Comparing 7 vendors in Asset Management System Startups across 0 criteria.

The global asset management system market is projected to grow significantly by 2030, driven by automation in inventory management, smart city initiatives, and the demand for streamlined supply chains. Key players like Zebra Technologies and Honeywell are advancing technologies such as RFID tags and sensors for real-time tracking. Hardware offerings will dominate due to the adoption of RFID and IoT devices. Returnable transport assets and RFID technology will lead the market, enhancing operational efficiency and sustainability across industries like manufacturing, healthcare, and logistics.

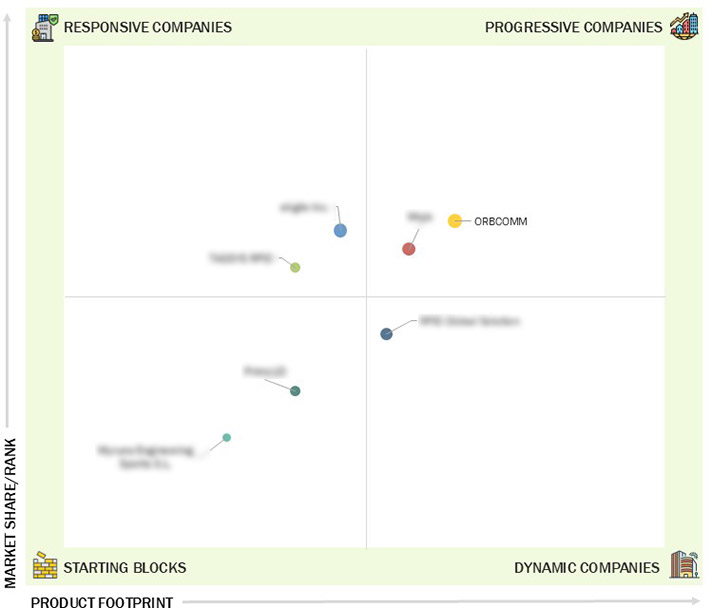

Market Leadership Quadrant

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered and Regional Scope

1.3.2 Inclusions and Exclusions

1.3.3 Years Considered

1.4 Currency Considered

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2.1 Introduction

2.2 Market Dynamics

2.2.1 Drivers

2.2.1.1 High adoption of GPS tracking devices

2.2.1.2 Rapid advances in IoT and AI technologies

2.2.1.3 Government initiatives to improve supply chain transparency

2.2.2 Restraints

2.2.2.1 High installation and ownership costs

2.2.2.2 Data security concerns

2.2.3 Opportunities

2.2.3.1 Increasing demand for image-based barcode readers

2.2.3.2 Rising emphasis on process automation and standardization

2.2.4 Challenges

2.2.4.1 Complexities associated with tracking return on investments

2.2.4.2 Difficulty in achieving real-time accuracy in dense environments

2.3 Trends/Disruptions Impacting Customer Business

2.4 Value Chain Analysis

2.5 Ecosystem Analysis

2.6 Investment and Funding Scenario

2.7 Technology Analysis

2.7.1 Key Technologies

2.7.2 Complementary Technologies

2.7.3 Adjacent Technologies

2.8 Patent Analysis

2.9 Trade Analysis

2.10 Porter’s Five Forces Analysis

2.10.1 Threat of New Entrants

2.10.2 Threat of Substitutes

2.10.3 Bargaining Power of Suppliers

2.10.4 Bargaining Power of Buyers

2.10.5 Intensity of Competitive Rivalry

3.1 Introduction

3.2 Key Player Strategies/Right to Win

3.3 Revenue Analysis

3.4 Market Share Analysis

3.5 Company Valuation and Financial Metrics

3.6 Brand/Product Comparison

3.7 Company Evaluation Matrix: Startups/SMEs

3.7.1 Progressive Companies

3.7.2 Responsive Companies

3.7.3 Dynamic Companies

3.7.4 Starting Blocks

3.7.5 Competitive Benchmarking: Startups/SMEs

3.7.5.1 Detailed list of key startups/SMEs

3.7.5.2 Competitive benchmarking of key startups/SMEs

3.8 Competitive Scenario

3.8.1 Product Launches and Enhancements

3.8.2 Deals

4.1 ORBCOMM

4.1.1 Business overview

4.1.2 Products/Solutions/Services offered

4.1.3 Recent developments

4.2 Mojix

4.2.1 Business overview

4.2.2 Products/Solutions/Services offered

4.2.3 Recent developments

4.3 eAgile Inc.

4.3.1 Business overview

4.3.2 Products/Solutions/Services offered

4.3.3 Recent developments

4.4 TAGSYS RFID

4.4.1 Business overview

4.4.2 Products/Solutions/Services offered

4.4.3 Recent developments

4.5 RFID Global Solution

4.5.1 Business overview

4.5.2 Products/Solutions/Services offered

4.5.3 Recent developments

4.6 Primo1D

4.6.1 Business overview

4.6.2 Products/Solutions/Services offered

4.6.3 Recent developments

4.7 Myruns Engineering Sports S.L.

4.7.1 Business overview

4.7.2 Products/Solutions/Services offered

4.7.3 Recent developments

The Manila Times

The Manila Times

Oct 2024

Oct 2024