Comparing 7 vendors in Telehealth and Telemedicine Startups across 0 criteria.

The Telehealth and Telemedicine Industry has experienced a transformative evolution over recent years, reshaping the landscape of healthcare delivery. This dynamic sector has been driven by a host of critical factors, including advancements in remote patient monitoring systems, AI-powered diagnostics, and seamless virtual care platforms. The integration of these technologies sets new benchmarks in healthcare delivery, particularly in addressing the challenges of accessibility and affordability. The industry dynamics are also significantly shaped by strategic collaborations, acquisitions, and investments in secure telecommunication technologies, which enhance accessibility and broaden the market reach.

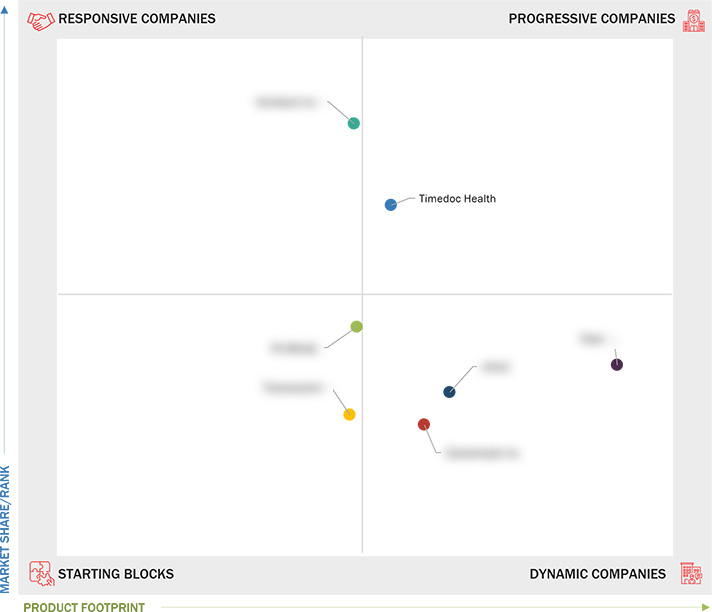

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.2.1 Telehealth

1.2.2 Telemedicine

1.3 Study Scope

1.3.1 Market Segmentation & Geographical Spread

1.3.2 Inclusions & Exclusions

1.3.3 Years Considered

1.3.4 Currency Considered

1.4 Stakeholders

1.5 Summary of Changes

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Growing geriatric population and increasing need for

