Comparing 11 vendors in Urinary Incontinence Devices Startups across 0 criteria.

The urinary incontinence devices market is an expanding sector driven by the increasing prevalence of urinary incontinence, an aging global population, and advancements in healthcare technology. This report analyzes recent developments and key strategies within this market from 2021 to 2025, shedding light on the competitive landscape defined by innovation, strategic partnerships, and aggressive geographical expansions.

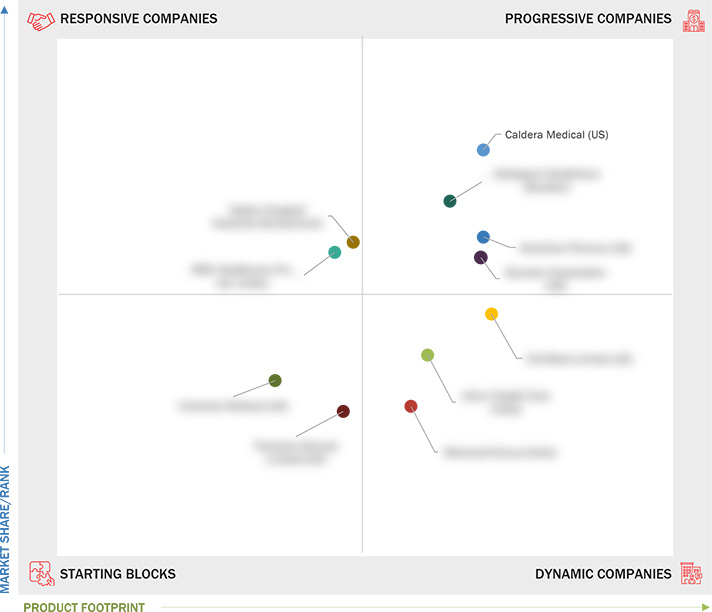

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered & Regions Considered

1.3.2 Inclusions & Exclusions

1.3.3 Years Considered

1.3.4 Currency Considered

1.4 Stakeholders

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Rising prevalence of urinary incontinence

2.2.1.2 Expanding geriatric population

2.2.1.3 Growing attention to personal hygiene

2.2.1.4 Advancements in home healthcare solutions

2.2.2 Restraints

2.2.2.1 Social stigma associated with incontinence care products

2.2.2.2 Environmental concerns related to disposal of urinary

incontinence products

2.2.2.3 Potential side-effects & complications

2.2.3 Opportunities

2.2.3.1 Technological advancements in urinary incontinence devices

2.2.3.2 Rapid urbanization and rising disposable income

2.2.4 Challenges

2.2.4.1 Use of alternative treatment options

2.3 Value Chain Analysis

2.4 Supply Chain Analysis

2.5 Ecosystem Analysis

2.6 Porter’s Five Forces Analysis

2.6.1 Threat of New Entrants

2.6.2 Threat of Substitutes

2.6.3 Bargaining Power of Buyers

2.6.4 Bargaining Power of Suppliers

2.6.5 Intensity of Competitive Rivalry

2.7 Trade Analysis

2.7.1 Import Data for HS Code 901839

2.7.2 Export Data for HS Code 901839

2.8 Patent Analysis

2.8.1 List of Major Patents

2.9 Key Conferences & Events, 2025–2026

2.10 Trends/Disruptions Impacting Customers’ Businesses

2.11 Technology Analysis

2.11.1 Key Technologies

2.11.1.1 Surgical & implantable devices

2.11.2 Complementary Technologies

2.11.2.1 Electrical stimulation devices

2.12 Investment & Funding Scenario

2.13 Impact of AI/Gen AI on Urinary Incontinence Devices Market

2.13.1 AI Use Cases

3.1 Introduction

3.2 Key Player Strategies/Right to Win

3.2.1 Overview of Strategies Adopted By Key Players in Urinary

Incontinence Devices Market

3.3 Revenue Analysis, 2019–2023

3.4 Market Share Analysis, 2023

3.5 Company Evaluation Matrix: Startups/SMEs, 2023

3.5.1 Progressive Companies

3.5.2 Responsive Companies

3.5.3 Dynamic Companies

3.5.4 Starting Blocks

3.5.5 Competitive Benchmarking: Startups/SMEs, 2023

3.5.5.1 Detailed list of key startup/SME players

3.5.5.2 Competitive benchmarking of key emerging players/startups

3.6 Company Valuation & Financial Metrics

3.7 Brand/Product Comparison

3.8 Competitive Scenario

3.8.1 Product Launches & Approvals

3.8.2 Deals

3.8.3 Expansions

3.8.4 Other Developments

4.1 WELLSPECT HEALTHCARE

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 CALDERA MEDICAL

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 DYNAREX CORPORATION

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 ADVACARE PHARMA

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 MRK HEALTHCARE PVT. LTD.

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 ADVIN HEALTH CARE

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 CLINIMED LIMITED

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 STERIMED GROUP

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

4.9 INCONTROL MEDICAL

4.9.1 Business overview

4.9.2 Products/Solutions/Services offered

4.9.3 Recent developments

4.10 ZEPHYR SURGICAL IMPLANTS

4.10.1 Business overview

4.10.2 Products/Solutions/Services offered

4.10.3 Recent developments

4.11 FLEXICARE (GROUP) LIMITED

4.11.1 Business overview

4.11.2 Products/Solutions/Services offered

4.11.3 Recent developments

Dynarex Corporation

Dynarex Corporation

Oct 2024

Oct 2024