Comparing 10 vendors in Orthopedic Devices Startups across 0 criteria.

Orthopedic devices include various joint replacement devices, orthopedic braces and support products, fixation appliances, and accessories for the stabilization and treatment of musculoskeletal disorders, trauma, and deformities, such as bone fractures, joint dislocations, osteoarthritis, lumbar sprains, and spasms, among other applications.

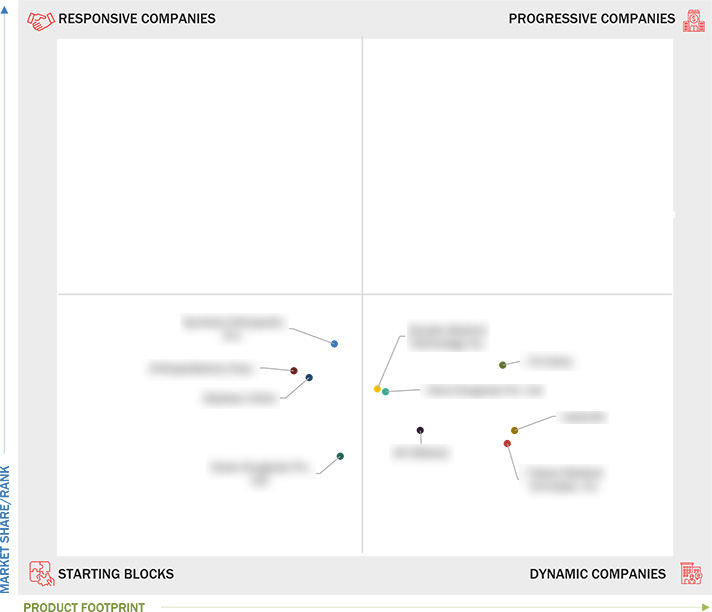

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Rising cases of orthopedic diseases and disorders

2.2.1.2 Increasing adoption of telemedicine and telesurgery

2.2.1.3 Increasing demand for minimally invasive orthopedic surgical procedures

2.2.1.4 Growing number of sports and accident-related orthopedic injuries

2.2.1.5 Rising geriatric population and projected increase in age-related bone disorders

2.2.2 Restraints

2.2.2.1 Risks and complications associated with orthopedic surgical procedures

2.2.2.2 High cost of orthopedic devices and treatments

2.2.3 Opportunities

2.2.3.1 Growing focus on orthobiologics

2.2.3.2 Rising number of hospitals and shift toward outpatient care

2.2.3.3 Increasing use of robotics and 3D printing in orthopedics

2.2.4 Challenges

2.2.4.1 Dearth of orthopedic surgeons

2.3 Trends/Disruptions Impacting Customer Business

2.4 Value Chain Analysis

2.5 Ecosystem Analysis

2.6 Investment and Funding Scenario

2.7 Technology Analysis

2.7.1 Key Technologies

2.7.2 Complementary Technologies

2.7.3 Adjacent Technologies

2.8 Patent Analysis

2.9 Trade Analysis

2.10 Porter’s Five Forces Analysis

2.10.1 Threat of New Entrants

2.10.2 Threat of Substitutes

2.10.3 Bargaining Power of Suppliers

2.10.4 Bargaining Power of Buyers

2.10.5 Intensity of Competitive Rivalry

3.1 Introduction

3.2 Key Player Strategies/Right to Win

3.3 Revenue Analysis

3.4 Market Share Analysis

3.5 Company Valuation and Financial Metrics

3.6 Brand/Product Comparison

3.7 Company Evaluation Matrix: Startups/SMEs

3.7.1 Progressive Companies

3.7.2 Responsive Companies

3.7.3 Dynamic Companies

3.7.4 Starting Blocks

3.7.5 Competitive Benchmarking: Startups/SMEs

3.7.5.1 Detailed list of key startups/SMEs

3.7.5.2 Competitive benchmarking of key startups/SMEs

3.8 Competitive Scenario

3.8.1 Product Launches and Approvals

3.8.2 Deals

4.1 AK Medical

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 Double Medical Technology Inc.

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 FH Ortho

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 Green Surgicals Pvt. Ltd.

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 Madison Ortho

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 OrthoPediatrics Corp.

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 Siora Surgicals Pvt. Ltd.

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 Symbios Orthopedie S.A.

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 Treace Medical Concepts, Inc.

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

4.10 restor3d

4.10.1 Business overview

4.10.2 Products/Solutions/Services offered

4.10.3 Recent developments

ks_report

ks_report

May 2023

May 2023