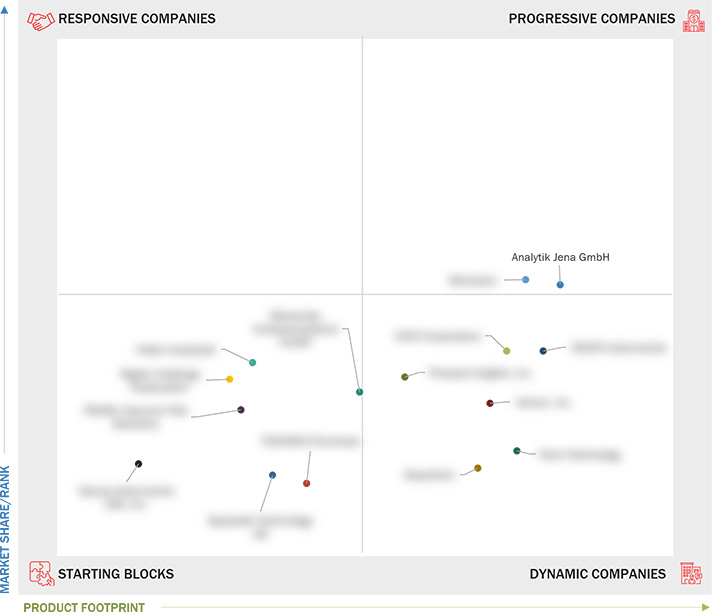

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Market Segmentation and Regions Covered

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Stakeholders

1.6 Summary of Changes

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Increasing regulatory emphasis and privatization of environmental testing services

2.2.1.2 Growing application of mass spectrometry in clinical and forensic settings

2.2.1.3 Rising focus on drug safety

2.2.1.4 Increasing investments in pharmaceutical research & development

2.2.2 Restraints

2.2.2.1 Capital-intensive investments for high-end equipment

2.2.2.2 Time-consuming sample preparation steps

2.2.3 Opportunities

2.2.3.1 Development of novel mass sensors and nanopore ion sources

2.2.3.2 Growth opportunities in emerging economies

2.2.4 Challenges

2.2.4.1 Inadequate infrastructure and shortage of skilled professionals

2.3 Trends/Disruptions Impacting Customer Business

2.4 Value Chain Analysis

2.4.1 R&D

2.4.2 Raw Material Procurement and Product Development

2.4.3 Marketing, Sales, and Distribution

2.4.4 Aftermarket Services

2.5 Supply Chain Analysis

2.5.1 Prominent Companies

2.5.2 Small and Medium-Sized Enterprises

2.5.3 End Users

2.5.4 Sales and Distribution

2.6 Ecosystem Analysis

2.7 Investment and Funding Scenario

2.8 Technology Analysis

2.8.1 Key Technologies

2.8.1.1 Quadrupole mass analyzers

2.8.1.2 Time-of-flight mass analyzers

2.8.1.3 Ion trap mass analyzers

2.8.2 Complementary Technologies

2.8.2.1 LC-MS

2.8.2.2 GC-MS

2.8.3 Adjacent Technologies

2.8.3.1 Mass spectrometry imaging

2.9 Patent Analysis

2.10 Trade Analysis

2.10.1 Import Scenario for HS Code 2027

2.10.2 Export Scenario for HS Code 2027

2.11 Key Conferences and Events, 2025–2026

2.12 Porter’s Five Force Analysis

2.12.1 Bargaining Power of Suppliers

2.12.2 Bargaining Power of Buyers

2.12.3 Threat of New Entrants

2.12.4 Threat of Substitutes

2.12.5 Intensity of Competitive Rivalry

2.13 Unmet Needs

2.14 Impact of AI/Gen AI on Mass Spectrometry Market

2.14.1 Introduction

2.14.2 Market Potential of Mass Spectrometry

2.14.3 AI Use Cases

2.14.4 Key Companies Implementing AI

2.14.5 Future of AI/Gen AI in Mass Spectrometry Ecosystem

3.1 Introduction

3.2 Key Player Strategies/Right to Win

3.2.1 Overview of Strategies Adopted By Players in Mass Spectrometry Market

3.3 Revenue Analysis, 2019–2023

3.4 Market Share Analysis, 2023

3.5 Market Ranking Analysis, 2023

3.6 Company Valuation and Financial Metrics

3.7 Brand/Product Comparison

3.8 Company Evaluation Matrix: Startups/SMEs, 2023

3.8.1 Progressive Companies

3.8.2 Responsive Companies

3.8.3 Dynamic Companies

3.8.4 Starting Blocks

3.8.5 Competitive Benchmarking of Startups/SMEs, 2023

3.8.5.1 Detailed list of key startups/SMEs

3.8.5.2 Competitive benchmarking of key startups/SMEs

3.9 Competitive Scenario

3.9.1 Product Launches and Approvals

3.9.2 Deals

3.9.3 Expansions

4.1 ANALYTIK JENA GMBH+CO. KG

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 HIDEN ANALYTICAL

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 LECO CORPORATION

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 RIGAKU HOLDINGS CORPORATION

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 YOUNGIN CHROMASS

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 SCION INSTRUMENTS

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 KORE TECHNOLOGY

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 PROCESS INSIGHTS, INC.

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 MASSTECH

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

4.10 ADVION, INC.

4.10.1 Business overview

4.10.2 Products/Solutions/Services offered

4.10.3 Recent developments

4.11 SPACETEK TECHNOLOGY AG

4.11.1 Business overview

4.11.2 Products/Solutions/Services offered

4.11.3 Recent developments

4.12 ELEMENTAR ANALYSENSYSTEME GMBH

4.12.1 Business overview

4.12.2 Products/Solutions/Services offered

4.12.3 Recent developments

4.13 SKYRAY INSTRUMENTS USA, INC.

4.13.1 Business overview

4.13.2 Products/Solutions/Services offered

4.13.3 Recent developments

4.14 MICROSAIC

4.14.1 Business overview

4.14.2 Products/Solutions/Services offered

4.14.3 Recent developments

4.15 PFEIFFER VACUUM+FAB SOLUTIONS

4.15.1 Business overview

4.15.2 Products/Solutions/Services offered

4.15.3 Recent developments

azom

azom

Feb 2026

Feb 2026