Comparing 9 vendors in Medical Connectors Startups across 0 criteria.

The medical connectors market is expanding in response to the proliferation of electronic medical devices and the growing need for reliable data and power transmission. Key drivers include the trend toward smaller, portable diagnostic and therapeutic equipment and an increased focus on patient safety. Innovations are centered on creating durable, sterilizable, and user-friendly connectors that prevent misconnections. The demand for hybrid connectors that integrate various functions like power, signal, and fluid transfer into a single interface also fuels market growth.

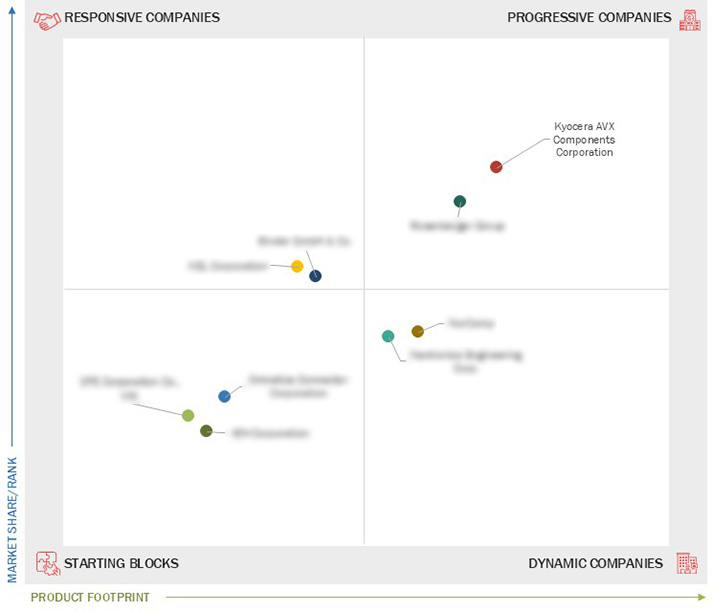

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Rising demand for medical equipment

2.2.1.2 Surge in elderly population

2.2.1.3 Increasing prevalence of chronic conditions and trauma injuries

2.2.1.4 Rising preference for minimally invasive surgeries

2.2.1.5 Surging demand for diagnostic imaging

2.2.1.6 Increasing demand for home based care

2.2.2 Restraints

2.2.2.1 Growing demand for wireless connectivity in medical devices

2.2.2.2 Stringent regulatory standards governing medical connectors

2.2.3 Opportunities

2.2.3.1 Expansion of medical device sector in Central & Eastern Europe and Asia Pacific

2.2.3.2 Wide adoption of telemedicine and remote patient monitoring

2.2.3.3 Integration of advanced medical technologies via international partnerships

2.2.4 Challenges

2.2.4.1 Shortage of skilled technicians and biomedical engineers

2.3 Trends/Disruptions Impacting Customer Business

2.4 Value Chain Analysis

2.5 Ecosystem Analysis

2.6 Investment and Funding Scenario

2.7 Technology Analysis

2.7.1 Key Technologies

2.7.2 Complementary Technologies

2.7.3 Adjacent Technologies

2.8 Patent Analysis

2.9 Trade Analysis

2.10 Porter’s Five Forces Analysis

2.10.1 Threat of New Entrants

2.10.2 Threat of Substitutes

2.10.3 Bargaining Power of Suppliers

2.10.4 Bargaining Power of Buyers

2.10.5 Intensity of Competitive Rivalry

3.1 Introduction

3.2 Key Player Strategies/Right to Win

3.3 Revenue Analysis

3.4 Market Share Analysis

3.5 Company Valuation and Financial Metrics

3.6 Brand/Product Comparison

3.7 Company Evaluation Matrix: Startups/SMEs

3.7.1 Progressive Companies

3.7.2 Responsive Companies

3.7.3 Dynamic Companies

3.7.4 Starting Blocks

3.7.5 Competitive Benchmarking: Startups/SMEs

3.7.5.1 Detailed list of key startups/SMEs

3.7.5.2 Competitive benchmarking of key startups/SMEs

3.8 Competitive Scenario

3.8.1 Product Launches

3.8.2 Deals

3.8.3 Expansions

4.1 Kyocera AVX Components Corporation

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 Rosenberger Group

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 BINDER

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 KEL Corporation

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 NorComp

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 Nextronics Engineering Corp.

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 Omnetics Connector Corporation

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 CFE Corporation Co., Ltd.

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 IEH Corporation

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

FF News | Fintech Finance

FF News | Fintech Finance

Oct 2025

Oct 2025