advanced healthcare infrastructure

2.2.1.2 Rising prevalence of chronic diseases

2.2.1.3 Reduced time and lower out-of-pocket costs

2.2.1.4 Advancements in telecommunication technologies

2.2.1.5 Shortage of skilled healthcare professionals

2.2.1.6 Increased government support and favorable regulatory

policies

2.2.1.7 Expansion of remote patient monitoring systems

2.2.2 Restraints

2.2.2.1 High investment costs for B2B models and lack of IT

expertise

2.2.2.2 State-to-state and inter-country regulatory variations

2.2.2.3 Behavioral reluctance to adopt new technologies

2.2.2.4 Rise in fraud and abUse in healthcare systems

2.2.2.5 Adherence to patient privacy, confidentiality, medical

ethics

2.2.3 Opportunities

2.2.3.1 Growing Use of wearables, applications, and sensors for

virtual care

2.2.3.2 Emergence of AI and ML

2.2.3.3 Increasing shift toward outpatient care models

2.2.3.4 High utility of telemedicine against infectious

communicable diseases and epidemics

2.2.3.5 Expansion of hospital-at-home (HaH) initiatives

2.2.3.6 Demand for electronic medical record-based telehealth

services

2.2.3.7 Rising incidence of mental illnesses and growing focus on

emotional well-being

2.2.4 Challenges

2.2.4.1 Data security and confidentiality concerns

2.2.4.2 Limited data accessibility

2.2.4.3 Inability to maintain patient hygiene and cleanliness

standards

2.3 Trends/Disruptions Impacting Customer’s Business

2.4 Industry Trends

2.5 Ecosystem Analysis

2.6 Value Chain Analysis

2.7 Technology Analysis

2.7.1 Key Technologies

2.7.1.1 Video conferencing and real-time communication platforms

2.7.1.2 AI and ML

2.7.1.3 Virtual assistants and chatbots

2.7.1.4 Voice recognition and natural language processing

2.7.1.5 EHR integration

2.7.1.6 Remote patient monitoring systems

2.7.2 Complementary Technologies

2.7.2.1 Edge computing

2.7.2.2 Cloud computing

2.7.2.3 Mobile health (mHealth) applications

2.7.2.4 Wearable devices, sensors, and IoT

2.7.3 Adjacent Technologies

2.7.3.1 Digital therapeutics

2.7.3.2 Blockchain technology

2.7.3.3 Augmented reality and virtual reality

2.8 Trade Analysis

2.8.1 Trade Data for HSN Code 90189099

2.8.1.1 Top 10 importers for HSN code 90189099

2.8.1.2 Top 10 exporters for HSN code 90189099

2.8.2 Trade Data for HSN Code 9021

2.8.2.1 Top 10 importers for HSN code 9021

2.8.2.2 Top 10 exporters for HSN code 9021

2.8.3 Trade Data for HSN Code 9022

2.8.3.1 Top 10 importers for HSN code 9022

2.8.3.2 Top 10 exporters for HSN code 9022

2.9 Porter’s Five Forces Analysis

2.9.1 Threat of New Entrants

2.9.2 Threat of Substitutes

2.9.3 Bargaining Power of Buyers

2.9.4 Bargaining Power of Suppliers

2.9.5 Intensity of Competitive Rivalry

2.10 Patent Analysis

2.10.1 Patent Publication Trends for Telehealth & Telemedicine

2.10.2 Insights: Jurisdiction and Top Applicant Analysis

2.11 Unmet Needs & End-User Expectations

2.11.1 Unmet Needs

2.11.2 End-User Expectations

2.12 Key Conferences & Events, 2025–2026

2.13 Investment & Funding Scenario

2.14 Business Model Analysis

2.14.1 Direct-to-Patient (D2P) Model

2.14.2 Business-to-Business (B2B) Model

2.14.3 Employer-Sponsored Model

2.14.4 Subscription-Based Model

2.14.5 Hybrid Telemedicine Model

2.14.6 Platform-as-a-Service (PaaS) Model

2.14.7 Value-Based Care Model

2.15 Impact of AI/Gen AI in Telehealth & Telemedicine Market

2.15.1 Key Use Cases

2.15.2 Major Case Studies

2.15.2.1 AI to redefine treatment effectiveness and safety

2.15.2.2 AI-driven chatbots and telehealth to enhance mental health

and chronic disease management

2.15.3 Impact of AI/Gen AI on Interconnected and Adjacent Ecosystems

2.15.3.1 Healthcare IT and EHR systems

2.15.3.2 Pharmaceuticals & drug discovery

2.15.3.3 Mental health tech

2.15.3.4 Healthcare analytics and insights

2.15.4 User Readiness & Impact Assessment

2.15.4.1 User readiness

2.15.4.1.1 User A: Hospitals

2.15.4.1.2 User B: Ambulatory surgery centers

2.15.4.2 Impact assessment

2.15.4.2.1 User A: Hospitals

2.15.4.2.2 User B: Ambulatory surgery centers

2.16 Reimbursement Scenario Analysis

3.1 Introduction

3.2 Key Player Strategies/Right to Win

3.2.1 Overview of Strategies Adopted By Key Players in Telehealth &

Telemedicine Market

3.3 Revenue Analysis, 2019–2023

3.4 Market Share Analysis, 2023

3.5 Company Evaluation Matrix: Startups/SMEs, 2023

3.5.1 Progressive Companies

3.5.2 Responsive Companies

3.5.3 Dynamic Companies

3.5.4 Starting Blocks

3.5.5 Competitive Benchmarking: Startups/SMEs, 2023

3.5.5.1 Detailed list of key startups/SMEs

3.5.5.2 Competitive benchmarking of key startups/SMEs

3.6 Company Valuation & Financial Metrics

3.7 Brand/Software Comparative Analysis

3.8 Competitive Scenario

3.8.1 Product Launches & Approvals

3.8.2 Deals

3.8.3 Expansions

3.8.4 Other Developments

4.1 TIMEDOC, INC.

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 CEREBRAL INC.

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 KINDBODY

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 TRANSCARENT

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 CARESIMPLE INC.

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 VSEE

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 EVISIT

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

Kindbody

Kindbody

Jun 2025

Jun 2025