Comparing 8 vendors in AI Datacenter Startups across 0 criteria.

The AI data center market focuses on specialized facilities designed to support the demanding computational needs of artificial intelligence applications. These centers are essential for industries using AI in areas like autonomous systems, healthcare, and financial modeling. With the rise of generative AI and large language models, there's a growing need for scalable, energy-efficient infrastructure. Cloud providers and tech companies are investing in advanced cooling, hardware, and software solutions to meet this demand and enable widespread AI adoption.

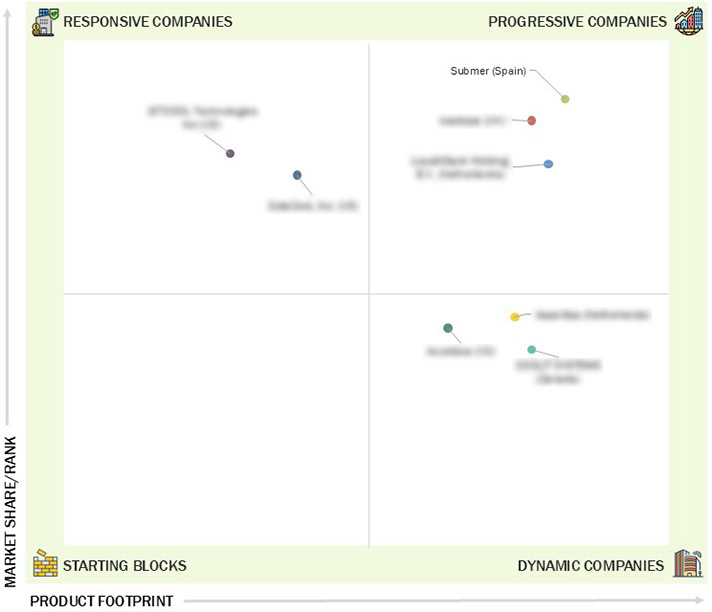

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 Rising demand for AI workloads

2.2.1.2 Explosion of data and growing reliance on big data

analytics

2.2.1.3 Government-led investments in AI data centers

2.2.1.4 Growing demand for AI-as-a-Service

2.2.2 Restraints

2.2.2.1 High implementation costs

2.2.2.2 Concerns regarding data breaches and unauthorized access

2.2.3 Opportunities

2.2.3.1 Rising adoption of green AI data centers

2.2.3.2 Increasing demand for hyperscale data centers

2.2.4 Challenges

2.2.4.1 Supply chain disruptions

2.2.4.2 High energy consumption and environmental concerns

2.3 Trends/Disruptions Impacting Customer Business

2.4 Value Chain Analysis

2.5 Ecosystem Analysis

2.6 Investment and Funding Scenario

2.7 Technology Analysis

2.7.1 Key Technologies

2.7.1.1 Generative AI

2.7.1.2 AI-optimized cloud platforms

2.7.2 Complementary Technologies

2.7.2.1 Edge computing

2.7.2.2 Cybersecurity

2.7.3 Adjacent Technologies

2.7.3.1 Big data

2.8 Patent Analysis

2.9 Key Conferences and Events, 2025–2026

2.10 Porter’s Five Forces Analysis

2.10.1 Threat of New Entrants

2.10.2 Threat of Substitutes

2.10.3 Bargaining Power of Suppliers

2.10.4 Bargaining Power of Buyers

2.10.5 Intensity of Competitive Rivalry

2.11 Impact of US Tariff on AI Data Center Market

2.11.1 Introduction

2.11.2 Key Tariff Rates

2.11.3 Impact on Country/Region

2.11.3.1 US

2.11.3.2 Europe

2.11.3.3 Asia Pacific

2.11.4 Exemptions for GPUs under USMCA Agreement

2.11.5 Impact on End Users

3.1 Introduction

3.2 Key Player Strategies/Right to Win, 2020–2025

3.3 Revenue Analysis, 2021–2024

3.4 Market Share Analysis, 2024

3.5 Company Valuation and Financial Metrics

3.6 Brand/Product Comparison

3.7 Company Evaluation Matrix: Startups/SMEs, 2024

3.7.1 Progressive Companies

3.7.2 Responsive Companies

3.7.3 Dynamic Companies

3.7.4 Starting Blocks

3.7.5 Competitive Benchmarking: Startups/SMEs, 2024

3.7.5.1 Detailed list of key startups/SMEs

3.7.5.2 Competitive benchmarking of key startups/SMEs

3.8 Competitive Scenario

3.8.1 Product Launches

3.8.2 Deals

4.1 LIQUIDSTACK HOLDING B.V.

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 COOLIT SYSTEMS

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 SUBMER

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 ASPERITAS

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 ICEOTOPE

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 JETCOOL TECHNOLOGIES INC.

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 ZUTACORE

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

4.8 ACCELSIUS LLC

4.8.1 Business overview

4.8.2 Products/Solutions/Services offered

4.8.3 Recent developments

MSN

MSN

Feb 2025

Feb 2025