Comparing 8 vendors in Smart Pills Startups across 0 criteria.

Smart pills refer to miniature electronic devices shaped and designed like pharmaceutical capsules but equipped with advanced functions such as sensing, imaging, and drug delivery. These devices may incorporate biosensors, image sensors, pH sensors, or chemical sensors. When ingested, they traverse the GI tract to gather valuable information that is otherwise challenging to obtain. Unlike implantable or wearable sensors, these ingestible sensors can be easily eliminated from the body after use.

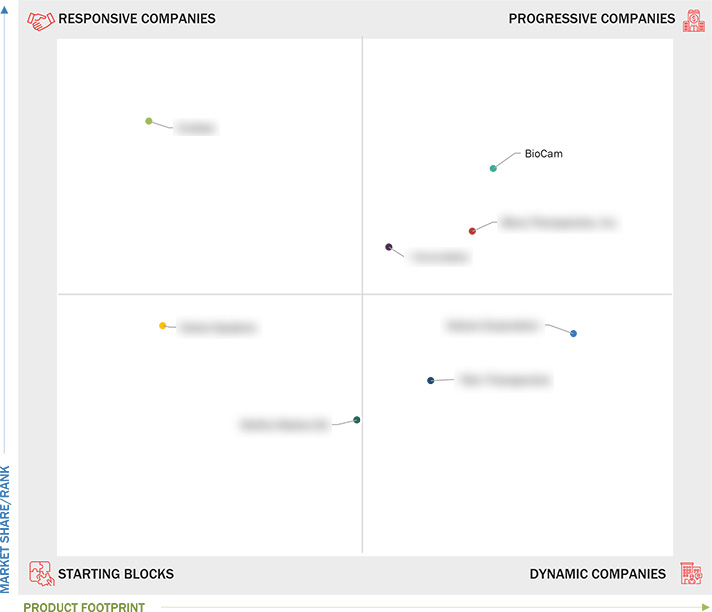

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Rising demand for non-invasive diagnostic monitoring devices

2.2.1.2 Technological advancements in capsule endoscopy

2.2.1.3 Increasing incidence of colon cancer

2.2.2 Restraints

2.2.2.1 High R&D costs for technological developments and advancements

2.2.2.2 Low accuracy and reliability of sensors and cameras in smart pills

2.2.3 Opportunities

2.2.3.1 Innovations in sensor technologies and wireless communication

2.2.3.2 Rising need for rapid drug delivery and development

2.2.4 Challenges

2.2.4.1 Increased patient privacy and data security concerns

2.2.4.2 Shortage of skilled healthcare professionals

2.3 Trends/Disruptions Impacting Customer Business

2.4 Value Chain Analysis

2.5 Ecosystem Analysis

2.6 Investment and Funding Scenario

2.7 Technology Analysis

2.7.1 Key Technologies

2.7.2 Complementary Technologies

2.7.3 Adjacent Technologies

2.8 Patent Analysis

2.9 Trade Analysis

2.10 Porter’s Five Forces Analysis

2.10.1 Threat of New Entrants

2.10.2 Threat of Substitutes

2.10.3 Bargaining Power of Suppliers

2.10.4 Bargaining Power of Buyers

2.10.5 Intensity of Competitive Rivalry

3.1 Introduction

3.2 Key Player Strategies/Right to Win

3.3 Revenue Analysis

3.4 Market Share Analysis

3.5 Company Valuation and Financial Metrics

3.6 Brand/Product Comparison

3.7 Company Evaluation Matrix: Startups/SMEs

3.7.1 Progressive Companies

3.7.2 Responsive Companies

3.7.3 Dynamic Companies

3.7.4 Starting Blocks

3.7.5 Competitive Benchmarking: Startups/SMEs

3.7.5.1 Detailed list of key startups/SMEs

3.7.5.2 Competitive benchmarking of key startups/SMEs

3.8 Competitive Scenario

3.8.1 Product Launches, Approvals and Enhancements

3.8.2 Deals

3.8.3 Other Developments

4.1 BioCam

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 Biora Therapeutics, Inc.

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 Innurvation

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 Endiatx

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 Veloce Corporation

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 Rani Therapeutics

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 Celero Systems

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 Motilis Medica SA

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

Medical Product Outsourcing

Medical Product Outsourcing

Jun 2025

Jun 2025