Comparing 6 vendors in Ventilators Startups across 0 criteria.

A ventilator—also known as a breathing machine or respirator—is a medical device that supports or takes over the breathing process. It is primarily used in hospital settings to manage conditions such as chronic obstructive pulmonary disease (COPD), sleep apnea, acute lung injury, and hypoxemia.

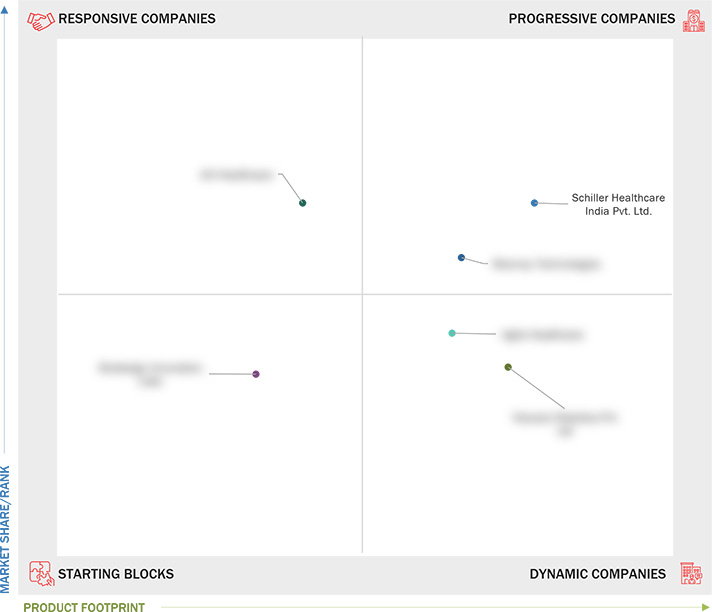

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered & Regions Considered

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.3.4 Currency Considered

1.4 Stakeholders

1.5 Summary of Changes

1.6 Impact of AI/Gen AI

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Rise in respiratory diseases

2.2.1.1.1 Increasing incidences of COPD and asthma

2.2.1.1.2 High prevalence of tobacco smoking

2.2.1.2 Urbanization and rising pollution levels

2.2.1.3 Rising obesity due to sedentary lifestyles

2.2.1.4 Growing geriatric population worldwide

2.2.1.5 Increasing preference for home care settings

2.2.1.6 Rising number of preterm births

2.2.1.7 Outbreak of infectious respiratory diseases

2.2.2 Restraints

2.2.2.1 Shortage of skilled medical workers

2.2.2.2 Excessive purchase of ventilators during COVID-19

2.2.2.3 Reimbursement concerns

2.2.3 Opportunities

2.2.3.1 Cost-efficiency of home care services

2.2.3.2 Growth opportunities in emerging economies

2.2.4 Challenges

2.2.4.1 Low awareness and inadequate resources in emerging economies

2.2.4.2 Harmful effects of respiratory devices on neonates

2.2.4.3 Supply chain disruptions

2.2.4.4 Global demand fluctuations

2.3 Industry Trends

2.3.1 Rising Demand for Enhanced Portable Ventilators

2.3.2 Market Consolidation

2.3.3 Growing Demand for Multimodal Ventilators

2.3.4 Increasing Adoption of Non-Invasive Ventilators

2.4 Technology Analysis

2.4.1 Key Technologies

2.4.1.1 Sensor technologies

2.4.1.1.1 Flow sensors

2.4.1.1.2 Oxygen sensors

2.4.1.1.3 Pressure sensors

2.4.2 Complementary Technologies

2.4.2.1 E-nose technology

2.4.2.2 MEMS technology

2.4.2.3 Electrochemical technology

2.4.2.4 Paramagnetic technology

2.4.2.5 Wireless gas sensor technology

2.4.3 Adjacent Technologies

2.4.3.1 High-flow nasal cannula (HFNC) devices

2.5 Regulatory Overview

2.6 Value Chain Analysis

2.7 Ecosystem Analysis

2.8 Supply Chain Analysis

2.9 Porter’s Five Forces Analysis

2.9.1 Threat of New Entrants

2.9.2 Threat of Substitutes

2.9.3 Bargaining Power of Suppliers

2.9.4 Bargaining Power of Buyers

2.9.5 Intensity of Competitive Rivalry

2.10 Market Sizing Assumptions

2.11 Patent Analysis

2.11.1 Patent Publication Trends for Ventilators

2.12 Trade Analysis

2.12.1 Export Data for Ventilators (HS Code 9018)

2.12.2 Import Data for Ventilators (HS Code 9018)

2.13 Key Conferences and Events, 2023–2024

2.14 Reimbursement Scenario

2.15 Unmet Needs and End-User Expectations

2.15.1 Unmet Needs in Ventilators Market

2.15.2 End-User Expectations in Ventilators Market

2.16 Trends/Disruptions Impacting Customers’ Businesses

2.17 Investment & Funding Scenario

2.18 Adjacent Market Analysis

2.18.1 Respiratory Diagnostics Market

2.18.2 Sleep Apnea Devices Market

2.19 Impact of AI/Gen AI on Ventilators Market

2.19.1 Introduction

2.19.2 Future of Healthcare—Big Data and AI

2.19.3 Knowledge-Based Systems for Ventilation Management

3.1 Overview

3.2 Key Player Strategies/Right to Win 2023

3.2.1 Overview of Strategies Adopted by Players in Ventilators Market

3.3 Revenue Analysis, 2019–2023

3.4 Market Share Analysis, 2023

3.5 Brand/Product Positioning Map

3.6 Company Evaluation Matrix: Startups/SMEs, 2023

3.6.1 Progressive Companies

3.6.2 Responsive Companies

3.6.3 Dynamic Companies

3.6.4 Starting Blocks

3.6.5 Competitive Benchmarking: Startups/SMEs, 2023

3.6.5.1 Detailed List of Key Startups/SMEs

3.6.5.2 Competitive Benchmarking of Key Startups/SMEs

3.7 Ventilators Market: R&D Expenditure

3.8 Company Valuation & Financial Metrics

3.8.1 Financial Metrics

3.8.2 Company Valuation

3.9 Brand/Product Comparison

3.10 Competitive Scenario

3.10.1 Product Launches & Approvals

3.10.2 Deals

3.10.3 Other Developments

4.1 SKANRAY TECHNOLOGIES, LTD.

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 AGVA HEALTHCARE

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 BIODESIGN INNOVATION LABS

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 NOCCARC ROBOTICS PVT LTD

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 SCHILLER HEALTHCARE INDIA PVT. LTD

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 AVI HEALTHCARE

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments