Comparing 8 vendors in Traditional Wound Care Startups across 0 criteria.

Traditional wound care involves using dry dressing products such as gauze, lint, plasters, bandages (natural or synthetic), and cotton wool. These dressings serve as primary or secondary coverings to protect wounds from contamination and aid in healing.

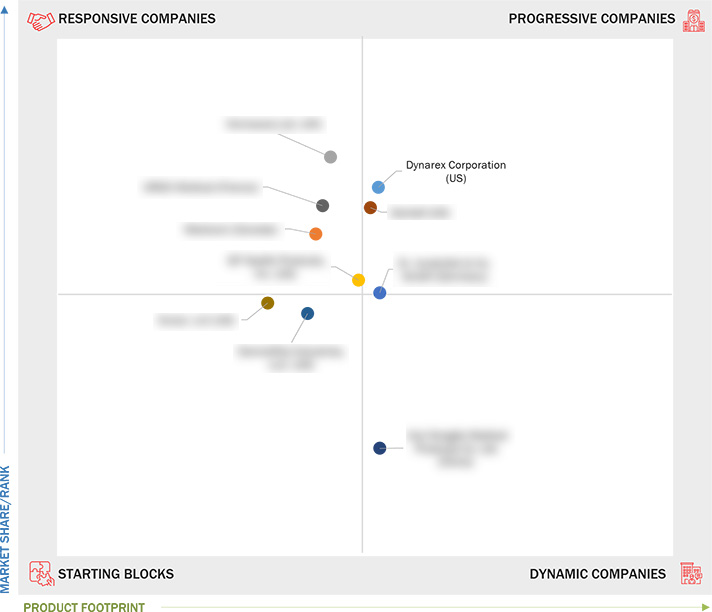

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Rising prevalence of diabetes

2.2.1.2 Growing geriatric population and subsequent rise in chronic wounds

2.2.1.3 Increasing incidence of burn injuries

2.2.1.4 Rising number of road accidents and trauma cases

2.2.1.5 Increasing expenditure on chronic wounds

2.2.2 Restraints

2.2.2.1 Limitations associated with traditional wound care

2.2.2.2 Rising adoption of advanced wound care technologies

2.2.3 Opportunities

2.2.3.1 Sustained adoption due to cost efficiency and wide accessibility

2.2.3.2 Growth potential of emerging economies

2.2.4 Challenges

2.2.4.1 Limited awareness associated with wound care

2.3 Trends/Disruptions Impacting Customer Business

2.4 Value Chain Analysis

2.5 Ecosystem Analysis

2.6 Investment and Funding Scenario

2.7 Technology Analysis

2.7.1 Key Technologies

2.7.2 Complementary Technologies

2.7.3 Adjacent Technologies

2.8 Patent Analysis

2.9 Trade Analysis

2.10 Porter’s Five Forces Analysis

2.10.1 Threat of New Entrants

2.10.2 Threat of Substitutes

2.10.3 Bargaining Power of Suppliers

2.10.4 Bargaining Power of Buyers

2.10.5 Intensity of Competitive Rivalry

3.1 Introduction

3.2 Key Player Strategies/Right to Win

3.3 Revenue Analysis

3.4 Market Share Analysis

3.5 Company Valuation and Financial Metrics

3.6 Brand/Product Comparison

3.7 Company Evaluation Matrix: Startups/SMEs

3.7.1 Progressive Companies

3.7.2 Responsive Companies

3.7.3 Dynamic Companies

3.7.4 Starting Blocks

3.7.5 Competitive Benchmarking: Startups/SMEs

3.7.5.1 Detailed list of key startups/SMEs

3.7.5.2 Competitive benchmarking of key startups/SMEs

3.8 Competitive Scenario

3.8.1 Product Launches

3.8.2 Deals

3.8.3 Expansions

3.8.4 Other Developments

4.1 Anji Hongde Medical Products Co., Ltd.

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 DERMARITE INDUSTRIES LLC

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 DUKAL

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 Dr. Ausbüttel & Co. GmbH

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 Dynarex Corporation

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 GENTELL INC

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 GF Health Products, Inc.

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 Vernacare Ltd.

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

93.1 KISS FM

93.1 KISS FM

Sep 2025

Sep 2025